Travelers 2003 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2003 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.97

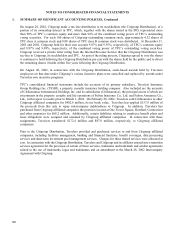

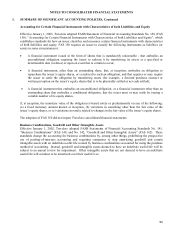

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES, Continued

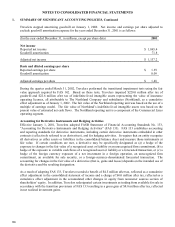

Goodwill and Intangible Assets

Travelers adopted FAS 141 and FAS 142 effective January 1, 2002. Upon adoption of FAS 141 and FAS 142,

Travelers stopped amortizing goodwill. Instead, goodwill is tested for impairment at least annually using a two-

step process. The first step is performed to identify potential impairment and, if necessary, the second step is

performed for the purpose of measuring the amount of impairment, if any. Other intangible assets that are not

deemed to have an indefinite useful life continue to be amortized over their useful lives. Travelers does not have

indefinite-lived intangible assets as of December 31, 2003.

The carrying amount of intangible assets that are not deemed to have an indefinite useful life is regularly

reviewed for indicators of impairments in value in accordance with FAS 144. Impairment is recognized only if

the carrying amount of the intangible asset is not recoverable from its undiscounted cash flows and is measured

as the difference between the carrying amount and the fair value of the asset.

Receivables for Investment Sales

Receivables for investment sales represent amounts due Travelers from investment brokers for securities sold,

which are recorded as of trade date, for which Travelers, in the normal course of securities settlement, has not

yet received the proceeds.

Claims and Claim Adjustment Expense Reserves

Claims and claim adjustment expense reserves represent estimated provisions for both reported and unreported

claims incurred and related expenses. The reserves are adjusted regularly based upon experience. Included in

the claims and claim adjustment expense reserves in the consolidated balance sheet at December 31, 2003 and

2002 are $1.325 billion and $1.370 billion, respectively, of reserves related to workers’ compensation that have

been discounted using an interest rate of 5%. Also included at December 31, 2003 and 2002 are $445.4 million

and $456.1 million, respectively, of reserves related to certain fixed and determinable asbestos-related

settlements, where all payment amounts and their timing are known, that have been discounted using a range of

interest rates of 1.56% to 5.50%.

In determining claims and claim adjustment expense reserves, Travelers carries on a continuing review of its

overall position, its reserving techniques and its reinsurance. The reserves are also reviewed periodically by a

qualified actuary employed by Travelers. These reserves represent the estimated ultimate cost of all incurred

claims and claim adjustment expenses. Since the reserves are based on estimates, the ultimate liability may be

more or less than such reserves. The effects of changes in such estimated reserves are included in the results of

operations in the period in which the estimates are changed. Such changes may be material to the results of

operations and financial condition and could occur in a future period.

Payables for Investment Purchases

Payables for investment purchases represent amounts owed by Travelers to investment brokers for securities

purchased, which are recorded as of trade date, for which Travelers, in the normal course of securities

settlement, has not yet settled the purchase.