Chrysler 2006 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Finally, the name “Fiat Group Automobiles S.p.A.” highlights

the international vocation of this large industrial organisation.

The creation of four companies reflects the attention devoted

by the Group to positioning the brands on the market.

The Fiat, Alfa Romeo, Lancia, and Fiat Light Commercial

Vehicles brands each have a specific identity with defined,

recognised characteristics, and apply distinct commercial

and market policies.

Formation of these four new companies must be interpreted

in view of the growing distinctiveness of the brands, enhanced

value, and reinforcement of their competitive capacities.

■On February 14 2007, Fiat and Tata Motors signed

an agreement which calls for a Tata license to build a pick-up

vehicle bearing the Fiat nameplate at Fiat Group Automobiles’

plant in Córdoba, Argentina. The first vehicles will roll off the

Córdoba assembly lines during 2008. Annual production is

slated at around 20,000 units. Total planned investment in the

project is around US$80million. With the production of the

pick-up model, the Fiat complex in Córdoba will retake the

integral activity of all its productive units, to a great extent

reinitiated with the manufacture of Fiat engines and gearboxes

and the recent agreement to produce gearboxes for PSA

Peugeot Citröen. The pick-up, based on the new generation

Tata pick-up truck, will be sold in South and Central America

and selected European markets through Fiat Automobiles’

distribution and importer network. This will permit the Fiat

brand to aggressively enter the medium pick-up sector,thanks

to Tata Motors’ specific know-how.

■On February 14 2007, Iveco and Tata Motors announced the

signing of a Memorandum of Understanding (MoU) to analyse

the feasibility of cooperation, across markets, in the area of

Commercial Vehicles. The MoU encompasses a number of

potential developments in engineering, manufacturing,

sourcing and distribution of products, aggregates and

components. Shortly after the MoU signature, Iveco and Tata

Motors will set up a joint Steering Committee to determine the

feasibility of cooperation, both in the short and over the long

term. When found feasible, the two companies will enter into

definitive agreements in the course of the coming months.

■Ameeting was held on February 19, 2007 at the Italian Prime

Minister’s Office, with the participation of the Prime Minister,

the Ministers of Labour and Transport, and the Vice Minister

Significant Events Occurring since the End

of the Fiscal Year

The most significant transactions completed by the Fiat Group

during early 2007 are set out below:

■On January 26, Fitch Ratings announced that it upgraded

Fiat’s rating to “BB” from “BB-“, reaffirming the short-term

rating to “B” and maintaining the outlook “positive”. Standard

&Poor’s Ratings Services revised its outlook on Fiat rating to

“positive” from “stable”, affirming the ‘BB’ long-term and ‘B’

short-term corporate credit ratings. On February 12, Moody’s

Investors Service upgraded to Ba2 from Ba3 Fiat rating

maintaining the positive outlook. The short term rating remains

unchanged.

■On February 1, 2007 Fiat Auto changed name to “Fiat Group

Automobiles S.p.A.”.

Four new companies were formed at the same time, 100%

owned by Fiat Group Automobiles S.p.A.: “Fiat Automobiles

S.p.A.”, “Alfa Romeo Automobiles S.p.A.”, “Lancia

Automobiles S.p.A.”, and “Fiat Light Commercial Vehicles

S.p.A.”.

These changes are consistent with the new corporate culture

at the Fiat Group. In particular,they reflect two strategic

decisions as to how to approach the business. On the one

hand, the Group will exist as a unified whole, and on the other

hand, each company will be characterised by the specific

nature of the respective operating sectors and individual

brands.

Over the next few months, all Group activities will highlight

this aspect by pairing the “Fiat Group” mark with the sector

or brand trademark.

Inclusion of the word “Group” in the name reflects its

prominent role as a constituent part of the Fiat Group,

considering the contribution that Fiat Auto makes to Group

results and the realisation of major synergies with other

Group sectors.

The new name also identifies a key area of activity that has

recently undergone profound transformation, featuring

a newly streamlined structure that is more solid and compact

than before.

At the same time, it also indicates the synergies linking

the automotive business, which has already generated major

benefits in terms of operating efficiency, resource

management, and cost cuts.

