Chrysler 2006 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

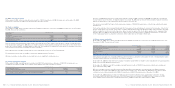

Fiat S.p.A. Financial Statements at December 31, 2006 - Notes to the Financial Statements 281Fiat S.p.A. Financial Statements at December 31, 2006 - Notes to the Financial Statements280

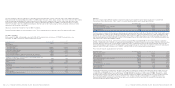

The provision for indemnities relates to the contingent liabilities arising from guarantee commitments and obligations to third

parties assumed when subsidiaries have sold their investments or business units.

The restructuring provision includes the employee termination benefits to be paid in accordance with the company’s rationalisation

plans.

The provision for employee bonuses comprises the expected cost for the annual performance bonuses.

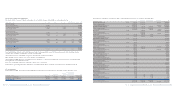

25. Trade payables

At December 31, 2006, trade payables amount to 184,661 thousand euros, a decrease of 200,521 thousand euros as compared

to December 31, 2005. The balance can be analysed as follows:

At At

(in thousands of euros) December 31, 2006 December 31, 2005 Change

Trade payables to third parties 167,115 380,335 (213,220)

Intercompany trade payables for goods and services 17,546 4,847 12,699

Total Trade payables 184,661 385,182 (200,521)

Trade payables to third parties are mainly due to CAV.E.T.and CAV. TO.MI. in relation to the work performed over the latter

part of the year (see Note 16).

Trade payables are due within one year and their carrying amount at the Balance Sheet date is deemed to approximate their

fair value.

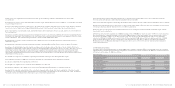

26. Current financial payables

At December 31, 2006, current financial payables amount to 1,627,430 thousand euros, up 1,070,047 thousand euros over

December 31, 2005. The balance can be analysed as follows:

At At

(in thousands of euros) December 31, 2006 December 31, 2005 Change

Financial payables to Group companies:

- Current account with Fiat Finance S.p.A. 426,538 – 426,538

- Loan from Fiat Finance S.p.A. 900,000 – 900,000

- Payables to Group companies for derivative financial instruments 10,315 – 10,315

-Accrued interest expense 68,701 434 68,267

Total financial payables to Group companies 1,405,554 434 1,405,120

Financial payables to third parties:

- Advances on factored receivables 221,876 556,949 (335,073)

Total financial payables to third parties 221,876 556,949 (335,073)

Total Current financial payables 1,627,430 557,383 1,070,047

The loan from Fiat Finance S.p.A. was obtained at the end of 2006 with maturity in the first quarter of 2007.

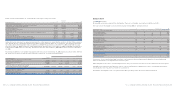

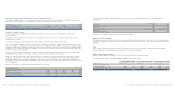

23. Other non-current liabilities

At December 31, 2006, Other non-current liabilities amount to 20,001 thousand euros, showing a net increase of 3,140 thousand

euros over the balance at the previous year end.

The item may be analysed as follows:

At At

(in thousands of euros) December 31, 2006 December 31, 2005 Change

Non-current post-employment benefits to be paid:

- to the former Chief Executive Officer 5,542 5,807 (265)

- to former employees 14,459 8,432 6,027

Non-current intercompany payables for consolidated IRES tax –2,622 (2,622)

Total Other non-current liabilities 20,001 16,861 3,140

The non-current post-employment benefits to be paid represent the present value of benefits (see Note 21) to be paid to the former

Chief Executive Officer and employees that left the company.

The balance of 2,622 thousand euros at December 31, 2005 for intercompany payables for consolidated IRES tax relates to items

transferred in connection with the national tax consolidation program in previous years whose liquidity status is subject to certain

conditions.

An analysis of other non-current liabilities by due date is as follows:

At At

(in thousands of euros) December 31, 2006 December 31, 2005

Other non-current liabilities

due within one year 866 609

due after one year but within five years 4,814 5,690

due after five years 14,321 10,562

total 20,001 16,861

24. Provisions for employee benefits and other current provisions

At December 31, 2006 this balance amounts to 26,791 thousand euros, a decrease of 4,200 thousand euros over December 31,

2005, and may be analysed as follows:

At At

(in thousands of euros) December 31, 2005 Accruals Utilisations December 31, 2006

Provision for contractual fees 23,256 – (23,256) –

Provision for indemnities – 18,000 – 18,000

Restructuring provision 4,115 1,890 (4,115) 1,890

Provision for employee bonuses 3,620 6,901 (3,620) 6,901

Total Provisions for employee benefits and other current provisions 30,991 26,791 (30,991) 26,791

The provision for contractual fees at December 31, 2005 was made with respect to any fees that would have been payable to

Mediobanca S.p.A. if the latter had listed the Ferrari S.p.A. shares sold in 2002. As discussed above (see Note 13) the provision

has been used to reduce the carrying amount of the investment in Ferrari S.p.A. repurchased during the year.