Chrysler 2006 Annual Report Download - page 154

Download and view the complete annual report

Please find page 154 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

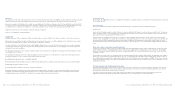

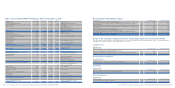

Effects of transition to IFRS on the Balance Sheet at December 31, 2005

(in millions of euros) Italian GAAP Reclassifications Adjustments IAS/IFRS

Intangible assets 28 – (28) – Intangible assets

Property, plant and equipment 41 (1) – 40 Property, plant and equipment

Equity investments 4,983 – 135 5,118 Investments

Other securities – 5 5 Other financial assets

– – – Deferred tax assets

5 – 5 Other non-current assets

Total fixed assets 5,052 4 112 5,168 Total Non-current assets

Inventories 8,431 (8,635) 204 – Inventories

Trade receivables 208 8 – 216 Trade receivables

Receivables from subsidiaries 113 (113) –

Financial receivables from subsidiaries 3,059 9 8 3,076 Current financial receivables

Taxes receivable 103 (103) –

Deferred tax assets –––

Other receivables 35 208 557 800 Other current receivables

Treasury stock 28 – (28)

Cash on hand – – – – Cash and cash equivalents

Total current assets 11,977 (8,626) 741 4,092 Total Current Assets

Accrued income and prepaid expenses 13 (13) –

–––Assets held for sale

TOTAL ASSETS 17,042 (8,635) 853 9,260 TOTAL ASSETS

Total stockholders’ equity 7,689 – 296 7,985 Total stockholders’ equity

Provisions for termination indemnities and Provisions for employee benefits

similar obligations 22 12 (5) 29 and other non-current provisions

Other provisions 31 (31) –

– – – Deferred tax liabilities

– 5 5 Non-current debt

17 – 17 Other non-current liabilities

Total provisions for risks and charges 53 (2) – 51 Total Non-current liabilities

Provision for employee severance indemnities 12 (12) –

Provisions for employees and

31 – 31 other current provisions

Trade payables 380 5 – 385 Trade payables

Payable to subsidiaries 223 (223) –

Borrowings from banks – – 557 557 Current debt

Advances 8,657 (8,657) –

Payables to social security authorities 2 (2) –

Other payables 23 228 – 251 Other payables

Taxes payable 3 (3) –

Total payables 9,288 (8,621) 557 1,224 Total Current Liabilities

Accrued expenses and deferred income – – –

––Liabilities held for sale

TOTAL STOCKHOLDERS’ EQUITY TOTAL STOCKHOLDERS’ EQUITY

AND LIABILITIES 17,042 (8,635) 853 9,260 AND LIABILITIES

Appendix Transition of the Parent Company Fiat S.p.A. to International Financial Reporting Standards (IFRS) 305Appendix Transition of the Parent Company Fiat S.p.A. to International Financial Reporting Standards (IFRS)304

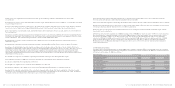

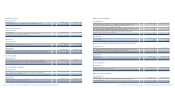

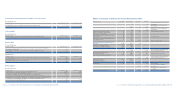

Reconciliation of Stockholders’ Equity

(in millions of euros) At January 1, 2005 At December 31, 2005

Stockholders’ equity in accordance with Italian GAAP 4,466 7,689

Measurement of contract work in progress using the percentage of completion method A176 204

Employee benefits B3 5

Write-off of deferred costs (excluding the financial expenses of the “Mandatory Convertible Facility”) C(42) (28)

Treasury stock D(26) (28)

Measurement of derivative financial instruments E(1) 8

Measurement at fair value of the investment in Mediobanca F75 135

Recognition and measurement of financial liabilities (“Mandatory Convertible Facility”) G5–

Total adjustments 190 296

Stockholders’ equity in accordance with IAS/IFRS 4,656 7,985

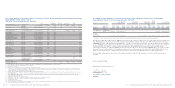

Details of the schedules regarding the effects on the Balance Sheet of the transition to IFRS

The final pages of this Appendix contain explanatory notes on the principal reconciling items between Italian accounting principles

and IFRS, cross-referenced in the following by the use of letters.

Intangible assets

Adjustments

(in millions of euros) At January 1, 2005 At December 31, 2005

Write-off of deferred costs (excluding the financial expenses

regarding the “Mandatory Convertible Facility”) C(42) (28)

Recognition and measurement of financial liabilities (the “Mandatory Convertible Facility”) G(8) –

(50) (28)

Property,plant and equipment

Reclassifications

(in millions of euros) At January 1, 2005 At December 31, 2005

to “Trade receivables” for minor adjustments and reclassifications (1) (1)

(1) (1)

Investments

Adjustments

(in millions of euros) At January 1, 2005 At December 31, 2005

Measurement at fair value of the investment in Mediobanca F75 135

75 135

Other financial assets

Adjustments

(in millions of euros) At January 1, 2005 At December 31, 2005

Recognition of financial guarantee contracts M75

75