Chrysler 2006 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

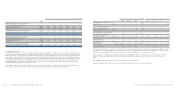

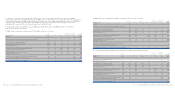

Fiat Group Consolidated Financial Statements at December 31, 2006 -Notes 129

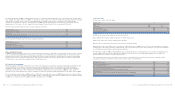

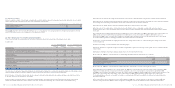

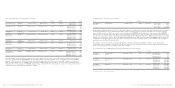

The column Other changes includes the reversal of impairment losses of 5 million euros in 2006 (16 million euros in 2005).

The column Change in the scope of consolidation shows an overall net reduction of 74 million euros which mainly reflects the

disposal of B.U.C. (24 million euros), the disposal of Sestrieres S.p.A. (23 million euros), the disposal of business Autodie business

of Comau Pico (21 million euros) and the deconsolidation of subsidiaries transferred to FAFS joint venture (10 million euros).

The column Reclassification to assets held for sale comprises the book value of the assets of Meridian Technologies Inc. and Ingest

Facility S.p.A., for which sales agreements reached in December 2006 were still subject to all the necessary authorisations at the

balance sheet date, of Fiat Auto in India and that of certain properties of the Iveco Sector.

Exchange losses of 95 million euros (gains of 422 million euros in 2005) principally reflect changes in the Euro/U.S. dollar

exchange rate.

The column Other changes represents the reclassification of the prior year balance of Advances and tangible assets in progress to

the appropriate categories at the time the assets were effectively acquired and put into operation.

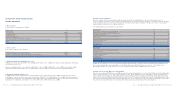

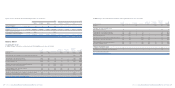

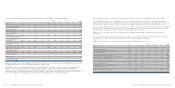

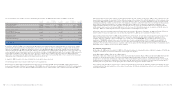

In 2005, changes in the gross carrying amount of Property,plant and equipment were as follows:

At Change in At

December the scope of Translation Other December

(in millions of euros) 31, 2004 Additions Divestitures consolidation differences changes 31, 2005

Land 500 1 (25) 26 24 7 533

-Owned industrial buildings 4,088 76 (143) 93 189 49 4,352

-Industrial buildings leased under finance leases 48 – – – – 25 73

Total Industrial buildings 4,136 76 (143) 93 189 74 4,425

-Owned plant, machinery and equipment 19,119 1,148 (1,081) 3,839 711 477 24,213

-Plant, machinery and equipment leased under finance leases 29 7––41353

Total Plant, machinery and equipment 19,148 1,155 (1,081) 3,839 715 490 24,266

Assets sold with a buy-back commitment 1,495 468 (396) – 7 8 1,582

-Owned other tangible assets 1,812 170 (187) 81 79 (1) 1,954

-Other tangible assets leased under finance leases 5 5 – – – 2 12

Total Other tangible assets 1,817 175 (187) 81 79 1 1,966

Advances and tangible assets in progress 677 400 – 49 30 (541) 615

Total gross carrying amount of Property, plant and equipment 27,773 2,275 (1,832) 4,088 1,044 39 33,387

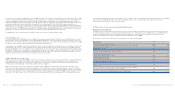

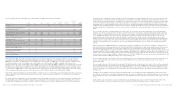

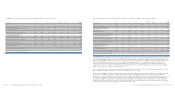

The net carrying amount of Property, plant and equipment at December 31, 2006 can be analysed as follows:

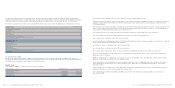

At Change in Reclassified At

December Impairment the scope of Translation to Assets Other December

(in millions of euros) 31, 2005 Additions Depreciation losses Divestitures consolidation differences held for sale changes 31, 2006

Land 526 2 – – (7) (9) (12) (57) 4 447

-Owned industrial buildings 2,230 119 (139) (1) (3) (36) (8) – 58 2,220

-Industrial buildings leased

under finance leases 63 – (2) – – – – – (2) 59

Total Industrial buildings 2,293 119 (141) (1) (3) (36) (8) – 56 2,279

-Owned plant, machinery

and equipment 5,948 952 (1,541) (14) (40) (14) (59) (58) 423 5,597

-Plant, machinery and equipment

leased under finance leases 25 – (5) – – (2) (1) (14) 4 7

Total Plant, machinery

and equipment 5,973 952 (1,546) (14) (40) (16) (60) (72) 427 5,604

Assets sold with a buy-back

commitment 1,176 523 (152) (36) (360) – 3 – 3 1,157

-Owned other tangible assets 424 194 (140) – (99) (11) (5) (10) 47 400

-Other tangible assets leased

under finance leases 8 2 (1) – (1) – – – (4) 4

Total Other tangible assets 432 196 (141) – (100) (11) (5) (10) 43 404

Advances and tangible

assets in progress 606 642 – – (17) (2) (13) (34) (533) 649

Total net carrying amount of

Property,plant and equipment 11,006 2,434 (1,980) (51) (527) (74) (95) (173) – 10,540

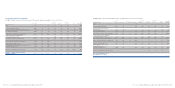

Additions of 2,434 million euros in 2006 mainly relate to the Automotive Sectors (Fiat Auto, Iveco, and CNH) and to the Powertrain

and Magneti Marelli Sector and do not include capitalised borrowing costs.

During 2006 the Group recognised impairment losses on Assets sold with a buy-back commitment from Trucks and Commercial

Vehicles for an amount of 36 million euros (24 million euros in 2005) in order to align their carrying amount to market value.

These losses are recognised in Cost of sales. In addition, the Group reviewed the recoverable amount of certain machinery and

equipment in order to determine whether there was any reduction in value arising from technical obsolescence. This assessment

led to the recognition of an impairment loss of 15 million euros, all of which was recorded in Trading profit.

Fiat Group Consolidated Financial Statements at December 31, 2006 -Notes 128