Travelers 2003 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2003 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62

• The company is performing substantially and consistently behind plan;

• The investee has announced, or Travelers has become aware of, adverse changes or events such as changes or

planned changes in senior management, restructurings, or a sale of assets;

• The regulatory, economic, or technological environment has changed in a way that is expected to adversely

affect the investee's profitability;

Factors affecting on-going financial condition:

• Factors that raise doubts about the investee's ability to continue as a going concern, such as negative cash

flows from operations, working-capital deficiencies, investment advisors' recommendations, or non-

compliance with regulatory capital requirements or debt covenants;

• A secondary equity offering at a price substantially lower than the holder’s cost;

• A breach of a covenant or the failure to service debt;

• Fraud within the company.

For debt and equity investments, factors that may indicate that a decline in value is not other-than-temporary include

the following:

• The securities owned continue to generate reasonable earnings and dividends, despite a general stock market

decline;

• Bond interest or preferred stock dividend rate (on cost) is lower than rates for similar securities issued

currently but quality of investment is not adversely affected;

• The investment is performing as expected and is current on all expected payments;

• Specific, recognizable, short-term factors have affected the market value;

• Financial condition, market share, backlog and other key statistics indicate growth.

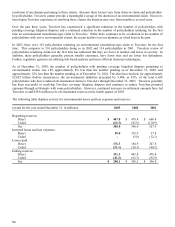

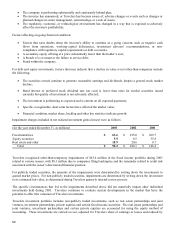

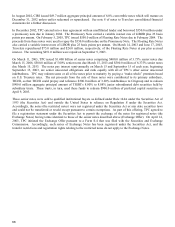

Impairment charges included in net realized investment gains (losses) were as follows:

(for the year ended December 31, in millions) 2003 2002 2001

Fixed maturities $ 65.4

$ 255.0 $ 109.7

Equity securities 5.9 8.5 35.8

Real estate and other 18.9 20.6 0.7

Total $ 90.2

$ 284.1 $ 146.2

Travelers recognized other-than-temporary impairments of $65.4 million in the fixed income portfolio during 2003

related to various issuers, with $8.3 million due to companies filing bankruptcy and the remainder related to credit risk

associated with the issuer’s deteriorated financial position.

For publicly traded securities, the amounts of the impairments were determined by writing down the investments to

quoted market prices. For non-publicly traded securities, impairments are determined by writing down the investment

to its estimated fair value, as determined during Travelers quarterly internal review process.

The specific circumstances that led to the impairments described above did not materially impact other individual

investments held during 2003. Travelers continues to evaluate current developments in the market that have the

potential to affect the valuation of Travelers investments.

Travelers investment portfolio includes non-publicly traded investments, such as real estate partnerships and joint

ventures, investment partnerships, private equities and certain fixed income securities. The real estate partnerships and

joint ventures, investment partnerships and certain private equities are accounted for using the equity method of

accounting. These investments are carried at cost, adjusted for Travelers share of earnings or losses and reduced by