Chrysler 2006 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Fiat Group Consolidated Financial Statements at December 31, 2006 -Notes 111

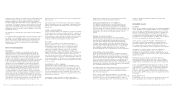

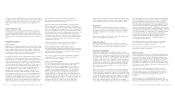

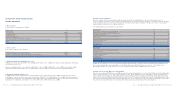

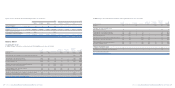

5. Other income (expenses)

This item consists of income arising from trading operations which is not attributable to the sale of goods and services

(such as royalties and other income from licences and know-how), net of miscellaneous operating costs which cannot be allocated

to specific functional areas, such as post-employment benefits for retired former employees (health care service costs), indirect

taxes and duties, and accruals for various provisions.

The detail of Other income (expenses) is as follows:

(in millions of euros) 2006 2005

Other income

Gains on disposal of Property, plant and equipment 95 166

Amortisation of deferred government investment grants 68 64

Government revenue grants 38 58

Royalties and other income from licences and know-how 20 55

Rental income 42 40

Recovery of expenses and compensation for damages 64 145

Release of excess provisions 130 177

Prior period income 272 294

Other income 256 362

Total Other income 985 1,361

Other expenses

Indirect taxes 112 106

Losses on disposal of Property, plant and equipment 32 35

Impairment of assets 729

Post-employment benefits for retired former employees 563

Charges for other provisions 282 533

Prior period expenses 184 186

Other expenses 258 452

Total Other expenses 880 1,404

Other income (expenses) 105 (43)

In 2005, the item Release of excess provisions included an amount arising in the Agricultural and Construction Equipment Sector

from a structural reduction in period welfare costs in North America, resulting in the release to income of 83 million euros

previously provided. The Sector released to income a further 25 million euros in 2006 for the same reason.

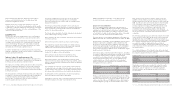

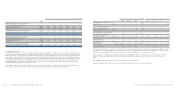

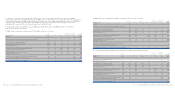

6. Gains (losses) on the disposal of investments

This item, amounting to 607 million euros 2006, includes the gains realised upon the creation of the FAFS joint-venture (463 million

euros) as well as the gains on the sale of Banca Unione Credito - B.U.C. (80 million euros), Immobiliare Novoli S.p.A. (39 million

euros), Machen Iveco Holding Sa, which held about 51% shareholding in Ashok Leyland Ltd (23 million euros), Atlanet S.p.A. (22

million euros) and the residual interest in IPI S.p.A. (9 million euros). The item also includes an amount of 29 million euros for the

expected loss (mainly allocated to the goodwill impairment loss, as described in Note 13) on the disposal of Meridian Technologies

Inc.; this sale is today still subject to the closing of the financing to the purchaser from financial institutions.

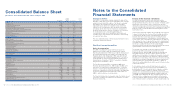

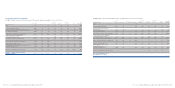

Composition and principal changes

Income Statement

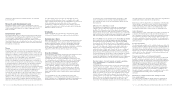

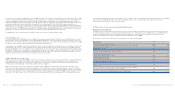

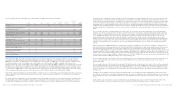

1. Net revenues

Net revenues can be analysed as follows:

(in millions of euros) 2006 2005

Revenues from:

- Sales of goods 46,105 41,013

- Rendering of services 2,827 2,346

- Contract revenues 917 1,285

-Rents on operating leases 519 397

-Rents on assets sold with a buy-back commitment 311 323

- Interest income from customers and other financial income of financial services companies 1,077 1,088

-Other 76 92

Total Net revenues 51,832 46,544

2. Cost of sales

Cost of sales comprises the following:

(in millions of euros) 2006 2005

Cost of sales attributable to the industrial business 42,991 38,898

Interest cost and other financial charges from financial services companies 897 726

Total Cost of sales 43,888 39,624

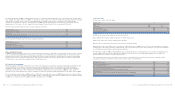

3. Selling, general and administrative costs

Selling costs amount to 2,627 million euros in 2006 (2,533 million euros in 2005) and comprise mainly marketing, advertising

and sales personnel costs.

General and administrative costs amount to 2,070 million euros in 2006 (1,980 million euros in 2005) and comprise mainly

expenses for administration which are not attributable to sales, production and research and development functions.

4. Research and development costs

In 2006, Research and development costs of 1,401 million euros (1,364 million euros in 2005) comprise all research and

development costs not recognised as assets amounting to 785 million euros (902 million euros in 2005) and the amortisation

of capitalised development costs of 616 million euros (462 million euros in 2005). During the period the Group incurred new

expenditure for capitalised development costs of 813 million euros (656 million euros in 2005).

Fiat Group Consolidated Financial Statements at December 31, 2006 -Notes 110