Chrysler 2006 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Fiat Group Consolidated Financial Statements at December 31, 2006 -Notes 187

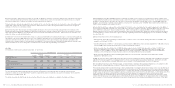

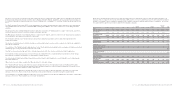

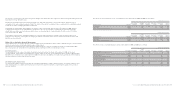

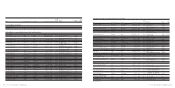

The effects of such transactions on the consolidated income statements for 2006 and 2005 are as follows:

of which: with related parties

Jointly

Unconsolidated controlled Associated Other related Total related Effect on

(in millions of euros) Total 2006 subsidiaries entities companies parties parties Total (%)

Net revenues 51,832 17 1,767 402 3 2,189 4.2%

Cost of sales 43,888 – 3,037 – 14 3,051 7.0%

Selling, general and administrative costs 4,697 – 2 – 1 3 0.1%

of which: with related parties

Jointly

Unconsolidated controlled Associated Other related Total related Effect on

(in millions of euros) Total 2005 subsidiaries entities companies parties parties Total (%)

Net revenues 46,544 15 1,574 277 4 1,870 4.0%

Cost of sales 39,624 –2,188 –13 2,201 5.6%

Selling, general and administrative costs 4,513 – – 3 1 4 0.1%

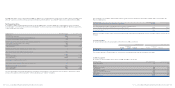

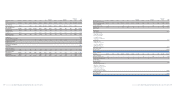

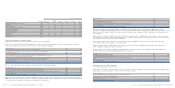

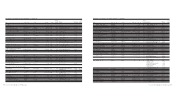

The effects on the consolidated balance sheets at December 31, 2006 and 2005 are as follows:

of which: with related parties

Jointly

At December Unconsolidated controlled Associated Other related Total related Effect on

(in millions of euros) 31, 2006 subsidiaries entities companies parties parties Total (%)

Other investments and financial assets 561 23 – 35 – 58 10.3%

Inventories 8,447 – 24 – – 24 0.3%

Trade receivables 4,944 18 280 78 1 377 7.6%

Receivables from financing activities 11,743 13 174 4 – 191 1.6%

Other current receivables 2,839 13 129 3 – 145 5.1%

Cash and cash equivalents 7,736 – – – – – 0.0%

Asset-backed financing 8,344 – 124 272 – 396 4.7%

Other debt 11,844 40 266 32 – 338 2.9%

Trade payables 12,603 3 947 55 – 1,005 8.0%

Other payables 5,019 1 44 – – 45 0.9%

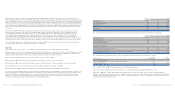

The increase over the prior year reflects the greater weight of the fixed rate loans component, influenced in particular by the bonds

issued by the Group during the year.

Floating rate financial instruments include principally cash and cash equivalents, loans provided by the financial services

companies to the sales network and part of debt. The effect of the sale of receivables is also considered in the sensitivity analysis

as well as the effect of hedging derivative instruments.

Ahypothetical, unfavourable and instantaneous change of 10% in short-term interest rates at December 31, 2006, applied

to floating rate financial assets and liabilities, operations for the sale of receivables and derivatives financial instruments,

would have caused increased net expenses before taxes, on an annual basis, of approximately 11 million euros (17 million

euros at December 31, 2005).

This analysis is based on the assumption that there is a general and instantaneous change of 10% in interest rates across

homogeneous categories. A homogeneous category is defined on the basis of the currency in which the financial assets and

liabilities are denominated.

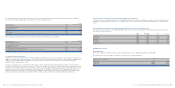

Other risks on derivative financial instruments

As described in Note 22, the Group holds certain derivative financial instruments whose value is linked to the price of listed shares

and stock market indices (principally Equity swaps on Fiat shares).

Although theses transactions were entered into for hedging purposes, they do not qualify for hedge accounting under IFRS.

As a consequence, the variability of the underlying values could have an effect on the Group’s results.

Sensitivity analysis

The potential loss in fair value of derivative financial instruments held by the Group at December 31, 2006, in the event

of ahypothetical, unfavourable and instantaneous change of 10% in the price of the underlying values would be approximately

40 million euros (8 million euros at December 31, 2005). The increase over 2005 is the result of new agreements entered during

the year and the rise in the value of the Fiat shares.

35. Related party transactions

The Fiat Group engages in transactions with unconsolidated subsidiaries, jointly controlled entities, associated companies and

other related parties on commercial terms that are normal in the respective markets, considering the quality of the goods or

services involved.

Fiat Group Consolidated Financial Statements at December 31, 2006 -Notes 186