Chrysler 2006 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Fiat Group Consolidated Financial Statements at December 31, 2006 -Notes 153

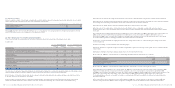

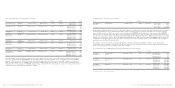

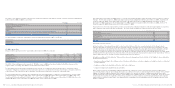

The following table summarises outstanding stock options under the CNH EIP at December 31, 2006:

Options Outstanding Options Exercisable

Weighted Average Weighted Average Weighted Average

Number of Shares remaining Exercise Price Number of Shares Exercise Price

Range of Exercise Price (in USD) Outstanding Contractual Life (in USD) Exercisable (in USD)

10.00 – 19.99 364,316 5.6 16.20 364,316 16.21

20.00 – 29.99 387,510 5.2 21.20 – –

30.00 – 39.99 523,600 4.4 31.70 523,600 31.70

40.00 – 69.99 485,040 3.1 68.85 474,084 68.85

Total at December 31, 2006 1,760,466 1,362,000

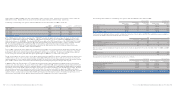

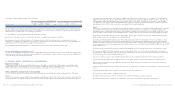

The Black-Scholes pricing model was used to calculate the fair value of stock options by CNH. The weighted-average assumptions

used under the Black-Scholes pricing model were as follows:

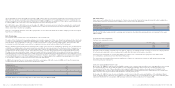

2006 2005

Directors’ plan Equity incentive plan Directors’ plan Equity incentive plan

Option life (years) 53.25 5 5

Expected volatility of CNH Global N.V. shares (%) 71.0 34.7 72.0 71.5

Expected dividend yield (%) 1.3 1.3 1.3 1.3

Risk-free interest rate (%) 4.8 4.5 3.9 3.7

Based on this model, the weighted-average fair values of stock options awarded for the years ended December 31, 2006, and 2005

were as follows:

(in USD) 2006 2005

CNH Directors’ Plan 14.61 10.13

CNH EIP 5.78 10.18

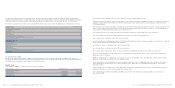

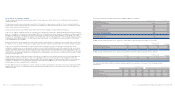

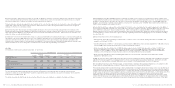

Changes during the period in all CNH stock option plans are as follows:

Directors’ plan Equity incentive plan

Number of Average exercise Number of Average exercise

shares price (in USD) shares price (in USD)

Outstanding at the beginning of the year 169,042 21.60 2,041,070 34.62

Granted during the year 54,589 25.75 2,010,046 21.20

Forfeited during the year (33,874) 34.74 (1,814,131) 22.84

Exercised during the year (62,987) 14.10 (476,519) 16.20

Expired during the year – – ––

Outstanding at December 31, 2006 126,770 23.19 1,760,466 36.42

Exercisable at December 31, 2006 82,770 22.43 1,362,000 40.48

Exercisable at December 31, 2005 141,872 22.50 1,747,634 36.76

At December 31, 2006 and 2005, there were 772,296 and 1 million common shares, respectively reserved for issuance under the

CNH Directors’ Plan. Outside directors do not receive benefits upon termination of their service as directors.

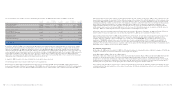

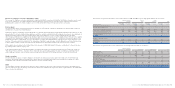

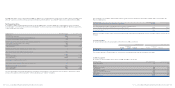

Asummary of outstanding stock options under the CNH Director Plan at December 31, 2006 is as follows:

Options Weighted Average Options Weighted Average

outstanding at remaining contractual outstanding at remaining contractual

Exercise price (in USD) December 31, 2006 life (in years) December 31, 2005 life (in years)

9.15 – 15.70 23,271 6.2 64,348 8.3

15.71 – 26.20 50,150 8.6 71,055 8.4

26.21 – 40.00 48,104 8.2 18,654 5.5

40.01 – 56.00 1,622 3.8 4,460 4.9

56.01 –77.05 3,623 3.3 10,525 4.3

Total at December 31, 2006 126,770 7.8 169,042 7.7

■The CNH Equity Incentive Plan,as amended (the “CNH EIP”)provides for grants of various types of awards to officers and

employees of CNH and its subsidiaries. In 2006, the CNH EIP was amended to reserve an additional 10,300,000 shares, raising

total reserved shares to 15,900,000. The amended CNH EIP now requires that CNH shareholders, at the CNH Global N.V.: Annual

General meeting or any Extraordinary General Meeting, ratify and approve the maximum number of shares available under the

EIP.In connection with this new requirement, CNH received written confirmation from Fiat, which at the time owned

approximately 90% of CNH’s issued and outstanding common stock, that would vote at the next Annual General meeting to

approve the increase in available shares under the CNH EIP.

Prior to 2006, certain stock option grants were issued which vest ratably over four years from the grant date and expire after ten

years. Certain performance-based options, which had an opportunity for accelerated vesting tied to the attainment of specified

performance criteria were issued; however, the performance criteria was not achieved. In any event, vesting of these options

occurs seven years from the grant date. All options granted prior to 2006 have a contract life of ten years.

Except as noted below,the exercise prices of all options granted under the CNH EIP are equal to or greater than the fair market value

of CNH common shares on the respective grant dates. During 2001, CNH granted stock options with an exercise price less than the

quoted market price of our common shares at the date of grant. The exercise price of this grant was based upon the average closing

price of CNH common shares on the New York Stock Exchange for the thirty-day period preceding the date of grant.

In 2006, the CNH Long-Term Incentive (“LTI”) award discussed below was replaced by plans providing performance based stock

options, cash, and stock options. As a part of this change, CNH, in September 2006, granted approximately 2.0 million performance

based stock options which will result in an estimated expense over the vesting period of approximately 10 USD million (at targeted

performance levels) under its EIP. Target performance levels were not achieved, resulting in only 387,510 shares vesting. All of the

other performance based stock options were forfeited. One-third of the options vested with the approval of 2006 results by the

Board of Directors. The remaining options will vest equally on the first and second anniversary of the initial vesting date. The actual

number of shares vesting may exceed 2 million if CNH’s performance exceeds targets; however, if minimum target levels are not

achieved, the options will not vest. Options granted under the EIP in 2006 have a five years contractual life.

Fiat Group Consolidated Financial Statements at December 31, 2006 -Notes 152