Chrysler 2006 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Fiat S.p.A. Financial Statements at December 31, 2006 - Notes to the Financial Statements 267Fiat S.p.A. Financial Statements at December 31, 2006 - Notes to the Financial Statements266

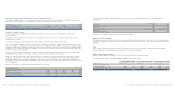

The loan of 2,709,592 thousand euros granted to Fiat Finance S.p.A. in 2005 consisted of 2,700,000 thousand euros as principal

increased by the accrued interest. It originally expired on January 16, 2006 and was then renewed and fully repaid in connection

with the recapitalisation of the subsidiaries mentioned above (see Note 13).

The current account with Fiat Finance S.p.A. represents a balance of 358,252 thousand euros on the Group centralised treasury

management.

The item Amounts due from Intermap (Nederland) B.V. for derivative financial instruments consists of the fair value of the first of

the two equity swaps on Fiat S.p.A. shares taken out with leading banks by Intermap (Nederland) B.V. under instruction from Fiat

S.p.A. to hedge the risk of a rise in the share price above the exercise price of the stock options granted to the company’s Chief

Executive Officer in 2004, as described in Note 8, to which reference should be made for additional information. The fair value

of this equity swap has been calculated on the basis of the market price at the Balance Sheet date.

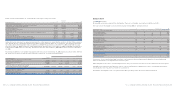

18. Other current receivables

At December 31, 2006, other current receivables amount to 626,428 thousand euros, a decrease of 173,491 thousand euros over

December 31, 2005. They are due as follows:

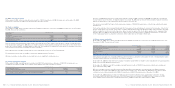

(in thousands of euros) At December 31, 2006 At December 31, 2005 Change

Intercompany receivables for consolidated IRES tax 146,847 74,024 72,823

Other intercompany receivables 61 31,983 (31,922)

VAT receivables 205,907 418,544 (212,637)

IRES tax receivables 268,429 236,832 31,597

Other 5,184 38,536 (33,352)

Total Other current receivables 626,428 799,919 (173,491)

Intercompany receivables for consolidated IRES tax arise from the tax calculated on the taxable income contributed by the Italian

subsidiaries participating in the national tax consolidation program.

At December 31, 2005, the item Other intercompany receivables included IRES receivables sold to subsidiaries for tax prepayments

made on their behalf (30,894 thousand euros).

At December 31, 2005, the item VAT receivables included factored credits of 335,073 thousand euros which were reimbursed

by tax authorities during 2006.

IRES tax receivables include receivables that the Italian subsidiaries participating in the national tax consolidation program

transferred to Fiat S.p.A. in the 2006 fiscal year and in previous fiscal years. At December 31, 2006 factored credits for which

arefund has been claimed amounted to 230,142 thousand euros (224,539 thousand euros at December 31, 2005).

At December 31, 2006, interest recognised on VAT receivables for which refund has been claimed (pro-rata portion for the

consolidated VAT) total 14,019 thousand euros (25,139 thousand euros at December 31, 2005) while that recognised on IRES

tax receivables (factored) amounts to 15,531 thousand euros (9,886 thousand euros at December 31, 2005).

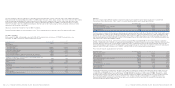

15. Other non-current assets

At December 31, 2006, other non-current assets amount to 1,573 thousand euros (4,502 thousand euros at December 31, 2005)

and consist of amounts receivable from tax authorities due after one year.

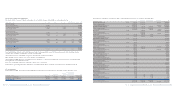

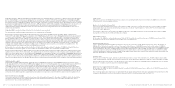

16. Trade receivables

At December 31, 2006, trade receivables amount to 154,692 thousand euros, a decrease of 60,960 thousand euros over December

31, 2005. They are due as follows:

(in thousands of euros) At December 31, 2006 At December 31, 2005 Change

Third parties

- Receivables 152,512 208,193 (55,681)

-Allowance for doubtful accounts (228) (228) –

Total third parties 152,284 207,965 (55,681)

Intercompany trade receivables 2,408 7,687 (5,279)

Total Trade receivables 154,692 215,652 (60,960)

Trade receivables from third parties mainly relate to amounts due from T.A.V. S.p.A. for the progress of works on high speed rail

sections during the latter part of 2006. These receivables match the trade payables resulting from the progress of the works to be

paid to the consortia CAV.E.T. and CAV.TO.MI. (see Note 25). The allowance for doubtful accounts has been calculated on the basis

of an assessment of the risk on a number of minor receivables.

Intercompany trade receivables mainly relate to licence agreements for the use of the Fiat trademark.

The carrying amount of trade receivables is deemed to approximate their fair value.

All trade receivables are due within one year and there are no significant overdue balances.

17. Current financial receivables

At December 31, 2006, current financial receivables total 84,173 thousand euros, a decrease of 2,991,721 thousand euros as

compared to December 31, 2005. They comprise intercompany loans and receivables as follows:

(in thousands of euros) At December 31, 2006 At December 31, 2005 Change

Loan to Fiat Finance S.p.A. –2,709,592 (2,709,592)

Current account with Fiat Finance S.p.A. –358,252 (358,252)

Amounts due from Intermap (Nederland) B.V. for derivative financial instruments 84,133 8,002 76,131

Other receivables due from Fiat Finance S.p.A. and Intermap (Nederland) B.V. 40 48 (8)

Total Current financial receivables 84,173 3,075,894 (2,991,721)