Chrysler 2006 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

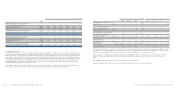

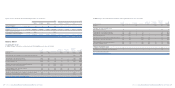

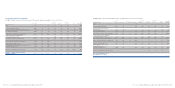

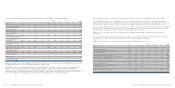

Fiat Group Consolidated Financial Statements at December 31, 2006 -Notes 109

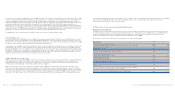

In addition, the Group entered certain agreements during

the year that led to the need to reclassify the businesses

concerned as Assets and Liabilities held for sale. In particular:

■The Fiat Group and Norsk Hydro reached an agreement on

December 6, 2006, for the sale of their interests in Meridian

Technologies Inc., 51% and 49% respectively, to a consortium

of investors headed by the Swiss holding company Estatia AG.

The total value of the transaction, subject to usual price

adjustment conditions, is worth approximately 200 million

Canadian dollars. The transaction is subject to the

authorisations from authorities (received in 2007) and to

the closing of the financing to the purchaser from financial

institutions.

■On December 14, 2006, Fiat Auto and Tata Motors reached

an agreement for the establishment of an industrial joint

venture located at the Fiat plant at Ranjangaon, in India.

■Fiat has reached on December 15, 2006, an agreement with

Pirelli Re Facility management for the sale of the subsidiary

Ingest Facility S.p.A. The sale will be carried out on the basis

of a total value of approximately 50 million euros subject to

usual price adjustments clauses and will be finalised after

antitrust authorisation have been received.

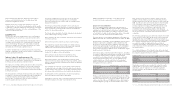

The following acquisitions were made in 2006 and mainly

relate to the purchase of minority interests in companies

in which the Group already held control:

■On March 23, 2006, Fiat’s privileged “Series A” shares in

CNH Global N.V. were converted into 100 million new ordinary

shares of CNH Global N.V.; as a result, the Group increased its

holding from 84% to 90%. This operation did not lead

to significant effect in the Group’s consolidated financial

statements.

■During the second quarter of 2006 Ferrari S.p.A. increased

its capital stock by the issue of 104,000 new shares, for use

in connection with its stock option plans. Fiat S.p.A.

subsequently acquired 93,600 of these newly-issued shares,

increasing its interest in the company to 56.4%.

■On September 29, 2006, Fiat exercised its call option on

28.6% of the shares of Ferrari S.p.A., taking its holding from

56.4% to 85%. Fiat has a call option on a further 5% of Ferrari

shares, currently held by the Arab fund Mubadala Development

Company after the Fund had acquired 5,200 Ferrari newly-

issued shares from Fiat. The call option may be exercised

between January 1, 2008 and July 31, 2008.

■On October 17, 2006, Ferrari acquired a 90% share in Ferrari

Financial Services AG.

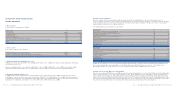

The following divestitures of subsidiaries were made in 2006:

■The procedure for the sale of the subsidiary Atlanet S.p.A.

to the British Telecom group was for the most part finalised

in the first quarter of 2006 on receiving the approval of the

Guarantor Authority for Competition and the Market; the

transaction was finally concluded with the sale of the Polish

and Brazilian businesses in the second half of 2006.

■Fiat sold its investment in Sestrieres S.p.A. to Via Lattea

S.p.A. on June 29, 2006.

■On August 30, 2006, Teksid S.p.A sold its holding in Société

Bretonne de Fonderie et Mecanique.

Fiat Group Consolidated Financial Statements at December 31, 2006 -Notes 108

■On August 31, 2006, Fiat sold its holding in Banca Unione

di Credito (B.U.C.) to BSI (a company of the Generali Group).

■On November 10, 2006, the subsidiary Comau Pico sold

its Autodie business to Mbtech Stuttgart.

■Finally, on December 28, 2006, Fiat Auto and Crédit Agricole

completed the transaction for the creation of a 50/50 joint

venture, Fiat Auto Financial Services (“FAFS”), which will

handle Fiat Auto’s main financing activities in Europe (retail

auto financing, dealership financing, and long-term car rental

and fleet management). In particular:

– Synesis Finanziaria (a company held equally by Unicredito,

Banca Intesa, Capitalia, and San Paolo-IMI) held 51% interest

in Fidis Retail Italia (“FRI”), which was sold to Fiat Auto,

upon exercise of its call option, for 479 million euros. FRI, a

company controlling the Fiat Auto European retail financing

activities, subsequently changed its corporate name to Fiat

Auto Financial Services S.p.A. (“FAFS”);

– FAFS acquired other Fiat Auto subsidiaries currently active

in the European Fiat Auto dealer financing and renting

business;

– Fiat Auto sold to Sofinco, the wholly owned consumer credit

subsidiary of Crédit Agricole, 50% of the capital stock of

FAFS for a total cash consideration of 940 million euros

subject to usual price adjustment clauses;

–Crédit Agricole/Sofinco refinanced FAFS for the entire debt

with the Fiat Group and part of their debt to third parties.

For the Fiat Group these transactions resulted in a capital gain

of 463 million euros, an increase in cash of more than 3 billion

euros (including the repayment of intercompany loans) and a

reduction in net industrial debt by approximately 360 million

euros.

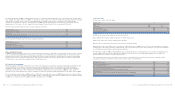

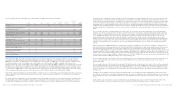

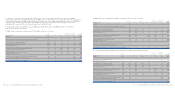

The effect on the Group’s assets and liabilities of the

mentioned acquisitions and divestitures of businesses are

described in Note 36.

Other information

Certain reclassifications have been made to the balance sheet

reported in the published consolidated financial statements

at December 31, 2005 in arriving at that presented in these

financial statements as comparative figures. These

reclassifications have no effect on the net result or

stockholder’sequity. In particular:

■Certain debt amounting to 519 million euros and previously

classified in the balance sheet at December 31, 2005 as Other

debt has been reclassified to Asset-backed financing in the

comparative balance sheet presented in these financial

statements, as it substantially relates to the securitisation

of receivables. This reclassification does not, however, alter

the total amount presented as Debt at that date.

■Following a detailed analysis of the composition of its

balance sheet provisions, the Group has reclassified certain

pension funds previously included as Other provisions. This

resulted in a reclassification of a net liability balance of 31

million euros at December 31, 2005, of which 133 million euros

relates to the present value of the obligation and 102 million

euros to the fair value of the plan assets (the corresponding

figures at January 1, 2005 were 120 million euros and 86

million euros respectively).