Chrysler 2006 Annual Report Download - page 159

Download and view the complete annual report

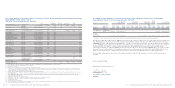

Please find page 159 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.B. Employee benefits

The employees’ severance indemnity (Trattamento di Fine

Rapporto or TFR)which was accounted for under Italian

accounting principles in accordance with specific legal

requirements is considered to be a defined benefit obligation

under IAS 19 – Employee Benefits and consequently has been

recalculated using the Projected Unit Credit Method.

In addition Fiat S.p.A. grants various forms of benefits to its

employees and former employees (termination incentives,

compensation, bonuses) in connection with previous or

current, local company or individual, employment agreements,

for which obligations are measured under IAS 19 in a manner

different from that used previously under Italian accounting

principles.

The application of IAS 19 has led to an overall increase in

stockholders’ equity at January 1, 2005 and in the 2005 net

result.

Finally Fiat S.p.A. accounts for employee benefits using the

corridor approach and has elected to present the interest

component of defined benefit employee plans in the item

“net financial income (expense)”, with the resulting increase

in financial expenses for 2005.

C. Write-off of deferred costs

(excluding the financial expenses of

the “Mandatory Convertible Facility”)

Under Italian accounting principles Fiat S.p.A. capitalised and

amortised certain costs (mainly start-up and extension costs)

which require a different accounting treatment under IFRS.

In addition, costs incurred in connection with increases in

capital stock, which are also deferred and amortised under

Italian accounting principles, are recognised under IFRS as a

deduction from equity in accordance with IAS 32 – Financial

Instruments: Disclosure and Presentation.

The adoption of IFRS has therefore led to a decrease in

stockholders’ equity at January 1, 2005 and to an increase

in the 2005 net result as the result of the reversal of the

Appendix Transition of the Parent Company Fiat S.p.A. to International Financial Reporting Standards (IFRS)314

amortisation charged to the Income Statement under Italian

accounting principles.

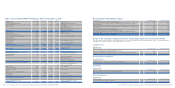

D. Treasury stock

In accordance with Italian accounting principles Fiat S.p.A.

accounted for treasury stock as an asset, recognising related

valuation adjustments and gains or losses on disposal in the

Income Statement.

Under IAS 32 treasury stock is deducted from stockholders’ equity

and any subsequent changes must also be recognised in equity.

The adoption of IFRS has therefore led to to a decrease in

stockholders’ equity at January 1, 2005 and in the 2005 net

result as the result of the reversal of the reinstatement of

treasury stock and of gains realised on disposal.

E. Measurement of derivative financial instruments

Starting from 2001 Fiat S.p.A. adopted IAS 39 – Financial

Instruments: Recognition and Measurement,to the extent

that is was considered consistent and not in contrast with the

general principles established by Italian law and regulations

governing financial statements. In particular, taking into

account the restrictions of Italian laws and regulations, it was

determined that IAS 39 was immediately applicable at that date

only in part and in reference to the designation of derivative

financial instruments as either “hedging instruments” or “

non-hedging instruments”, and with respect to the symmetrical

accounting of the result of the measurement of the hedging

instrument and the result attributable to the hedged item

(hedge accounting). The transactions which were entered into

within the extent of the company’s risk management policies

and which qualified for hedge accounting were classified as

“hedges”, while the others, although set up for the purpose

of managing risk exposure (as speculative operations are

not permitted as a policy), were designated as “trading”

transactions.

The main differences between Italian accounting principles

and IFRS may be summarised as follows:

instruments) – under Italian accounting principles these

instruments were measured at market value and if this was less

than contractual value the difference was recognised in the

Income Statement in accordance with the concept of prudence.

IAS 39 also requires the difference to be recognised when

market value exceeds contractual value. The accounting

treatment for foreign currency financial instruments under

Italian accounting principles was however in compliance with

IAS 39.

Fiat S.p.A. entered into a “Total Return Equity Swap”

agreement in 2005 to hedge the risk of a significant increase

in the Fiat share price above the exercise price of the stock

options granted to the Managing Director. At January 1, 2005

the Swap had a negative fair value that was recognised in the

financial statements prepared in accordance with Italian

accounting principles (a treatment in line with IFRS); at

December 31, 2005, however,the Swap had a positive fair

value which was not recognised under Italian accounting

principles and which therefore led to an increase in the 2005

net result for IFRS purposes.

F. Measurement at fair value of the investment

in Mediobanca

Investments in other companies classified as financial fixed

assets were measured at cost in the financial statements of

Fiat S.p.A. prepared in accordance with Italian accounting

principles; the carrying amount was adjusted for impairment

losses which were then reinstated in subsequent years if the

reasons underlying the impairment no longer subsisted.

Under IAS 39 – Financial Instruments: Recognition and

Measurement investments in other companies classified as

non-current financial assets and which are not held for trading

are measured at fair value if this can be determined, and the

resulting gains or losses resulting from changes in fair value are

recognised directly in equity until the assets are sold or impaired;

at that time cumulative gains and losses previously recognised in

equity are included in the Income Statement for the period.

The investment in Mediobanca S.p.A. held by the company is

classified as an available-for-sale financial asset, with its fair

value being determined from its Stock Exchange quotation at

Appendix Transition of the Parent Company Fiat S.p.A. to International Financial Reporting Standards (IFRS) 315

■Financial instruments designated as “hedging instruments”

–under Italian accounting principles the instrument is

measured symmetrically with the underlying hedged item.

As a result when the underlying hedged item is not adjusted

to fair value in the financial statements there is no requirement

to adjust the financial instrument. Similarly, where the hedged

item has not yet been recognised in the financial statements

(hedging of future cash flows), the valuation of the hedging

instrument at fair value is deferred.

Under IFRS:

–In the case of a fair value hedge the gains or losses arising

from remeasuring the hedging instrument at fair value are

recognised in the Income Statement, while the gains or losses

on the hedged item attributable to the hedged risk adjust the

carrying amount of the hedged item and are similarly

recognised in income. No impact consequently arises on net

profit or loss or stockholders’ equity from the adoption of IFRS

(except for any ineffective portion of the hedge), while

adjustments impact the carrying values of hedging instruments

and hedged items. Fiat S.p.A. has not entered any agreements

of this nature which have led to an impact on the periods

presented or which require the redetermination of the amounts

under IFRS.

–In the case of a cash flow hedge (hedging of future cash flows)

the portion of the gain or loss on the hedging instrument that

is determined to be an effective hedge is recognised directly in

equity through the statement of changes in equity, and the

ineffective portion of the gain or loss is recognised in the

Income Statement. Consequently differences between Italian

accounting principles and IFRS can only have an effect on

stockholders’ equity for the effective portion. In this respect the

impact on stockholders’ equity of the forward rate agreements

entered into by Fiat S.p.A. to hedge the risk of an increase in

interest rates on the variable part of the interest payable on the

Mandatory Convertible Facility is reflected in stockholders’

equity at January 1, 2005. These agreements had a negative

fair value at that date, not recognised under Italian accounting

principles, but which is recognised under IFRS with a

consequent decrease in stockholders’ equity.

■Financial instruments designated as “non-hedging

instruments” (except for foreign currency derivative financial