Chrysler 2006 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

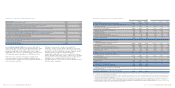

■Holding companies, Other companies and Eliminations

closed 2006 with a trading loss of 169 million euros. The

improvement of 61 million euros from 2005 was mainly due to

the effect of the reorganisation and rationalisation of non-core

activities and central structures.

Operating result

In 2006, operating result was positive by 2,061 million euros

compared with an operating income of 2,215 million euros in

2005. The 154 million euro decrease reflects lower net unusual

income of 1,105 million euros (110 million euros in 2006 and

1,215 million euros in 2005) versus an improvement in trading

profit of 951 million euros. In 2006, gains on disposal

of investments totalled 607 million euros and were in part

offset by restructuring charges of 450 million euros and other

unusual expenses of 47 million euros. In 2005, unusual items

included the gain from the termination of the Master

Agreement with General Motors of 1,134 million euros,

and the Italenergia Bis gain (878 million euros), net of

restructuring charges of 502 million euros and the balance

of other unusual income (expenses) which was negative

by 322 million euros.

Net gains on the disposal of investments,equal to 607 million

euros,included the gain of 463 million euros resulting from

the sale, within the framework of the agreement with Crédit

Agricole, of 50% of Fiat Auto Financial Services, the joint

venture that handles Fiat Auto’smain financing activities in

Europe, as well as the gains on the sale of B.U.C. – Banca

Unione di Credito (80 million euros), Immobiliare Novoli

S.p.A. (39 million euros), Machen Iveco Holding SA that

controlled 51% of Ashok Leyland Ltd (23 million euros),

Atlanet S.p.A. (22 million euros) the residual interest in IPI

S.p.A. (9 million euros), and the expected loss of 29 million

euros in connection with the sale of the stake held in Meridian

Technologies Inc., that comprises Teksid’s Magnesium

activities. Completion of the transaction is still subject to

closing of the financing to the purchaser by financial

institutions. The 905 million euros recorded in 2005 included

the gain (878 million euros) from the sale of the investment

Report on Operations Financial Review of the Group 33Report on Operations Financial Review of the Group32

counterparties to settle contractual guarantees granted on

the sale of businesses in previous years totalling 30 million

euros and other minor items.

in Italenergia Bis to Electricité de France and the gain realised

upon the sale of Palazzo Grassi S.p.A. (23 million euros).

Restructuring costs totalled 450 million euros and were

mainly attributable to Comau (179 million euros) in connection

with the redefinition and restructuring of the perimeter of the

Sector’s operations, CNH (145 million euros), Fiat Powertrain

Technologies (60 million euros), Magneti Marelli (16 million

euros), Business Solutions (12 million euros).

In the previous year, these costs, totalling 502 million euros,

stemmed mainly from restructuring of the Sector’s central

organisation and several operations outside Italy of most

Group Sectors. The most significant amounts were

attributable to Fiat Auto (162 million euros) also as a result

of restructuring of the Fiat-GM Powertrain activities (the joint

venture unwound at the beginning of May 2005), Iveco (99

million euros), CNH (87 million euros), Comau (46 million

euros), and Magneti Marelli (33 million euros).

Other unusual income (expenses) was negative by 47 million

euros, of which 26 million euros attributable to the

impairment of the goodwill of certain European companies

of Comau, resulting from the reshaping and restructuring

of the perimeter of the Sector’s operations undertaken during

the second half of the year and 17 million euros due to the

reorganisation and rationalisation of relationships with

Group suppliers.

In 2005 this item was positive by 812 million euros and

included the following: gain from the termination of the

Master Agreement with General Motors for 1,134 million euros

(net of accessory costs); a gain of 117 million euros realised

upon final disposal of the real estate properties that had been

securitised in 1998; expenses of 187 million euros related to

the reorganisation and rationalisation of both Group suppliers

(started in 2004) and Fiat Auto dealers; Fiat Auto expenses

of 141 million euros associated with platform rationalisation

and production relocation; 71 million euros in expenses for

the indemnity recognised to Global Value for the unwinding

of the joint venture with IBM; indemnities paid to

The 2005 operating result of Holding companies and Other

companies included the gain of 878 million euros resulting

from the disposal of the investment in Italenergia Bis and,

under other unusual income, an amount of 1,134 million

euros (net of ancillary costs) related to the General Motors

settlement.

