Chrysler 2006 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Fiat S.p.A. Financial Statements at December 31, 2006 - Notes to the Financial Statements 259Fiat S.p.A. Financial Statements at December 31, 2006 - Notes to the Financial Statements258

IRAP deferred tax expense of 3,438 thousand euros relates to the part of the margins earned on the long-term agreements with

T.A.V. S.p.A. whose taxation is deferred to the completion of the work, net of deferred deductible costs relating to the same tax.

Tax income relating to prior periods of 173 thousand euros relates to refunds of foreign income taxes and the finalisation of last

year’s national consolidated tax return.

Income taxes in the prior year consist almost exclusively of deferred tax expense of 277,000 thousand euros resulting from the

realisation of deferred tax assets recognised in the Balance Sheet at December 31, 2004 in relation to the income arising from

the termination of the Master Agreement with General Motors.

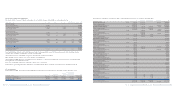

Areconciliation between theoretical income taxes determined on the basis of the tax rates applicable in Italy and the income taxes

reported in the financial statements is as follows:

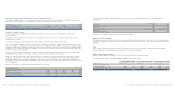

(in thousands of euros) 2006 2005

Theoretical income taxes 764,834 460,730

Tax effect of permanent differences (703,920) (138,560)

Taxes relating to prior years (173) 713

Unrecognised net deferred tax assets (91,501) (47,241)

Other differences –3,186

Current and deferred income tax recognised in the financial statements, excluding IRAP (30,760) 278,828

IRAP (current and deferred) 5,065 –

Income taxes reported in the Income Statement (current and deferred income taxes) (25,695) 278,828

Theoretical income taxes are calculated by applying the IRES tax rate (33% in 2006 and 2005) to the result before taxes. IRAP tax

is excluded to facilitate an understanding of the reconciliation between theoretical and reported income taxes; since it is calculated

on a tax basis that differs from profit before taxes, it would otherwise generate distortions between one year and another.

The permanent differences referred to above include amongst other things the tax effect of non-taxable income in 2006 amounting

to 837,061 thousand euros (459,423 thousand euros in 2005) and of non-deductible costs in 2006 amounting to 133,141 thousand

euros (320,863 thousand euros in 2005). In particular, non-taxable income in 2006 results principally from the reversal of

impairment losses on investments which led to an effect of 801,685 thousand euros (173,828 thousand euros in 2005). The

theoretical tax on this income in 2005 included also 283,020 thousand euros relating to the non-recurring financial income

of 857,636 thousand euros arising from the Mandatory Convertible Facility.

Non-deductible costs mainly include impairment losses on investments whose tax effect totalled 117,902 thousand euros in 2006

(315,989 thousand euros in 2005).

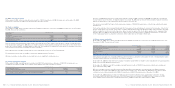

Net income from derivative financial instruments of 65,816 thousand euros (14,832 thousand euros in 2005) consists of the

component of profit and loss resulting from the valuation of derivative financial instruments arranged through other Group

companies which, in their turn, are parties to agreements with primary banks. In particular, the 2006 amount includes gains

of 71,198 thousand euros (14,832 thousand euros in 2005) arising from the change in fair value of two equity swaps, expiring

in 2007, stipulated to hedge the risk of an increase in the Fiat share price above the exercise price of stock options granted in

2004 and 2006 to the Chief Executive Officer (see Note 20). The equity swaps have a notional amount of 219,853 thousand euros

(70,241 thousand euros at December 31, 2005). Although theses equity swaps were entered into for hedging purposes, they do

not qualify for hedge accounting under IFRS and accordingly are defined as trading derivative financial instruments.

9. Financial income from significant non-recurring transactions

There is no financial income from significant non-recurring transactions in 2006.

In 2005 this item consisted of income of 857,636 thousand euros arising from the increase of capital stock on September 20, 2005

and the simultaneous extinguishment of the Mandatory Convertible Facility. In particular, this income represents the difference

between the subscription price of the shares (10.28 euros per share) and their stock market price at the subscription date (7.337

euros per share) related to the new shares issued (291,828,718 ordinary shares), net of the related costs.

10. Income taxes

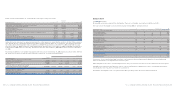

Income taxes recognised in the Income Statement can be analysed as follows:

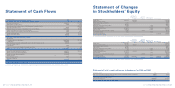

(in thousands of euros) 2006 2005

Current taxes:

-IRES (30,587) 1,115

- IRAP 1,627 –

Total Current taxes (28,960) 1,115

Deferred taxes for the period:

- IRES –277,000

-IRAP 3,438 –

Total deferred taxes for the period 3,438 277,000

Taxes relating to prior periods (173) 713

Total Income taxes (25,695) 278,828

IRES current tax income of 30,587 thousand euros arises from the compensation for the tax losses brought by the company into

the national tax consolidation for the year.

IRAP current tax expense of 1,627 thousand euros results from the taxable income for the year arising mostly from the margins

earned on the long-term agreements with T.A.V. S.p.A. for the completion of the work for the high speed stretch of line between

Turin and Novara.