Travelers 2003 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2003 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.119

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

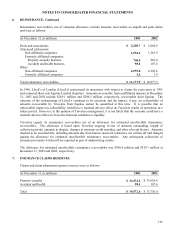

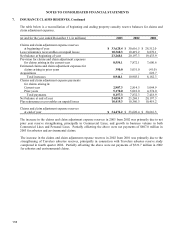

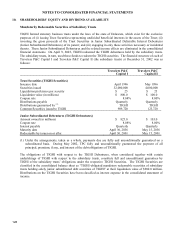

7. INSURANCE CLAIMS RESERVES, Continued

In 2003, estimated claims and claim adjustment expenses for claims arising in prior years was a net unfavorable

development of $390.0 million. This included $548.7 million of net unfavorable development which impacted

results of operations, primarily due to unfavorable development of $521.1 million related to reserve

strengthening at Gulf Insurance, a majority-owned subsidiary that writes specialty insurance. Claims arising in

prior years for 2003 also included unfavorable development of $115.0 million related to American Equity, an

operation that was placed in run-off in the second quarter of 2002 and $59.8 million related to environmental

claims. This was partially offset by net favorable development in other Commercial Lines businesses, principally

property coverages, in which Travelers has experienced lower non-catastrophe-related claim frequency. In

addition, Personal Lines had a $162.0 million net prior year reserve development benefit in 2003 principally due

to continued reduced levels of non-catastrophe claim frequency in both homeowners and non-bodily injury

automobile businesses and a $50.0 million reduction in reserves held related to the terrorist attack on September

11, 2001. In 2003, estimated claims and claim adjustment expenses for claims arising in prior years included

$42.4 million of net favorable loss development on Commercial Lines loss sensitive policies in various lines;

however, since the business to which it relates is subject to premium adjustments, there is no impact on results of

operations. For each of the years ended December 31, 2003, 2002 and 2001, changes in allocations between

policy years of loss adjustment expenses, pursuant to regulatory reporting requirements, are included in claims

and claim adjustment expenses for claims arising in prior years and did not impact results of operations.

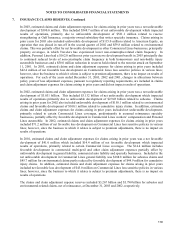

In 2002, estimated claims and claim adjustment expenses for claims arising in prior years was a net unfavorable

development of $3.031 billion. This included $3.132 billion of net unfavorable development which impacted

results of operations primarily due to unfavorable development of $2.945 billion related to asbestos. Claims

arising in prior years for 2002 also included unfavorable development of $150.1 million related to environmental

claims and favorable development of $100.1 million related to cumulative injury claims. In addition, estimated

claims and claim adjustment expenses for claims arising in prior years included net unfavorable development,

primarily related to certain Commercial Lines coverages, predominantly in assumed reinsurance specialty

businesses, partially offset by favorable development in Commercial Lines workers’ compensation and Personal

Lines automobile. In 2002, estimated claims and claim adjustment expenses for claims arising in prior years

included $71.2 million of net favorable loss development on Commercial Lines loss sensitive policies in various

lines; however, since the business to which it relates is subject to premium adjustments, there is no impact on

results of operations.

In 2001, estimated claims and claim adjustment expenses for claims arising in prior years was a net favorable

development of $41.0 million which included $14.4 million of net favorable development which impacted

results of operations, primarily related to certain Commercial Lines coverages. The $14.4 million includes

favorable development in commercial multi-peril and other claim adjustment expenses partially offset by

unfavorable development in general liability, commercial auto liability and specialty businesses. Included in the

net unfavorable development in Commercial Lines general liability was $188.8 million for asbestos claims and

$45.7 million for environmental claims partly reduced by favorable development of $44.9 million for cumulative

injury claims. In addition, estimated claims and claim adjustment expenses for claims arising in prior years

included net favorable loss development of $43.0 million on Commercial Lines loss sensitive policies in various

lines; however, since the business to which it relates is subject to premium adjustments, there is no impact on

results of operations.

The claims and claim adjustment expense reserves included $3.267 billion and $3.790 billion for asbestos and

environmental-related claims, net of reinsurance, at December 31, 2003 and 2002, respectively.