Chrysler 2006 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Fiat S.p.A. Financial Statements at December 31, 2006 - Notes to the Financial Statements 279Fiat S.p.A. Financial Statements at December 31, 2006 - Notes to the Financial Statements278

Other non-current provisions

Other non-current provisions at December, 31 2006 total 33 thousand euros (47 thousand euros at December 31, 2005) and relate

to sums set aside to pay scholarship grants to employees’ children.

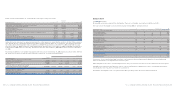

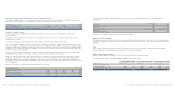

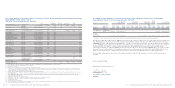

22. Non-current financial payables

At December 31, 2006, non-current financial payables amount to 2,810,029 thousand euros, an increase of 2,804,767 thousand

euros over December 31, 2005. The balance relates to the following:

At At

(in thousands of euros) December 31, 2006 December 31, 2005 Change

Financial payables to Group companies 2,800,000 – 2,800,000

Financial guarantee contracts 10,029 5,262 4,767

Total Non-current financial liabilities 2,810,029 5,262 2,804,767

Financial payables to Group companies relate to the euro loans due beyond one year extended by Fiat Finance S.p.A. in the first

half of 2006 in connection with the recapitalisation of subsidiaries already mentioned (see Note 13). Interest accrued on these loans

ranges between 6.20% and 7.18%.

An analysis of loans received by repayment date is as follows:

(in thousands of euros) At December 31, 2006

Maturity 2010 400,000

Maturity 2011 1,400,000

Maturity 2013 1,000,000

Total Financial payables to Group companies 2,800,000

The fair value of these loans at December 31, 2006 is approximately 3 billion euros; the difference between this and their original

value (being their nominal value) is essentially due to the improvement in the credit merit of Fiat S.p.A. Fair value was calculated

by taking market rates and adjusting these as appropriate to take into account Fiat’scredit spread at the Balance Sheet date.

The item financial guarantee contracts consists of the fair value of the liabilities assumed as the result of providing guarantees.

After assessing the possibility of any risks for which provisions for contingent liabilities must be recognised and after determining

that this item relates essentially only to guarantees provided on behalf of Group company loans, it has been concluded that the

present value of the fees receivable for guarantees given (see Other financial assets in Note 14) represents the best estimate of

the fair value of these guarantees.

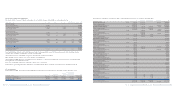

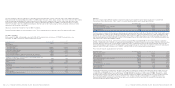

This item may be analysed by maturity date as follows:

At At

(in thousands of euros) December 31, 2006 December 31, 2005

Financial guarantee contracts

due within one year 2,512 1,331

due after one year but within five years 7,473 3,044

due beyond five years 44 887

total 10,029 5,262

The amounts recognised in the Income Statement for post-employment benefits are as follows:

Employee severance indemnity Other Total

(in thousands of euros) 2006 2005 2006 2005 2006 2005

Service cost

- Current service cost 712 704 1,137 1,139 1,849 1,843

-Net actuarial (gains) losses recognised during the year 94 –397 1,003 491 1,003

Total current service cost 806 704 1,534 2,142 2,340 2,846

Interest costs 322 278 410 377 732 655

Total cost (income) for post-employment benefits 1,128 982 1,944 2,519 3,072 3,501

The items Current service cost and Net actuarial (gains) losses recognised during the year are recorded in the Income Statement

item Personnel costs (see Note 5) if relating to employees and in Other operating costs (see Note 6) if relating to the Chief

Executive Officer.

Interest expense is recognised under the Income Statement item Financial income (expenses) (see Note 8).

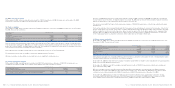

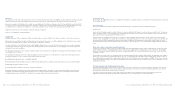

Changes in the present value of the obligation for post-employment benefits are as follows:

Employee severance indemnity Other Total

(in thousands of euros) 2006 2005 2006 2005 2006 2005

Present value of obligation at the beginning of the year 12,792 11,651 18,250 17,838 31,042 29,489

Current service cost 621 943 1,137 1,139 1,758 2,082

Interest costs 322 278 410 377 732 655

Actuarial (gains) losses arising during the year 581 825 2,394 867 2,975 1,692

Benefits paid (6,080) (1,807) (8,397) (1,971) (14,477) (3,778)

Other changes 176 902 (139) –37 902

Present value of obligation at the end of the year 8,412 12,792 13,655 18,250 22,067 31,042

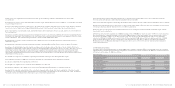

The present value of the defined benefit obligations in 2006 and at the end of the two previous years is as follows:

At At At

(in thousands of euros) December 31, 2006 December 31, 2005 December 31, 2004

Present value of obligation at the end of the year:

- Employee severance indemnity 8,412 12,792 11,651

- Others 13,655 18,250 17,838

Total 22,067 31,042 29,489

The effects of the differences between the previous actuarial assumptions and what has actually occurred (experience adjustments)

at December 31, 2006 and 2005, is as follows:

(in thousands of euros) 2006 2005

Experience adjustments actuarial (gains) losses:

- Employee severance indemnity 83 783

- Others 1,769 2,545

Total effect on the present value of defined benefit obligation 1,852 3,328