Net result

Net financial expenses totalled 576 million euros in 2006, an

improvement of 267 million euros from the 843 million euros

of 2005. The positive change is mainly attributable to the lower

level of net industrial debt of the Group, in particular the

elimination of the charges on the Mandatory Convertible

Facility and on the financing connected with the Italenergia Bis

transaction, which were reimbursed in September 2005, as well

as higher financial income of 56 million euros arising from the

equity swap agreements on Fiat shares which had been

entered into to cover stock option plans. The financial

component of costs for pension plans and other employee

benefits totalled 166 million euros in 2006 (146 million euros

in 2005).

Fiscal 2005 had benefited from unusual financial income

of 858 million euros resulting from the capital increase

of September 20, 2005 with the simultaneous conversion

of the Mandatory Convertible Facility. The income represents

the difference between the subscription price of the shares

and their stock market price at the date of subscription.

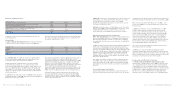

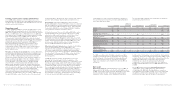

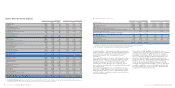

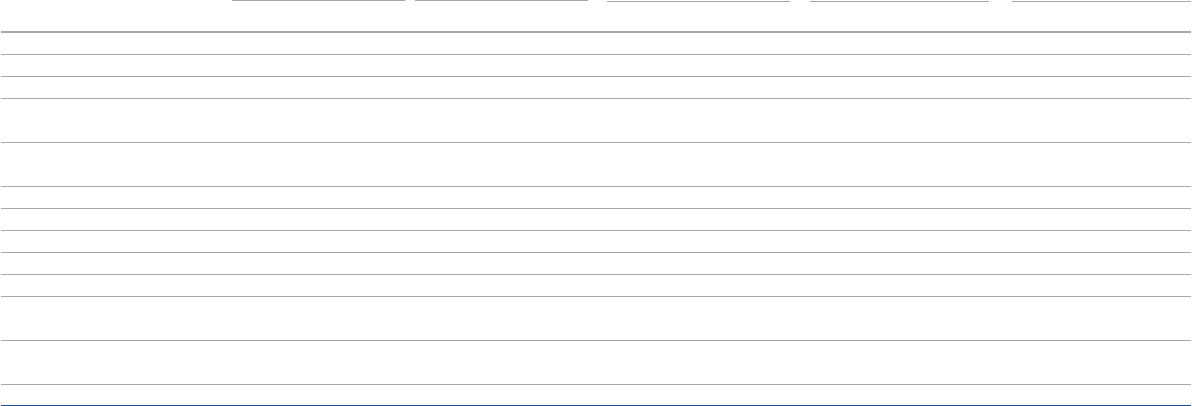

The following table illustrates the components of operating

result broken down by Sector:

Gains/Losses

on the disposal Other unusual

Trading profit of investments Restructuring costs income (expenses) Operating result

(in millions of euros) 2006 2005 2006 2005 2006 2005 2006 2005 2006 2005

Fiat Auto 291 (281) 461 –9162 (16) (375) 727 (818)

Maserati (33) (85) ––––––(33) (85)

Ferrari 183 157 ––––––183 157

Agricultural and Construction

Equipment (CNH-Case New Holland) 737 698 ––145 87 ––592 611

Trucks and Commercial

Vehicles (Iveco) 546 332 25 (10) 699 –(11) 565 212

Fiat Powertrain Technologies 168 109 ––60 20 (6) (8) 102 81

Components (Magneti Marelli) 190 162 ––16 33 1(2) 175 127

Metallurgical Products (Teksid) 56 45 (29) 5414 3(9) 26 27

Production Systems (Comau) (66) 42 (1) (1) 179 46 (26) (3) (272) (8)

Services (Business Solutions) 37 35 3912 22 –(15) 28 7

Publishing and

Communications (Itedi) 11 16 1––2–(1) 12 13

Holdings companies, Other

companies and Eliminations (169) (230) 147 902 19 17 (3) 1,236 (44) 1,891

Total for the Group 1,951 1,000 607 905 450 502 (47) 812 2,061 2,215