Chrysler 2006 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

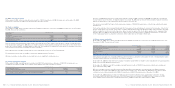

Fiat S.p.A. Financial Statements at December 31, 2006 - Notes to the Financial Statements 261Fiat S.p.A. Financial Statements at December 31, 2006 - Notes to the Financial Statements260

Balance Sheet

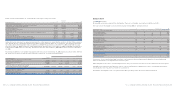

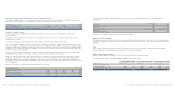

11. Intangible assets

All intangible assets were acquired from third parties. There are no intangible assets with an indefinite useful life.

The main classes of intangible assets and related changes during 2006 are summarised below:

At (Decreases) and At

(in thousands of euros) December 31, 2005 Additions Amortisation Other changes December 31, 2006

Concessions, licences and similar rights

- Gross carrying amount 1,003 26 – 28 1,057

- Accumulated amortisation (912) – (74) 16 (970)

-Net carrying amount 91 26 (74) 44 87

Other intangible assets

- Gross carrying amount 373 138 – – 511

- Accumulated amortisation (9) – (47) – (56)

- Net carrying amount 364 138 (47) – 455

Intangible assets in progress and advances

-Gross carrying amount 221 57 –(48) 230

- Accumulated amortisation – – – – –

- Net carrying amount 221 57 – (48) 230

Total intangible assets

- Gross carrying amount 1,597 221 – (20) 1,798

- Accumulated amortisation (921) – (121) 16 (1,026)

- Net carrying amount 676 221 (121) (4) 772

Concessions, licences and similar rights include the costs incurred for the development and registration of owned trademarks

which are amortised on a straight-line basis over three years.

Other intangible assets relate to leasehold improvements. They are amortised over the term of the related leases (4 and 12 years).

Intangible assets in progress and advances relate to costs for administrative registration procedures of trademarks that had not

been finalised at year end, which are therefore not amortised.

Amortisation of intangible assets is recognised under Other operating costs in the Income Statement (Note 6).

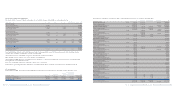

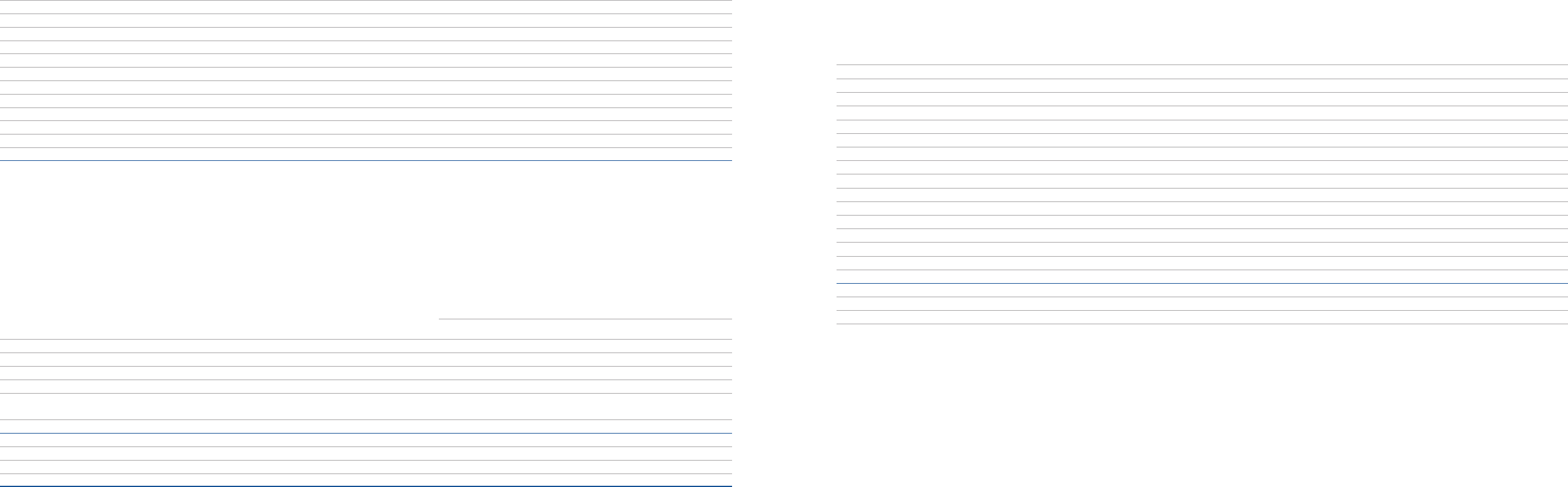

Details of deferred tax liabilities net of deferred tax assets may be analysed as follows:

Recognised

At in Income At

(in thousands of euros) December 31, 2005 Statement Charged to equity December 31, 2006

Deferred tax assets arising from:

- Write-downs of investments that are deductible in future years 391,907 (241,037) – 150,870

- Taxed provisions and other minor differences 36,036 (21,851) – 14,185

Total Deferred tax assets 427,943 (262,888) – 165,055

Deferred tax liabilities arising from:

- Deferred tax on gains (39,736) 39,736 – –

-Measurement of construction contracts by the percentage of completion method (75,865) 38,220 – (37,645)

- Other (8,910) 421 (1,505) (9,994)

Total Deferred tax liabilities (124,511) 78,377 (1,505) (47,639)

Theoretical tax benefit arising from tax loss carryforward 143,089 89,778 – 232,867

Adjustments for assets whose recoverability is not probable (446,521) 91,295 1,505 (353,721)

Total Deferred tax liabilities, net of Deferred tax assets – (3,438) – (3,438)

Deferred tax assets have been recognised by carrying out a critical analysis to ensure that the conditions for their future realisation

exist, through the use of updated strategic business plans and the related tax plans. As a consequence, the total theoretical future

tax benefits arising from deductible temporary differences (165,055 thousand euros at December 31, 2006 and 427,943 thousand

euros at December 31, 2005) and tax loss carryforward (232,867 thousand euros at December 31, 2006 and 143,089 thousand euros

at December 31, 2005), has been reduced by 353,721 thousand euros at December 31, 2006 (446,521 thousand euros at December

31, 2005).

Total temporary differences (deductible and taxable) and total tax losses at December 31, 2006 and the amounts for which Deferred

tax assets have not been recognised, analysed by year of expiry,are set out in the following table:

Year of expiry

Total at

(in thousands of euros) December 31, 2006 2007 2008 2009 2010 Beyond 2010

Temporary differences and tax losses relating to IRES:

-Deductible temporary differences 497,567 490,321 1,164 1,146 687 4,249

- Taxable temporary differences (131,344) – – (101,060) – (30,284)

- Tax losses 705,655 – 178,678 230,529 – 296,448

- Temporary differences and tax losses for which

deferred tax assets have not been recognised (1,071,878) (490,321) (179,842) (130,615) (687) (270,413)

Temporary differences and tax losses relating to State taxation – – – – – –

Temporary differences relating to IRAP:

- Deductible temporary differences 20,177 12,801 1,162 1,087 878 4,249

- Taxable temporary differences (101,071) (11) – (101,060) – –

Temporary differences and tax losses relating to local taxation (80,894) 12,790 1,162 (99,973) 878 4,249