Chrysler 2006 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

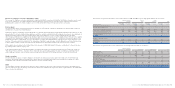

The item also includes an amount of 29 million euros (32 million euros at December 31, 2005) for certain properties and industrial

buildings owned by CNH and no longer being used as a result of the restructuring process set up in prior years following the acquisition

of the Case Group, and certain properties and industrial buildings of Fiat Auto and Iveco for an overall amount of 7 million euros.

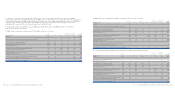

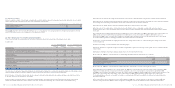

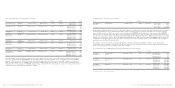

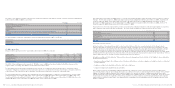

The items included in Assets held for sale and Liabilities held for sale as of December 31, 2006, may be summarized as follows:

(in millions of euros) At December 31, 2006

Intangible assets 8

Property, plant and equipment 173

Leased assets 7

Deferred tax assets 6

Inventories 37

Trade receivables 80

Receivables from financing activities 6

Other receivables, Accrued income and prepaid expenses 10

Cash and cash equivalents 5

Total Assets 332

Employee benefits 13

Other provisions 42

Asset-backed financing –

Other debt 34

Trade payables 172

Deferred tax liabilities 4

Other payables, Accrued expenses and deferred income 44

Total Liabilities 309

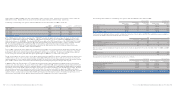

25. Stockholders’ equity

Stockholders’ equity at December 31, 2006 increased by 623 million euros over that at December 31, 2005 mainly due to net

income for the period (1,151 million euros) and foreign exchange losses from the translation into euros of the financial statements

of subsidiaries denominated in other currencies (552 million euros).

Capital stock

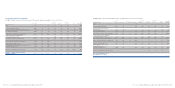

At December 31, 2006, the capital stock of Fiat S.p.A. is as follows:

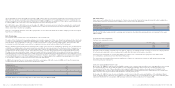

(number of shares) At December 31, 2006 At December 31, 2005

Shares issued and fully paid

- Ordinary shares 1,092,246,316 1,092,246,316

-Preference shares 103,292,310 103,292,310

- Saving shares 79,912,800 79,912,800

Total shares issued 1,275,451,426 1,275,451,426

Fiat Group Consolidated Financial Statements at December 31, 2006 -Notes 145

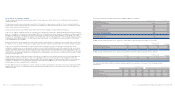

Issued shares have a nominal value of 5 euros, with each category having rights as follows:

Each share conveys the right to a proportionate share of the earnings available for distribution and of the residual net assets upon

liquidation, without harming the rights of preference and savings shares on the allocation of the earnings as described in the

following paragraph.

Each ordinary share conveys the right to vote without any restrictions whatsoever. Each preference share conveys the right to vote

only on issues that are within the purview of the Extraordinary Stockholders’ Meeting and on resolutions concerning Regulations

for Stockholders’ Meetings. Savings shares are not entitled to vote.

The net income for the year resulting from the annual financial statements of Fiat S.p.A. is allocated as follows:

■to the Legal Reserve, 5% of net income until this reserve reaches one fifth of the capital stock;

■to savings shares, a dividend of up to 0.31 euros per share;

■to the Legal Reserve (additional allocation), to the Extraordinary Reserve and/or to retained earnings, such allocations as shall be

decided by the Annual General Meeting of Stockholders;

■to preference shares, a dividend of up to 0.31 euros per share;

■to ordinary shares, a dividend of up to 0.155 euros per share;

■to savings shares and ordinary shares, in equal proportions, an additional dividend of up to 0.155 euros per share;

■to each ordinary,preference and savings share, in equal proportions, the balance of the net income which the Stockholders’

Meeting resolves to distribute.

When the dividend paid to savings shares in any year amounts to less than 0.31 euros, the difference is added to the preferred

dividend to which they are entitled in the following two years.

If the savings shares are delisted, they are transformed into registered shares if originally bearer shares, and have the right to a

higher dividend increased by 0.175 euros, rather than 0.155 euros, with respect to the dividend received by the ordinary and

preference shares.

If the ordinary shares are delisted, the higher dividend received by the savings shares with respect to the dividend received by

ordinary and preference shares is increased by 0.2 euros per share.

As no dividends were distributed in 2004 and 2005, savings shares are entitled to an additional 0.62 euros per share at

December 31, 2006.

Fiat Group Consolidated Financial Statements at December 31, 2006 -Notes 144