Chrysler 2006 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Rizzoli Corriere della Sera MediaGroup S.p.A. is a listed company in which Fiat is one of the major shareholders, has a seat on the

Board of Directors and is a party to a stockholders’ agreement. As a result the company is considered to be an associate. In order

to account for this investment using the equity method, reference was made to its most recent published financial statements

being those for the third quarter of 2006, as those to be issued for financial year 2006 will be published subsequent to the

publication of the consolidated financial statements of the Fiat Group.

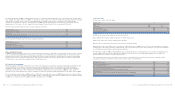

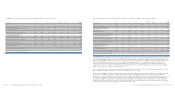

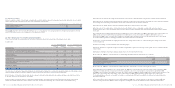

At December 31, 2006, the fair value of Investments in listed jointly controlled entities and listed associates, determined on the

basis of quoted market prices, is as follows:

(in millions of euros) Carrying value Fair Value

Tofas-Turk Otomobil Fabrikasi Tofas A.S. 206 498

Rizzoli Corriere della Sera MediaGroup S.p.A. 107 286

Turk Traktor Ve Ziraat Makineleri A.S. 23 130

Al-Ghazi Tractors Ltd. 14 51

Total Investments in listed jointly controlled entities and associates 350 965

At December 31, 2006, the item Investments in other companies includes the investment in Mediobanca S.p.A. of 268 million euros

(227 million euros at December 31, 2005), as well as, the investment in Assicurazioni Generali S.p.A. (5 million euros), acquired in

2006 as a result of the winding up of Consortium S.r.l. and the consequent transfer to its quota holders of the shares that the

company held in Mediobanca S.p.A. and Assicurazioni Generali S.p.A. on the basis of their investments.

At December 31, 2006, there are neither investments nor other financial assets given as collateral for debt.

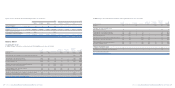

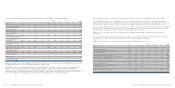

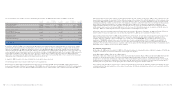

17. Leased assets

The Group leases out assets, mainly its own products, as part of its financial services business. This item changed as follows in 2006:

At Change in the At

December scope of Translation Disposals and December

(in millions of euros) 31, 2005 Additions Depreciation consolidation differences other changes 31, 2006

Gross carrying amount 1,898 926 – (1,779) (24) (674) 347

Less: Depreciation and impairment (644) – (318) 517 6 339 (100)

Net carrying amount of Leased assets 1,254 926 (318) (1,262) (18) (335) 247

The net reduction of 1,262 million euros included in the column Change in the scope of consolidation reflects the deconsolidation

of subsidiaries whose activities were transferred to the FAFS joint venture.

The change in 2005 was as follows:

At Change in the At

December scope of Translation Disposals and December

(in millions of euros) 31, 2004 Additions Depreciation consolidation differences other changes 31, 2005

Gross carrying amount 1,106 409 – 825 37 (479) 1,898

Less: Depreciation and impairment (366) – (184) (300) (13) 219 (644)

Net carrying amount of Leased assets 740 409 (184) 525 24 (260) 1,254

Fiat Group Consolidated Financial Statements at December 31, 2006 -Notes 135

resulting in a reduction of 1,213 million euros. This reduction had been partially offset by an increase of 125 million euros arising

from the equity method valuation of the investment in Iveco Finance Holdings Limited, no longer consolidated on a line-by-line

basis following the sale of 51% to Barclays Mercantile Business Finance Ltd.

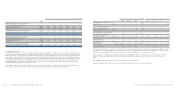

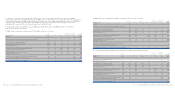

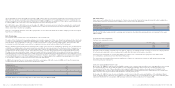

The item Investments in jointly controlled entities comprises the following:

At December 31, 2006 At December 31, 2005

Amount Amount

%of (in millions %of (in millions

interest of euros) interest of euros)

Fiat Auto Financial Services S.p.A. (ex Fidis Retail Italia S.p.A.) 50.0 528 ––

Tofas-Turk Otomobil Fabrikasi Tofas A.S. 37.9 206 37.9 245

Naveco Ltd. 50.0 117 50.0 118

Società Europea Veicoli Leggeri-Sevel S.p.A. 50.0 93 50.0 108

Société Européenne de Véhicules Légers du Nord-Sevelnord Société Anonyme 50.0 61 50.0 59

Consolidated Diesel Company 50.0 47 50.0 59

LBX Company LLC 50.0 27 ––

New Holland HFT Japan Inc. 50.0 27 50.0 35

Turk Traktor Ve Ziraat Makineleri A.S. 37.5 23 – –

Nan Jing Fiat Auto Co. Ltd. 50.0 22 50.0 33

Transolver Finance Establecimiento Financiero de Credito S.A. 50.0 17 50.0 17

New Holland Trakmak Traktor A.S. 37.5 14 – –

CNH de Mexico SA de CV 50.0 13 50.0 17

Other minor 18 14

Total Investments in jointly controlled entities 1,213 705

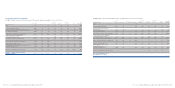

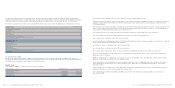

The item Investments in associates comprises the following:

At December 31, 2006 At December 31, 2005

Amount Amount

%of (in millions %of (in millions

interest of euros) interest of euros)

Iveco Finance Holdings Limited 49.0 141 49.0 131

Rizzoli Corriere della Sera MediaGroup S.p.A. 9.9 107 9.9 104

Kobelco Construction Machinery Co. Ltd. 20.0 97 20.0 106

CNH Capital Europe S.a.S. 49.9 71 49.9 65

Al-Ghazi Tractors Ltd. 43.2 14 43.2 14

Fidis Retail Italia S.p.A. – – 49.0 431

Turk Traktor Ve Ziraat Makineleri A.S. ––37.5 29

Immobiliare Novoli S.p.A. ––40.0 21

LBX Company LLC – – 50.0 20

New Holland Trakmak Traktor A.S. – – 37.5 14

Other minor 73 123

Total Investments in associates 503 1,058

Fiat Group Consolidated Financial Statements at December 31, 2006 -Notes 134