Travelers 2003 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2003 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.106

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

2. MERGERS, ACQUISITIONS AND DISPOSITIONS, Continued

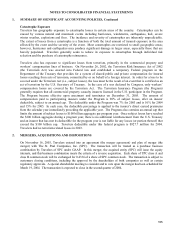

On August 1, 2002, Commercial Insurance Resources, Inc. (CIRI), a subsidiary of Travelers and the holding

company for the Gulf Insurance Group (Gulf), completed its previously announced transaction with a group of

outside investors and senior employees of Gulf. Capital investments made by the investors and employees included

9.7 million shares of mandatorily convertible preferred stock for a purchase price of $8.83 per share, $49.7 million

of convertible notes and .4 million common shares for a purchase price of $8.83 per share, representing a 24%

ownership interest, on a fully diluted basis. The dividend rate on the preferred stock is 6.0%. The interest rate on

the notes is 6.0% payable on an interest-only basis. The notes mature on December 31, 2032. Trident II, L.P.,

Marsh & McLennan Capital Professionals Fund, L.P., Marsh & McLennan Employees’ Securities Company, L.P.

and Trident Gulf Holding, LLC (collectively, Trident) invested $125.0 million, and a group of approximately 75

senior employees of Gulf invested $14.2 million. Fifty percent of the Gulf senior employees’ investment was

financed by CIRI. This financing is collateralized by the CIRI securities purchased and is forgivable if Trident

achieves certain investment returns. The applicable agreements provide for registration rights and transfer rights and

restrictions and other matters customarily addressed in agreements with minority investors. Gulf’s results, net of

minority interest, are included in the Commercial Lines segment.

On October 1, 2001, Travelers paid $329.5 million to Citigroup for The Northland Company and its subsidiaries

and Associates Lloyds Insurance Company. These entities had a combined net book value of $572.1 million.

The excess of this net book value over the purchase price was reflected as a contribution to Travelers. In

addition, on October 3, 2001, the capital stock of Associates Insurance Company, with a net book value of

$356.5 million, was contributed to Travelers. These acquisitions were accounted for as transfers of net assets

between entities under common control. The prior period financial statements were not restated due to

immateriality.

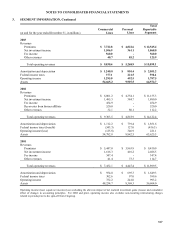

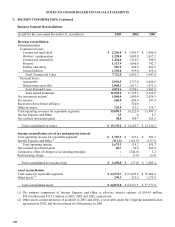

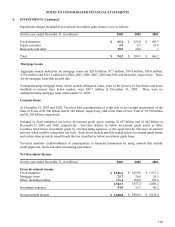

3. SEGMENT INFORMATION

Travelers comprises two reportable business segments: Commercial Lines and Personal Lines. See note 1 –

Nature of Operations for a discussion of the Commercial Lines and Personal Lines segments.

The accounting policies used to generate the following segment data are the same as those described in the

summary of significant accounting policies in note 1. The amount of investments in equity method investees and

total expenditures for additions to long-lived assets other than financial instruments were not significant.