Chrysler 2006 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Introduction

Principal Transactions that affected the Scope

of Consolidation in 2006

■The procedure for the sale of the subsidiary Atlanet S.p.A.

to the British Telecom group was for the most part finalised

in the first quarter of 2006 on receiving the approval of the

Italian Guarantor Authority for Competition and the Market.

The transaction was completed when the businesses in Poland

and Brazil were sold during the second half of 2006.

■On August 30, 2006, Teksid S.p.A. sold 100% of the interest

it held in Société Bretonne de Fonderie et Mecanique.

■On August 31, 2006, Fiat sold its holding in Banca Unione

di Credito (B.U.C.) to BSI (a company of the Generali Group).

■On December 28, 2006 Fiat Auto and Crédit Agricole

completed the transaction for the creation of a 50/50 joint

venture, Fiat Auto Financial Services (FAFS), which will handle

Fiat Auto’s main financing activities in Europe (retail auto

financing, dealership financing, and long-term car rental and

fleet management). In particular: Fiat Auto, upon exercise of

its call option, purchased from Synesis Finanziaria 51% of Fidis

Retail Italia (a company controlling the Fiat Auto European

retail financing activities) which then changed its corporate

name into Fiat Auto Financial Services. FAFS acquired certain

Fiat Auto subsidiaries active in the European Fiat Auto dealer

financing and renting business. Fiat Auto sold to Sofinco, the

wholly owned consumer credit subsidiary of Crédit Agricole,

50% of the share capital of FAFS.

These changes in the scope of operations do not have

a significant overall impact on the comparability of the data

for the two reference periods. Nevertheless, analyses of both

the Group as a whole and the individual areas highlight

the respective effects.

Report on Operations Financial Review of the Group24

During 2006, Fiat raised its stake in Ferrari from 56% to 85%;

description of related transactions is presented in the Notes

to the Financial Statements. In addition, it should be noted that

on December 6, 2006, the Fiat Group and Norsk Hydro reached

an agreement for the sale of their interests in Meridian

Technologies Inc., 51% and 49% respectively, to a consortium

of investors headed by the Swiss holding company Estatia AG.

Closing of the transaction is subject to approval by competent

authorities.

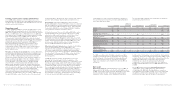

Starting January 1, 2006 reporting of certain Business Areas

of the Group was redefined as follows.

The Fiat Powertrain Technologies Sector is no longer included

in the Automobiles Business Area since it no longer comprises

only the passenger vehicles engine and transmissions activities

–over which Fiat regained control in May 2005 following the

termination of the Master Agreement with General Motors –

but also the industrial powertrain activities that were included

in the Iveco Sector until December 31, 2005.

In accordance with IAS 14 – Segment Reporting, the figures

for 2005 have consequently been reclassified by assigning

the former Iveco powertrain activities to Fiat Powertrain

Technologies (FPT); the Iveco Sector, on the other hand,

no longer includes these activities. From the beginning

of 2006, FPT also encompasses the C.R.F.powertrain activities.

Starting from January 1, 2006 the Fiat Powertrain Technologies

Sector is included in the Components and Production Systems

Business Area and, therefore, from the same date,

the Automobiles Business Area comprises Fiat Auto (the Fiat,

Alfa Romeo, Lancia and Fiat Light Commercial Vehicles

brands), Maserati and Ferrari.

Report on Operations Financial Review of the Group 25

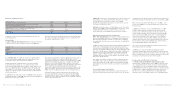

Financial Review of the Group

Operating Performance of the Group

(in millions of euros) 2006 2005

Net revenues 51,832 46,544

Cost of sales 43,888 39,624

Selling, general and administrative costs 4,697 4,513

Research and development costs 1,401 1,364

Other income (expenses) 105 (43)

Trading profit 1,951 1,000

Gains (losses) on the disposal of investments 607 905

Restructuring costs 450 502

Other unusual income (expenses) (47) 812

Operating result 2,061 2,215

Financial income (expenses) (576) (843)

Unusual financial income –858

Result from investments: 156 34

-Net result of investees accounted for using the equity method 125 115

-Other income and expenses from investments 31 (81)

Result before taxes 1,641 2,264

Income taxes 490 844

Result from continuing operations 1,151 1,420

Result from discontinued operations ––

Net result for the year 1,151 1,420

Attributable to:

Equity holders of the parent 1,065 1,331

Minority interests 86 89

Financial Review of the Group

In the review that follows, net revenues and trading profit are

discussed by single Business Area/Sector; the other data refer

to the Group as a whole.

Net revenues

In 2006 the Fiat Group recorded net revenues of 51,832 million

euros, up 11.4% from 2005. The increase is largely attributable

to the positive contribution of Fiat Auto and Iveco. Revenues

also increased at CNH and the Components and Production

Systems Business Area.