Chrysler 2006 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

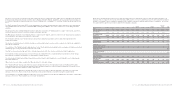

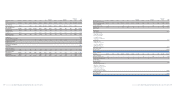

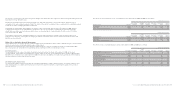

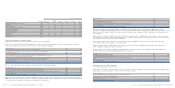

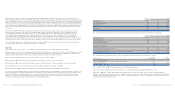

Fiat Group Consolidated Financial Statements at December 31, 2006 -Notes 193

Total sales of of which

consolidated

(in millions of euros) subsidiaries B.U.C. FAFS

Non-current assets 1,586 76 1,453

Cash and cash equivalents 653 196 442

Other current assets 5,119 1,005 3,957

Total assets 7,358 1,277 5,852

Debt 6,336 1,074 5,219

Other liabilities 590 34 395

Total liabilities 6,926 1,108 5,614

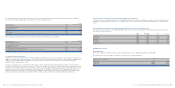

The consideration received for these sales of consolidated subsidiaries and the related net cash inflows are as follows:

Total sales of of which

consolidated

(in millions of euros) subsidiaries B.U.C. FAFS

Consideration received:

- Consideration due 593 254 277

- Less: Deferred sales proceeds, net (85) – (85)

Total Consideration received 508 254 192

Net cash inflows on disposals:

- Consideration received 508 254 192

- Less: Cash and cash equivalents disposed of (461) (196) (247)

Total Net cash inflows on disposals 47 58 (55)

Reimbursement of loans extended by the Group’scentralised cash management 3,131 –3,131

Total Net cash inflows generated 3,178 58 3,076

The consideration received for the sales of other investments and the related net cash inflows are as follows:

Total sales of of which

(in millions of euros) other investments FAFS

Total Consideration received 1,157 998

-Less: consideration paid for exercising the call option on FRI and the

subsequent capitalisation (659) (659)

Total Net cash inflows generated 498 339

It is recalled that during 2005 the Group disposed of the following businesses:

■In the first quarter of 2005, 65% of the investment in the temporary employment agency WorkNet was sold.

■On June 1, 2005, Iveco sold to Barclays Mercantile Business Finance Ltd a 51% stake in Iveco Finance Holdings Limited, a

company comprising certain financial services companies of Iveco operating in France, Germany, Italy, Switzerland and the United

Kingdom. Since that date the investment in Iveco Finance Holdings Limited is no longer consolidated on a line-by-line basis but is

accounted for using the equity method.

agreed that the businesses formerly contributed by Fiat and GM would be returned to the owner of each respective business

before the Master Agreement. The termination agreement stated that each JV partner should receive businesses of equal net asset

value. Any difference in the net asset value of the businesses returned to GM and Fiat would have resulted in a balancing payment

from one JV partner to the other. Consequently the liquidation of the JV had no impact on income or net equity. Fiat subsequently

consolidated the net assets it retained, effectively reclassifying the net equity investment in these assets from equity investments

to consolidated assets and liabilities. The profits of Fiat Powertrain from January 1, 2005 until the acquisition date amounted to 21

million euros and this figure is included in the line item Result from investments in the consolidated financial statements of the

Fiat Group.

■At the end of 2005, the Fiat Group acquired Enel’s share of the joint venture Leasys S.p.A., whose activity is the hire and

management of company car fleets, thereby obtaining 100% control. The financial statements of this company have been

consolidated from December 31, 2005. The loss of Leasys for 2005 included in the line item Result from investments in the

consolidated financial statements of the Fiat Group amounted to 11 million euros. The transaction led to the acquisition

of already recognised goodwill from the acquired entity for an amount of 50 million euros, which was left unaltered in the

consolidated financial statements given the acquiree’s ability to earn a higher rate of return and the fact that the value of this also

stemmed from synergies to be realised after the acquisition as well as from other benefits expected to arise from the operation.

If the acquisition date for these transactions had been January 1, 2005, the revenues and net income for the period would have

increased by 483 million euros and by 17 million euros, respectively.

Disposals

As described in the section Scope of consolidation, the Group disposed of the following businesses in 2006:

■The procedure for the sale of the subsidiary Atlanet S.p.A. to the British Telecom group was for the most part finalised in the first

quarter of 2006 on receiving the approval of the Italian Guarantor Authority for Competition and the Market; the transaction was

finally concluded with the sale of the Polish and Brazilian business in the second half of the year.

■Fiat sold its investment in Sestrieres S.p.A. to Via Lattea S.p.A. on June 29, 2006.

■On August 30, 2006, Teksid S.p.A. sold its holding in Société Bretonne de Fonderie et Mecanique.

■On August 31, 2006, Fiat sold its holding in Banca Unione di Credito (B.U.C.) to BSI (a company of the Generali Group).

■The subsidiary Comau Pico sold its Autodie business to Mbtech Stuttgart on November 10, 2006.

■On December 28, 2006, Fiat Auto and Crédit Agricole finalised the formation of the 50/50 joint venture FAFS.

The book value at the disposal date of the net assets sold is summarised in the following table. Specific disclosure is made for the

B.U.C. disposal and the formation of FAFS given the significance of the amounts involved. In particular, disclosures relating to the

formation of FAFS are separated between those that relate to the business previously controlled by the Fiat Group which was

therefore consolidated on a line-by-line basis, and those that relate to the business of financing the final customer (the retail

business), which was previously headed by the associate Fidis Retail Italia.

Fiat Group Consolidated Financial Statements at December 31, 2006 -Notes 192