Travelers 2003 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2003 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

127

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

9. FEDERAL INCOME TAXES, Continued

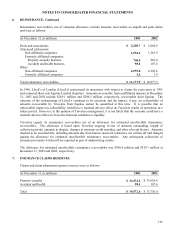

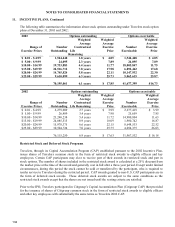

The net deferred tax assets comprise the tax effects of temporary differences related to the following assets and

liabilities:

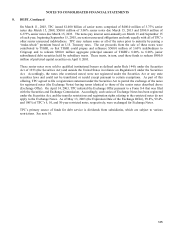

(at December 31, in millions) 2003 2002

Deferred tax assets

Claims and claim adjustment expense reserves $ 947.4 $ 923.4

Net operating loss carryforward - 486.5

Unearned premium reserves 432.2 388.2

Employee benefits 7.6 74.6

Insurance-related assessments 44.6 45.1

Other 151.2 145.4

Total 1,583.0 2,063.2

Deferred tax liabilities

Deferred acquisition costs 336.8 304.4

Investments 521.8 261.0

Other 46.5 50.7

Total 905.1 616.1

Deferred federal income taxes $ 677.9 $ 1,447.1

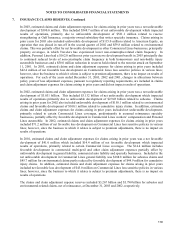

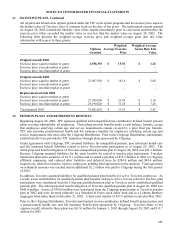

For the period ending March 27, 2002, Travelers is included in the consolidated federal income tax return filed

by Citigroup. Citigroup allocates federal income taxes to its subsidiaries on a separate return basis adjusted for

credits and other amounts required by the consolidation process. Any resulting liability is paid currently to

Citigroup. Any credits for losses will be paid by Citigroup currently to the extent that such credits are for tax

benefits that have been utilized in the consolidated federal income tax return.

In the event that the consolidated return develops an alternative minimum tax (AMT), each company with an

AMT on a separate company basis will be allocated a portion of the consolidated AMT. Settlement of the AMT

will be made in the same manner and timing as the regular tax.

As of March 28, 2002, as a result of the IPO, Travelers is no longer included in the Citigroup consolidated

federal income tax return. As of that date, Travelers began filing its own consolidated federal income tax return.

At December 31, 2002, Travelers had a net operating loss carryforward of $1.390 billion. Under terms of the tax

sharing agreement with Citigroup, Travelers is entitled to carry operating losses back to prior years upon

receiving Citigroup’s consent. During the first quarter of 2003, Travelers received Citigroup’s consent and, as a

result, Travelers deferred tax asset was reduced by $486.5 million with a corresponding reduction to the current

federal income tax payable (included in other cash flows from operating activities in the consolidated statement

of cash flows.) On June 9, 2003, Travelers received a federal income tax refund of $530.9 million representing

the full utilization of the net operating loss carryforward.

In the opinion of Travelers management, realization of the recognized deferred federal income taxes of $677.9

million is more likely than not based on expectations as to Travelers future taxable income. Travelers has

reported income (loss) before federal income taxes, minority interest and cumulative effect of changes in

accounting principles of $1.120 billion on average over the last three years and has generated federal taxable

income exceeding $448.1 million on average in each year during the same period.