Chrysler 2006 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

If working capital is restated to include the items reclassified

under Assets and Liabilities held for sale, the decrease would

total 678 million euros.

The increase in net inventories recorded in 2006 (+420 million

euros, or 457 million euros if inventories recognised among

Assets held for sale were included) is mainly attributable to

higher levels of activity at Fiat Auto.

Trade receivables decreased by 25 million euros. If trade

receivables recognised among Assets held for sale are

included, the balance would increase by 56 million euros.

At December 31, 2006, trade receivables, other receivables,

and receivables from financing activities falling due after that

date and sold without recourse, and therefore eliminated from

the balance sheet in compliance with IAS 39 derecognition

requirements, totalled 5,697 million euros (2,463 million euros

at December 31, 2005). This amount includes receivables,

mainly from the sales network, sold to jointly-controlled

financial services companies (FAFS) for 3,400 million euros

and associated financial services companies (Iveco Financial

Services, controlled by Barclays) for 661 million euros (710

Report on Operations Financial Review of the Group 39Report on Operations Financial Review of the Group38

The net financial position of the Fiat Group is presented in

Note 28 to the Consolidated Financial Statements according to

Consob’s requirements. Reconciliation of net financial position

and net debt is also provided in said Note.

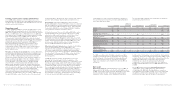

Asset-backed financing decreased by 2,385 million euros in

2006 mainly as a result of the deconsolidation of the Fiat Auto

financial services companies transferred to the joint venture

with Crédit Agricole (approximately 2 billion euros) and

foreign currency translation differences (750 million euros)

connected to the appreciation of euro against the USD.

Excluding these changes, asset-backed financing would have

increased by approximately 0.4 billion euros.

In 2006, other debt was lower by 3,188 million euros. Net of

debt reclassified among liabilities held for sale for 33 million

euros, the decrease is mainly attributable to the

deconsolidation of B.U.C. – Banca Unione di Credito, whose

sale was finalised at the end of August, leading to a reduction

of approximately 1.1 billion euros, in addition to the repayment

of bonds at maturity for approximately 2.4 billion euros, the

net reduction in bank loans and other debt for approximately

1.8 billion euros, and foreign exchange translation differences

totalling approximately 300 million euros. Conversely, it

should be noted that during the first six months of 2006, the

Group completed a number of bond issuances that enabled it

to refinance approximately 2.4 billion euros in debt, and in

particular:

■6.625% Senior Notes with a face value of 1 billion euros

maturing on February 15, 2013, issued by Fiat Finance & Trade

Ltd. and guaranteed by Fiat S.p.A., and placed on February

10 at a price of 100%;

■the 500 million dollar Case New Holland Inc. bond issue

(equal to 380 million euros) with a 7.125% yield and maturing

on March 1, 2014. Guaranty is provided by CNH Global N.V.

and the placement was completed on March 3;

■a 1 billion euro bond issue with a 5.625% yield and due on

November 15, 2011. The offering closed on May 12 at a price

of 99.565. The notes, issued by Fiat Finance and Trade Ltd. as

part of the 15 billion euro Global Medium Term Notes program,

are guaranteed by Fiat S.p.A.

million euros at December 31, 2005). The increase recorded

during 2006 is due to the deconsolidation of the financial

services companies of Fiat Auto conveyed in

the above mentioned joint venture with Crédit Agricole.

The increase in inventories and trade receivables (+513 million

euros if items recognised among Assets held for sales were

included) was more than offset by the increase in trade

payables,which grew by 826 million euros in 2006

(approximately 1 million euros if trade payables recognised

among liabilities held for sale were included) mainly due to

higher levels of activity at Fiat Auto and Iveco as well as the

rise in the liability balance of the item Other

receivables/(Payables), accruals and deferrals (158 million

euros, or 192 million euros if items recognised among

Assets/Liabilities held for sale were included) which is mainly

attributable to the collection of receivables from tax authorities.

At December 31, 2006 consolidated net debt (including net

debt reclassified to Assets/Liabilities held for sale) amounted

to 11,836 million euros, 6,687 million euros less than the

18,523 million euros at December 31, 2005.

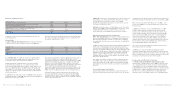

(in millions of euros) At 12.31.2006 At 12.31.2005

Debt (20,188) (25,761)

-Asset-backed financing (a) (8,344) (10,729)

-Other debt (a) (11,844) (15,032)

Debt included among liabilities held for sale (33) –

Other financial liabilities (b) (105) (189)

Other financial assets (b) 382 454

Current financial receivables from jointly controlled financial services entities (c) 143 –

Current securities 224 556

Cash and cash equivalents 7,736 6,417

Cash and cash equivalents included among assets held for sale 5–

Net debt (11,836) (18,523)

- Industrial Activities (1,773) (3,219)

-Financial Services (10,063) (15,304)

(a) The amounts of “Other debt” and “Asset-backed financing” at December 31, 2005 differ from those published in the Consolidated Financial Statements at December 31, 2005 due to the

reclassification described in the Notes to the Consolidated Financial Statements.

(b) This item includes the asset and liability fair values of derivative financial instruments.

(c) This item includes current financial receivables from the new joint venture Fiat Auto Financial Services.

The cash position (cash, cash equivalents and current

securities, including those reclassified to Assets held for sale

for 5 million euros), which totalled 7,965 million euros at

December 31, 2006, increased by 992 million euros compared

to 6,973 million euros at the beginning of the year. In addition

to the resources generated by operations (net of investments),

the increase reflects the benefit of approximately 3 billion

euros deriving from conclusion of the agreement between Fiat

Auto and Crédit Agricole, which were partially offset by flows

used to reduce gross debt over the course of the year.

At December 31, 2006, “Cash and cash equivalents” included

627 million euros (706 million euros at December 31, 2005)

specifically allocated to service the debt for securitisation

structures, mainly recognised among “Asset-backed

financing.”