Travelers 2003 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2003 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.105

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES, Continued

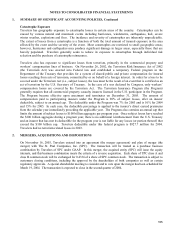

Catastrophe Exposure

Travelers has geographic exposure to catastrophe losses in certain areas of the country. Catastrophes can be

caused by various natural and manmade events including hurricanes, windstorms, earthquakes, hail, severe

winter weather, explosions and fires. The incidence and severity of catastrophes are inherently unpredictable.

The extent of losses from a catastrophe is a function of both the total amount of insured exposure in the area

affected by the event and the severity of the event. Most catastrophes are restricted to small geographic areas;

however, hurricanes and earthquakes may produce significant damage in larger areas, especially those that are

heavily populated. Travelers generally seeks to reduce its exposure to catastrophes through individual risk

selection and the purchase of catastrophe reinsurance.

Travelers also has exposure to significant losses from terrorism, primarily in the commercial property and

workers’ compensation lines of business. On November 26, 2002, the Terrorism Risk Insurance Act of 2002

(the Terrorism Act) was enacted into Federal law and established a temporary Federal program in the

Department of the Treasury that provides for a system of shared public and private compensation for insured

losses resulting from acts of terrorism, committed by or on behalf of a foreign interest. In order for a loss to be

covered under the Terrorism Act (i.e., subject losses), the loss must be the result of an event that is certified as an

act of terrorism by the U.S. Secretary of Treasury. In the case of a war declared by Congress, only workers’

compensation losses are covered by the Terrorism Act. The Terrorism Insurance Program (the Program)

generally requires that all commercial property casualty insurers licensed in the U.S. participate in the Program.

The Program became effective upon enactment and terminates on December 31, 2005. The amount of

compensation paid to participating insurers under the Program is 90% of subject losses, after an insurer

deductible, subject to an annual cap. The deductible under the Program was 7% for 2003 and is 10% for 2004

and 15% for 2005. In each case, the deductible percentage is applied to the insurer’s direct earned premiums

from the calendar year immediately preceding the applicable year. The Program also contains an annual cap that

limits the amount of subject losses to $100 billion aggregate per program year. Once subject losses have reached

the $100 billion aggregate during a program year, there is no additional reimbursement from the U.S. Treasury

and an insurer that has met its deductible for the program year is not liable for any losses (or portion thereof) that

exceed the $100 billion cap. Travelers deductible under this federal program is $927.7 million for 2004.

Travelers had no terrorism-related losses in 2003.

2. MERGERS, ACQUISITIONS AND DISPOSITIONS

On November 16, 2003, Travelers entered into an agreement (the merger agreement) and plan of merger (the

merger) with The St. Paul Companies, Inc. (SPC). The transaction will be treated as a purchase business

combination by Travelers of SPC under GAAP. In this merger, the acquired entity (SPC) will issue the equity

interests, and this business combination meets the criteria of a reverse acquisition. Each share of TPC class A and

class B common stock will be exchanged for 0.4334 of a share of SPC common stock. The transaction is subject to

customary closing conditions, including the approval by the shareholders of both companies as well as certain

regulatory approvals. A special shareholder meeting to consider and to vote upon the merger has been scheduled for

March 19, 2004. The transaction is expected to close in the second quarter of 2004.