The agricultural tractor industry is expected to continue

running at high levels, while the combine industry should

recover from the recent declines on the back of pricing

recovery in corn and soybeans. The worldwide construction-

equipment industry should remain strong for both heavy and

light equipment, although the North American markets are

expected to soften for a year before resuming upward growth

in 2008. In this context, CNH expects to improve sales volumes

thanks to new products, improved pricing and market share

gains. Higher volumes, manufacturing efficiencies and other

cost reductions will be partially offset by continuing higher

R&D investments.

In Western Europe, the market for light, medium and heavy

commercial vehicles is expected to remain substantially stable.

In this environment, Iveco aims at increasing both profitability

and market share by a substantial commercial repositioning,

with price improvements coming from the introduction of new

Euro 4 and Euro 5 compliant vehicles. For heavy trucks, Iveco

will be leveraging the performances of the New Stralis,

especially in terms of fuel efficiency and the improvement

in the resale value of our vehicles.

In order to achieve set targets, the Fiat Group will continue

to push inter-Sector purchasing synergies, increasing and

accelerating development of best-cost-country spending,

strengthening strategic partnerships with suppliers through

long-term contracts, and focusing on the implementation

of the world-class manufacturing initiative.

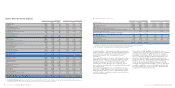

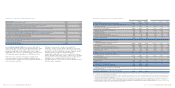

As a result, the Group confirms its targets for 2007: trading

profit between 2.5 billion euros and 2.7 billion euros (4.5%

to 5.1% trading margin) and net income between 1.6 billion

euros and 1.8 billion euros.

By sector, full-year 2007 trading margin targets (trading profit

as a percentage of revenues) will range as follows:

■Autos, 2.6% to 3.4%;

■CNH, 8.9% to 9.7%;

■Iveco, 7.1% to 7.9%.

While working on the achievement of these objectives, the

Fiat Group will continue to implement its strategy of targeted

alliances, in order to reduce capital commitments, and reduce

the related risks.

Report on Operations Significant Events Occurring since the End of the Fiscal Year and Business Outlook 57

for Economic Development, as well as national labour

federation and industry representatives. The Chief Executive

Officer Sergio Marchionne illustrated the Group’s development

plans for 2007-2010, with special attention being devoted to

the situation in Italy. The meeting concluded with the signing

of a transcript in which the Italian Government affirmed its

willingness to support the Company’s development plans.

In particular, this would involve close assessment of initiatives

taken in support of investments and research, and recognise

the existence of conditions for granting the Fiat Group a quota

for “mobilità lunga” (long-term mobility benefit to bridge

the period prior to retirement). This amount was defined

in the December 18, 2006 labour agreement, which envisages

that a maximum of 2,000 Group employees will be laid off.

The meeting transcript also envisages setting up a roundtable

with the participation of local institutions to examine the

measures necessary to overcome logistical and economic

restraints at the Termini Imerese plant in Sicily, so that

production of a model can be allocated to it starting from 2009.

Furthermore, the obligations imposed by the “Personal Data

Protection Code” (Legislative Decree No. 196/2003) were

satisfied in compliance with the provisions of the “Technical

Regulation of Minimum Security Measures” (Appendix B

of the Code). Consequently, the Fiat S.p.A. Security Planning

Document was updated by the addition of the Plan for

additional measures reinforcing security levels in order

to combat the evolution of emerging risk factors.

Business Outlook

The Western European automobile market is expected

to remain stable in 2007, while demand in Brazil should

show moderate growth.

In this context, the Group’s Automobile Sector plans

to leverage the introduction of its new models (mainly

Fiat Bravo, Fiat Linea and Fiat 500) to continue to boost

volume and improve mix in the European markets. Meanwhile,

the Sector’s Brazilian operations are expected to deliver

atrading performance in line with 2006. The Company will

continue to implement its strategy of aggressive cost-cutting

in all non-essential areas and, while streamlining governance

costs, it will continue to invest in marketing and advertising,

in order to support its growth ambitions.

Report on Operations Significant Events Occurring since the End of the Fiscal Year and Business Outlook56

Significant Events Occurring

since the End of the Fiscal Year

and Business Outlook