Chrysler 2006 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Operating Performance

In 2006, the Sector’s reference market continued to be

impacted by uncertainty, shrinking volumes and intense

pressure on prices.

Car manufacturers in the Western World generally scaled back

their investment programs, but they did not stop introducing

new models on the market. They continued to focus on

converting existing facilities and rationalising production

capacity,while greenfield investments were suspended or

postponed.

By contrast, a number of countries in Asia and Eastern Europe

have shown an increase in investments, often through joint

ventures between Western car manufacturers and local

partners.

The unfavourable market conditions negatively impacted

Comau revenues, which decreased by approximately 18.6%

from 2005 mainly due to a slowdown in activity levels at the

European Body-welding operations.

To meet the challenge of slow markets, flagging order intake

and diminishing revenues, Comau embarked on a restructuring

program in the third quarter of 2006, reshaping the scope of

its activities and presence in the countries where it operates.

The programme will start to show benefits in 2007, while its

full effect on profitability will be achieved from 2008 onwards.

With markets shrinking, order intake totalled 1,194 million

euros in 2006, down approximately 16% from 2005.

In 2006, new orders for contract work came to 929 million

euros, down 23% from 2005. Overall, 54% of the orders for

contract work were acquired in Europe, 27% in the Nafta area,

while the remaining 19% came from the Mercosur and new

markets (5% in China). 32% of all orders came from Fiat Group

companies and 68% from other manufacturers. At

December 31, 2006 the order backlog totalled 593 million

euros, down approximately 15% from 2005.

For Service operations, 2006 saw a significant increase

in orders (+11%), reaching a value of 265 million euros

(25% of which coming from Fiat Group companies).

Report on Operations Comau 79Report on Operations Teksid78

Operating Performance

In 2006, an unsettled energy market continued to put strong

pressure on the metallurgical industry. Against this challenging

background, the Sector’s diversification in terms of customers,

products and geographical destination, as well as ongoing

improvements in process efficiency and logistics, made it

possible to improve overall performance.

In 2006, a French company (SBFM) active in the Cast Iron

business was sold. Excluding the impact of this sale, Teksid

revenues would have increased (+3.5%) with respect to the

previous year.

Revenues of the Cast Iron Business Unit decreased by 5.6%

and volumes by 6.5%. The change is connected to the

mentioned sale of SBFM. On a comparable basis, revenues

would have increased by 7.2% due to both higher volumes

(+1.5%) and the favourable effect of exchange rates, the

Brazilian real in particular.Brazil was the highest growing area

also in terms of revenues.

It is worth noting that in the Cast Iron business, Teksid is also

active in China through Hua Dong Teksid Automotive Foundry

Co. Ltd, a jointly controlled company accounted for using the

equity method. This company recorded a 20.2% increase in

volumes from 2005.

The Magnesium Business Unit (where Teksid operates through

Meridian Technologies Inc., in which Teksid holds a 51%

interest and Norway’s Norsk Hydro group the remaining 49%)

recorded a reduction in both revenues (-5.2%) and volumes

(-6.2%) due to a slowdown in the reference market, in

particular the North American market, which nevertheless

continued to account for approximately 80% of revenues

in 2006.

As part of Teksid’s strategy to focus on its core business,

in December 2006 the Fiat Group and Norsk Hydro reached

an agreement for the sale of their interests in Meridian

Technologies Inc. to a consortium of investors headed by

the Swiss holding company Estatia AG. Completion of the

transaction is subject to approval by competent authorities

(received in 2007) and closing of the financing to the purchaser

by financial institutions.

Metallurgical Products – Teksid Production Systems – Comau

Highlights

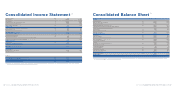

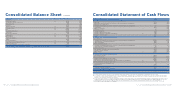

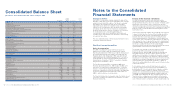

(in millions of euros) 2006 2005

Net revenues 979 1,036

Trading profit 56 45

Operating result (*) 26 27

Investments in tangible and intangible assets 32 45

Total R&D expenses (**) 55

Employees at year-end (number) 8,342 8,952

(*) Including restructuring costs and unusual income (expenses).

(**) Including R&D capitalised and charged to operations.

Highlights

(in millions of euros) 2006 2005

Net revenues 1,280 1,573

Trading profit (66) 42

Operating result (*) (272) (8)

Investments in tangible and intangible assets (**) 56 38

-of which capitalised R&D costs 79

Total R&D expenses (***) 20 20

Employees at year-end (number) 12,293 12,725

(*) Including restructuring costs and unusual income (expenses).

(**) The 2006 figure includes 34 million euros for investments by Comau North America

related to sales/leaseback transactions carried out in previous years.

(***) Including R&D capitalised and charged to operations.