Travelers 2003 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2003 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.95

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES, Continued

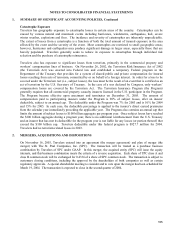

In April 2003, the FASB issued Statement of Financial Standards No. 149, “Amendment of Statement 133 on

Derivative Instruments and Hedging Activities” (FAS 149), which amends and clarifies the accounting for

derivative instruments, including certain derivative instruments embedded in other contracts, and for hedging

activities under FAS 133. FAS 149 amends FAS 133 for decisions made as part of the Derivatives

Implementation Group process that effectively required amendments to FAS 133. FAS 149 also clarifies under

what circumstances a contract with an initial net investment and purchases and sales of when-issued securities

that do not yet exist meet the characteristics of a derivative. In addition, it clarifies when a derivative contains a

financing component that warrants special reporting in the statement of cash flows. FAS 149 is effective for

contracts entered into or modified after June 30, 2003 and for hedging relationships designated after June 30,

2003. The adoption of FAS 149 did not have a significant impact on Travelers results of operations, financial

condition or liquidity.

Recognition of Interest Income and Impairment on Purchased and Retained Beneficial Interests in

Securitized Financial Assets

Effective April 1, 2001, Travelers adopted EITF Issue 99-20, “Recognition of Interest Income and Impairment

on Purchased and Retained Beneficial Interests in Securitized Financial Assets” (EITF 99-20). EITF 99-20

provides new guidance on the recognition and measurement of interest income and impairment on certain

investments, e.g., certain asset-backed securities. The recognition of impairment resulting from the adoption of

EITF 99-20 is to be recorded as a cumulative effect adjustment as of the beginning of the fiscal quarter in which

it is adopted. Interest income on beneficial interests falling within the scope of EITF 99-20 is to be recognized

prospectively. As a result of adopting EITF 99-20, Travelers recorded a charge of $1.3 million after tax,

reflected as a cumulative effect adjustment. The implementation of this EITF did not have a significant impact

on results of operations, financial condition or liquidity.

Accounting Policies

Investments

Fixed maturities include bonds, notes and redeemable preferred stocks. Fixed maturities are valued based upon

quoted market prices or dealer quotes, or if quoted market prices or dealer quotes are not available, discounted

expected cash flows using market rates commensurate with the credit quality and maturity of the investment.

Also included in fixed maturities are loan-backed and structured securities, which are amortized using the

retrospective method. The effective yield used to determine amortization is calculated based upon actual

historical and projected future cash flows, which are obtained from a widely-accepted securities data provider.

Fixed maturities, including instruments subject to securities lending agreements, are classified as available for

sale and are reported at fair value, with unrealized investment gains and losses, net of income taxes, charged or

credited directly to shareholders’ equity.

Equity securities, which include common and nonredeemable preferred stocks, are classified as available for sale

and carried at fair value based on quoted market prices. Changes in fair values of equity securities, net of

income tax, are charged or credited directly to shareholders’ equity.

Mortgage loans are carried at amortized cost. A mortgage loan is considered impaired when it is probable that

Travelers will be unable to collect principal and interest amounts due. For mortgage loans that are determined to

be impaired, a reserve is established for the difference between the amortized cost and fair market value of the

underlying collateral. In estimating fair value, Travelers uses interest rates reflecting the current real estate

financing market returns. Impaired loans were not significant at December 31, 2003 and 2002.