Chrysler 2006 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

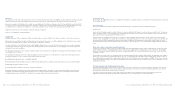

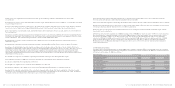

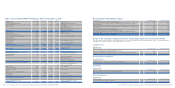

Provisions for employee benefits and other current provisions

Reclassifications

(in millions of euros) At January 1, 2005 At December 31, 2005

from “Other provisions” for changes in the format of the Balance Sheet 6 31

631

Trade payables

Reclassifications

(in millions of euros) At January 1, 2005 At December 31, 2005

from “Payables to subsidiaries” for changes in the format of the Balance Sheet 11 5

11 5

Current debt

Reclassifications

(in millions of euros) At January 1, 2005 At December 31, 2005

from “Accrued expenses and deferred income” for changes in the format of the Balance

Sheet (interest component) 130 –

from “Payables to subsidiaries” for changes in the format of the Balance Sheet 7 –

137 –

Adjustments

(in millions of euros) At January 1, 2005 At December 31, 2005

Recognition and measurement of financial liabilities (the “Mandatory Convertible Facility”) G(13) –

Sale of receivables L359 557

Measurement of derivative financial instruments E1 –

347 557

Other payables

Reclassifications

(in millions of euros) At January 1, 2005 At December 31, 2005

from “Advances” for changes in the format of the Balance Sheet 7,336 8,657

to “Inventories” as a reduction of amounts received A(7,321) (8,635)

from “Taxes receivables” for changes in the format of the Balance Sheet 9 3

from “Payables to subsidiaries” for changes in the format of the Balance Sheet 205 218

from “Payables to social security authorities” for changes in the format of the Balance Sheet 3 2

to “Other non-current liabilities” for changes in the format of the Balance Sheet

(reclassification of non-current balances) (13) (17)

219 228

Appendix Transition of the Parent Company Fiat S.p.A. to International Financial Reporting Standards (IFRS) 309Appendix Transition of the Parent Company Fiat S.p.A. to International Financial Reporting Standards (IFRS)308

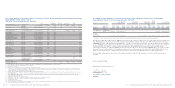

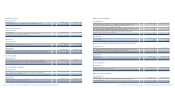

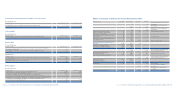

Effects of transition to IFRS on the Income Statement for 2005

(in millions of euros) Italian GAAP Reclassifications Adjustments IAS/IFRS

Dividends and other income from

8 – 8 investments

(Impairment losses) reversals on

(429) (2) (431) investments

Gains (losses) on the disposal of

(1) – (1) investments

Revenues from sales and services 20 25 28 73 Other operating revenues

Change in contract work in progress 13 (13) –

Other revenues and income 12 (12) –

Raw materials, services, leases and rentals 77 (77) –

Personnel costs 42 11 7 60 Personnel costs

Amortisation, depreciation and writedowns 27 (27) –

Other operating costs 41 (41) –

145 (24) 121 Other operating costs

Difference between the value and costs of

production (142) (433) 43

Write-ups of equity investments 528 (528) –

(Write-downs) of equity investments (957) 957 –

Total value adjustments to financial assets (429) 429 –

Income (expenses) from significant

1,133 – 1,133 non-recurring transactions

Income from equity investments 8 (8) –

Other financial income 113 (169) (7) (63) Financial income (expenses)

Interest and other financial expenses 169 (169) –

Financial income from significant

– 858 858 non-recurring transactions

Extraordinary income 1,136 (1,136) –

Extraordinary expenses 15 (15) –

Profit (loss) before taxes 502 – 894 1,396 Profit (loss) before taxes

Income taxes 279 – – 279 Income taxes

Profit (loss) from continuing

– 894 1,117 operations

Profit (loss) from discontinued

–––operations

Net profit (loss) for the period 223 – 894 1,117 Net profit (loss) for the period