Travelers 2003 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2003 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

85

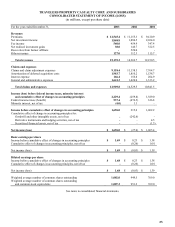

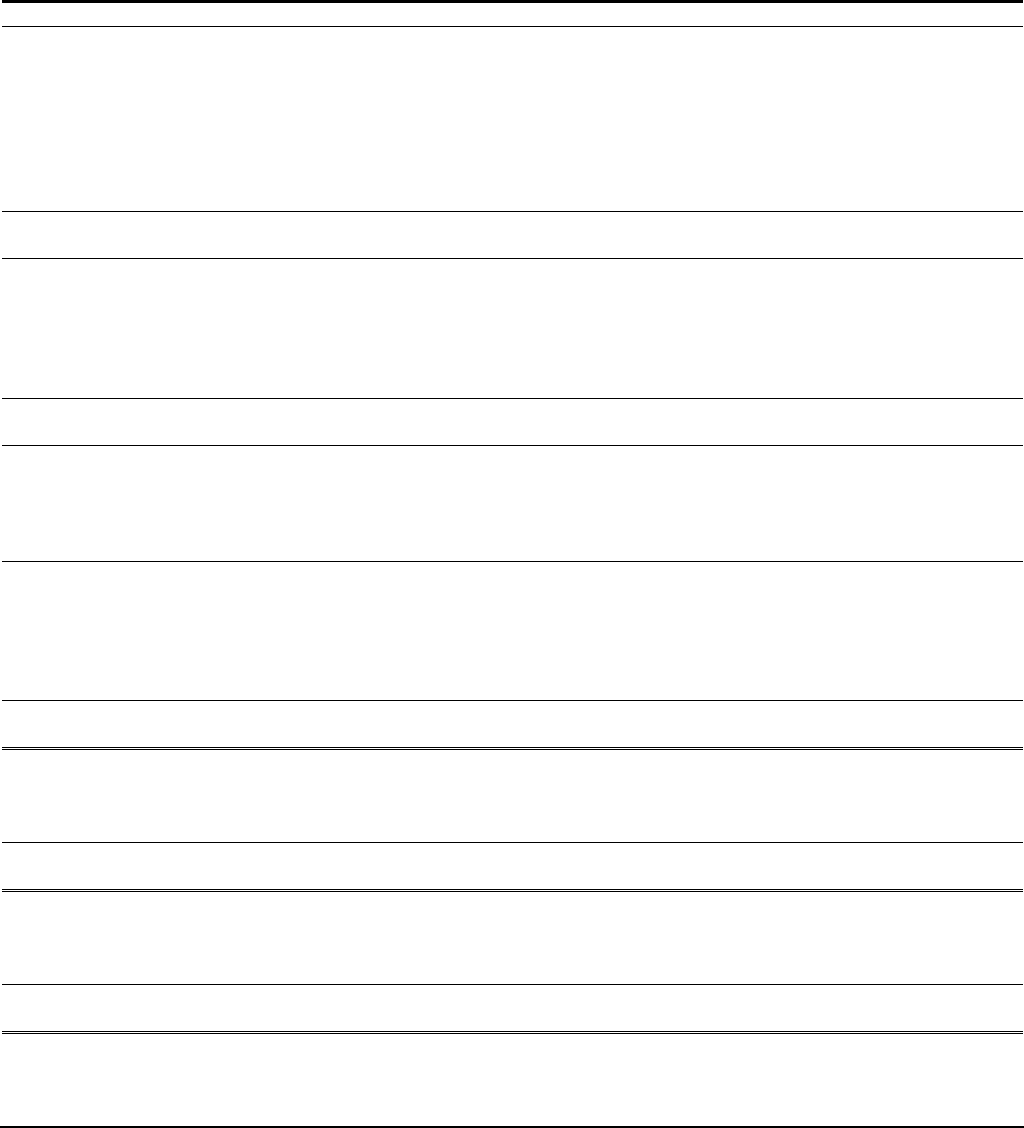

TRAVELERS PROPERTY CASUALTY CORP. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF INCOME (LOSS)

(in millions, except per share data)

For the year ended December 31, 2003 2002 2001

Revenues

Premiums $ 12,545.4 $ 11,155.3 $ 9,410.9

Net investment income 1,868.8 1,880.5 2,034.0

Fee income 560.0 454.9 347.4

Net realized investment gains 38.0 146.7 322.5

Recoveries from former affiliate - 520.0 -

Other revenues 127.0 112.3 115.7

Total revenues 15,139.2 14,269.7 12,230.5

Claims and expenses

Claims and claim adjustment expenses 9,118.4 11,138.5 7,764.7

Amortization of deferred acquisition costs 1,983.7 1,810.2 1,538.7

Interest expense 166.4 156.8 204.9

General and administrative expenses 1,641.3 1,424.0 1,333.2

Total claims and expenses 12,909.8 14,529.5 10,841.5

Income (loss) before federal income taxes, minority interest

and cumulative effect of changes in accounting principles 2,229.4 (259.8) 1,389.0

Federal income taxes (benefit) 537.4 (476.5) 326.8

Minority interest, net of tax (4.0) 1.1 -

Income before cumulative effect of changes in accounting principles 1,696.0 215.6 1,062.2

Cumulative effect of change in accounting principles for:

Goodwill and other intangible assets, net of tax

Derivative instruments and hedging activities, net of tax

-

-

(242.6)

-

-

4.5

Securitized financial assets, net of tax - - (1.3)

Net income (loss) $ 1,696.0 $ (27.0) $ 1,065.4

Basic earnings per share

Income before cumulative effect of changes in accounting principles $ 1.69 $ 0.23 $ 1.38

Cumulative effect of changes in accounting principles, net of tax - (0.26) 0.01

Net income (loss) $ 1.69 $ (0.03) $ 1.39

Diluted earnings per share

Income before cumulative effect of changes in accounting principles $ 1.68 $ 0.23 $ 1.38

Cumulative effect of changes in accounting principles, net of tax - (0.26) 0.01

Net income (loss) $ 1.68 $ (0.03) $ 1.39

Weighted average number of common shares outstanding 1,002.0

949.5 769.0

Weighted average number of common shares outstanding

and common stock equivalents

1,007.3

951.2

769.0

See notes to consolidated financial statements.