Chrysler 2006 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

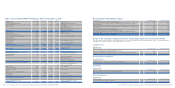

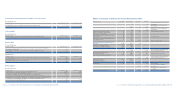

Fiat S.p.A. Financial Statements at December 31, 2006 - Notes to the Financial Statements 299Fiat S.p.A. Financial Statements at December 31, 2006 - Notes to the Financial Statements298

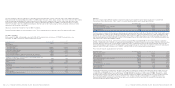

Stock Options granted Members of the Board of Directors, General Managers and Executives with Strategic

Responsibilities (Article 78 of Consob Regulation No. 11971/99)

Options

Options held at the Options granted Options exercised expired in Options held

Grantee beginning of the year during the year during the year the year at the end of the year

Average

market

Office held at Number Average Exercise Number Average Exercise Number Average price Number Number Average Exercise

First name and the date of the of exercise period of exercise period of exercise at exercise of of exercise period

last name grant options price (mm/yy) options price (mm/yy) options price date options options price (mm/yy)

Paolo Fresco Chairman 2,250,000 20.614 07/01-01/10 2,250,000 20.614 07/01-01/10

Sergio Marchionne Chief Executive

Officer 10,670,000 6.583 06/08-01/11* 10,670,000 6.583 06/08-01/11

Executives

with strategic

responsibilities 801,000 18.572 02/01-09/10 40,000 10.397 14.14 192,600 568,400 17.703 02/01-09/10

*The options are exercisable for one-third of the shares only upon satisfaction of the profitability targets, whose amount and reference period are defined in advance.

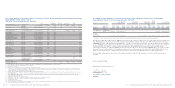

As indicated in Note 20, on November 3, 2006 the Fiat S.p.A. Board of Directors approved a stock option plan, which provides more

than 300 managers, including executives with strategic responsibilities, and the Chief Executive Officer with the right to purchase

10,000,000 Fiat S.p.A. ordinary shares at the fixed price of 13.37 euros per share. In particular, the options granted to the managers

and no. 5,000,000 options granted to the Chief Executive Officer have a vesting period of four years, with a quarter of the number

vesting each year, are subject to achieving certain pre-determined profitability targets in the reference period and may be

exercised from the date on which the 2010 financial statements are approved. The remaining 5,000,000 options also have a vesting

period of four years with a quarter of the number vesting each year and may be exercised from November 2010. Furthermore the

ability to exercise the options is additionally subject to specific restrictions regarding the duration of the mandate given.

The stock option plan will become effective after approval by the Stockholders Meeting and once all its conditions have been

satisfied.

Turin, February 20, 2007

On behalf of the Board of Directors

Luca Cordero di Montezemolo

Chairman

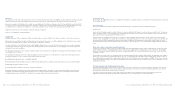

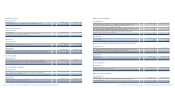

Fees paid to Members of the Board of Directors and Control Bodies, General Managers and Executives with Strategic

Responsibilities (in thousands of euros)

(Article 78 of Consob Regulation No. 11971/99)

Term Compensation Non-cash Bonuses and Other

First name and last name Office held in 2006 of office Expiration (*) for office held benefits (**) other incentives fees Total

Luca Cordero di Montezemolo Director 01/01-12/31/2006 2009 550.0 9.1 1,000.0 5,484.0 7,043.1

Chairman 1) 2)

John Elkann Director 01/01-12/31/2006 550.0 24.5 574.5

Vice Chairman 2009 3)

Sergio Marchionne Chief Executive Officer 01/01-12/31/2006 2009 2,000.0 4,228.0 368.8 6,596.8

4) 5)

Andrea Agnelli Director 01/01-12/31/2006 2009 77.0 77.0

Roland Berger Director 05/03-12/31/2006 2009 48.3 48.3

Tiberto Brandolini d’Adda Director 01/01-12/31/2006 2009 77.0 77.0

Luca Garavoglia Director 01/01-12/31/2006 2009 92.0 92.0

Gian Maria Gros-Pietro Director 01/01-12/31/2006 2009 92.0 92.0

Hermann-Josef Lamberti Director 01/01-12/31/2006 2009 92.0 92.0

Virgilio Marrone Director 01/01-12/31/2006 2009 77.0 77.0

6)

Vittorio Mincato Director 01/01-12/31/2006 2009 89.0 89.0

Pasquale Pistorio Director 01/01-12/31/2006 2009 80.0 80.0

Carlo Sant’Albano Director 05/03-12/31/2006 2009 48.3 48.3

7)

Ratan Tata Director 05/03-12/31/2006 2009 39.3 39.3

Mario Zibetti Director 01/01-12/31/2006 2009 101.0 101.0

Angelo Benessia Director 01/01-05/03/2006 40.8 40.8

Flavio Cotti Director 01/01-05/03/2006 34.8 34.8

John Daniel Winteler Director 01/01-05/03/2006 31.8 31.8

Carlo Pasteris Chairman of the Board 05/03-12/31/2006 2009 41.9 3.0 44.9

of Statutory Auditors 8)

Giuseppe Camosci Statutory Auditor 01/01-12/31/2006 2009 42.0 42.0

Cesare Ferrero Chairman of the Board 01/01-05/03/2006 49.1 40.0 89.1

of Statutory Auditors 9)

Statutory Auditor 05/03-12/31/2006 2009

Giorgio Ferrino Statutory Auditor 01/01-05/03/2006 14.1 14.1

Executives with strategic 0.0 119.0 6,667.0 11,876.0 18,662.0

responsibilities (***) 10) 11) 12) 13)

(*) Year in which the Stockholders Meeting is convened for approval of the Annual Report, coinciding with expiration of the term of office.

(**) They include the use of means of transport for personal purposes.

(***) It includes 17 executives.

1) The gross annual compensation for the office of Chairman amounts to 500,000 euros.

2) Compensation for office held in Ferrari, including variable compensation. Starting from the fourth year of office as Chairman of Ferrari, he will accrue the right to receive the following

severance package: a sum payable over twenty years, the amount of which, after ten years, may not be greater than five times the fixed portion of his annual compensation. The relevant

accrual posted by Ferrari in 2006 amounted to 593.3 thousand euros.

3) The gross annual compensation for the office of Vice Chairman amounts to 500,000 euros.

4) Variable compensation whose payment is subject to the achievement of predetermined targets related to the annual budget and which may not be greater than 2.5 times the gross annual

fixed compensation.

5) The amount includes compensation for office held in the subsidiaries IHF and BUC (368.8 thousand euros) but does not include compensation for the office held in Fiat Auto (500 thousand

euros), which he does not receive but is channelled to Fiat S.p.A. In 2006, the Company posted an accrual of 771 thousand euros for the Chief Executive Officer’s severance package.

6) Compensation channelled to IFI S.p.A.

7) Compensation channelled to IFIL Investments S.p.A.

8) Compensation for the office of Common representative of holders of savings shares, held until April 20, 2006.

9) Compensation for the office of Chairman of the Board of Statutory Auditors of Fiat Auto S.p.A.

10) Including fringe benefits.

11) Variable portion of the compensation.

12) Including compensation for employment work, amounts paid upon termination of employment (3,318.0 thousand euros), and compensation not channelled for offices held at subsidiaries.

13) Social contributions paid by the company are not included.