Travelers 2003 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2003 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28

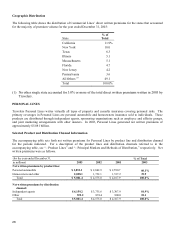

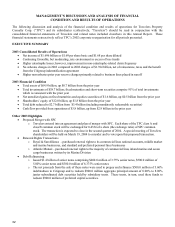

Geographic Distribution

The following table shows the distribution of Commercial Lines’ direct written premiums for the states that accounted

for the majority of premium volume for the year ended December 31, 2003:

State

% of

Total

California 11.9%

New York 10.0

Texas 6.3

Illinois 5.1

Massachusetts 5.1

Florida 4.7

New Jersey 4.2

Pennsylvania 3.6

All Others (1) 49.1

Total 100.0%

(1) No other single state accounted for 3.0% or more of the total direct written premiums written in 2003 by

Travelers.

PERSONAL LINES

Travelers Personal Lines writes virtually all types of property and casualty insurance covering personal risks. The

primary coverages in Personal Lines are personal automobile and homeowners insurance sold to individuals. These

products are distributed through independent agents, sponsoring organizations such as employee and affinity groups,

and joint marketing arrangements with other insurers. In 2003, Personal Lines generated net written premiums of

approximately $5.081 billion.

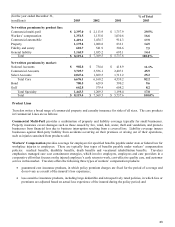

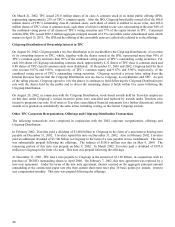

Selected Product and Distribution Channel Information

The accompanying table sets forth net written premiums for Personal Lines by product line and distribution channel

for the periods indicated. For a description of the product lines and distribution channels referred to in the

accompanying table, see “– Product Lines” and “– Principal Markets and Methods of Distribution,” respectively. Net

written premiums were as follows.

(for the year ended December 31, % of Total

in millions) 2003 2002 2001 2003

Net written premiums by product line:

Personal automobile $ 3,053.3 $ 2,842.9 $ 2,590.7 60.1%

Homeowners and other 2,028.1 1,732.1 1,517.2 39.9

Total

$ 5,081.4 $ 4,575.0 $ 4,107.9 100.0%

Net written premiums b

y

distribution

channel:

Independent agents $ 4,159.2 $ 3,735.6 $ 3,307.9 81.9%

Othe

r

922.2 839.4 800.0 18.1

Total $ 5,081.4 $ 4,575.0 $ 4,107.9 100.0%