Chrysler 2006 Annual Report Download - page 49

Download and view the complete annual report

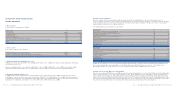

Please find page 49 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Fiat Group Consolidated Financial Statements at December 31, 2006 -Notes 95

Dividends received from these investments are included

in Other income (expenses) from investments.

Transactions eliminated on consolidation

All significant intragroup balances and transactions and

any unrealised gains and losses arising from intragroup

transactions are eliminated in preparing the consolidated

financial statements. Unrealised gains and losses arising from

transactions with associates and jointly controlled entities are

eliminated to the extent of the Group’s interest in those

entities.

Foreign currency transactions

Transactions in foreign currencies are recorded at the

foreign exchange rate prevailing at the date of the transaction.

Monetary assets and liabilities denominated in foreign

currencies at the balance sheet date are translated at the

exchange rate prevailing at that date. Exchange differences

arising on the settlement of monetary items or on reporting

monetary items at rates different from those at which they

were initially recorded during the period or in previous

financial statements, are recognised in the income statement.

Consolidation of foreign entities

All assets and liabilities of foreign consolidated companies

with a functional currency other than the Euro are translated

using the exchange rates in effect at the balance sheet date.

Income and expenses are translated at the average exchange

rate for the period. Translation differences resulting from the

application of this method are classified as equity until the

disposal of the investment. Average rates of exchange are used

to translate the cash flows of foreign subsidiaries in preparing

the consolidated statement of cash flows.

Goodwill and fair value adjustments arising on the acquisition

of a foreign entity are recorded in the relevant functional

currency of the foreign entity and are translated using the

period end exchange rate.

In the context of IFRS First-time Adoption, the cumulative

translation difference arising from the consolidation of foreign

operations was set at nil, as permitted by IFRS 1; gains or

losses on subsequent disposal of any foreign operation only

partially from the market: the remaining are obtained from Fiat

S.p.A. through the Group’s treasury companies (included in

industrial companies), which lend funds both to industrial

Group companies and to financial services companies as the

need arises. This financial service structure within the Group

means that any attempt to separate current and non-current

debt in the consolidated balance sheet cannot be meaningful.

Suitable disclosure on the due dates of liabilities is moreover

provided in the notes.

The Statement of Cash Flows is presented using the indirect

method.

In connection with the requirements of the Consob Resolution

No. 15519 of July 27, 2006 as to the format of the financial

statements, specific supplementary Income Statement and

Balance Sheet formats have been added for related party

transactions so as not to compromise an overall reading

of the statements.

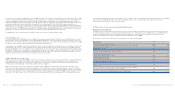

Basis of consolidation

Subsidiaries

Subsidiaries are enterprises controlled by the Group, as

defined in IAS 27 – Consolidated and Separate Financial

Statements.Control exists when the Group has the power,

directly or indirectly,to govern the financial and operating

policies of an enterprise so as to obtain benefits from its

activities. The financial statements of subsidiaries are included

in the consolidated financial statements from the date that

control commences until the date that control ceases. The

equity and net result attributable to minority stockholders’

interests are shown separately in the consolidated balance

sheet and income statement, respectively. When losses in a

consolidated subsidiary pertaining to the minority exceed

the minority interest in the subsidiary’s equity, the excess

is charged against the Group’s interest, unless the minority

stockholders have a binding obligation to reimburse the losses

and are able to make an additional investment to cover the

losses, in which case the excess is recorded as an asset in the

consolidated financial statements. If no such obligation exists,

should profits be realised in the future, the minority interests’

share of those profits is attributed to the Group, up to the

Fiat Group Consolidated Financial Statements at December 31, 2006 -Notes 94

amount necessary to recover the losses previously absorbed

by the Group.

Subsidiaries that are either dormant or generate a negligible

volume of business, are not consolidated. Their impact on the

Group’s assets, liabilities, financial position and earnings is

immaterial.

Jointly controlled entities

Jointly controlled entities are enterprises over whose activities

the Group has joint control, as defined in IAS 31 – Interests in

Joint Ventures.The consolidated financial statements include

the Group’sshare of the earnings of jointly controlled entities

using the equity method, from the date that joint control

commences until the date that joint control ceases.

Associates

Associates are enterprises over which the Group has

significant influence, but no control or joint control, over

the financial and operating policies, as defined in IAS 28

–Investments in Associates.The consolidated financial

statements include the Group’s share of the earnings of

associates using the equity method, from the date that

significant influence commences until the date that significant

influence ceases. When the Group’s share of losses of an

associate, if any,exceeds the carrying amount of the associate

in the Group’s balance sheet, the carrying amount is reduced

to nil and recognition of further losses is discontinued except

to the extent that the Group has incurred obligations in respect

of the associate.

Investments in other companies

Investments in other companies that are available-for-sale

financial assets are measured at fair value, when this can be

reliably determined. Gains or losses arising from changes in

fair value are recognised directly in equity until the assets are

sold or are impaired, when the cumulative gains and losses

previously recognised in equity are recognised in the income

statement of the period.

Investments in other companies for which fair value is

not available are stated at cost less any impairment losses.

include accumulated translation differences arising after

January 1, 2004.

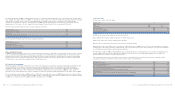

Intangible assets

Goodwill

In the case of acquisitions of businesses, the acquired identifiable

assets, liabilities and contingent liabilities are recorded at fair

value at the date of acquisition. Any excess of the cost of the

business combination over the Group’s interest in the fair value

of those assets and liabilities is classified as goodwill and

recorded in the financial statement as an intangible asset. If

this difference is negative (negative goodwill), it is recognised

in the income statement at the time of acquisition.

In the absence of a specific Standard or Interpretation on

the matter, when the Group acquires a minority interest in

controlled companies the excess of the acquisition cost over

the carrying value of the assets and liabilities acquired is

recognised as goodwill (the “Parent entity extension method”).

Goodwill is not amortised, but is tested for impairment

annually or more frequently if events or changes in

circumstances indicate that it might be impaired. After initial

recognition, goodwill is measured at cost less any accumulated

impairment losses.

On disposal of part or whole of a business which was

previously acquired and which gave rise to the recognition

of goodwill, the remaining amount of the related goodwill is

included in the determination of the gain or loss on disposal.

In the context of IFRS First-time Adoption, the Group elected

not to apply IFRS 3 – Business Combinations retrospectively

to the business combinations that occurred before January 1,

2004; as a consequence, goodwill arising on acquisitions

before the date of transition to IFRS has been retained at the

previous Italian GAAP amounts, subject to impairment testing

at that date.

Development costs

Development costs for vehicle project production (cars, trucks,

buses, agricultural and construction equipment, related