Travelers 2003 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2003 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

76

Medical risk factors

Changes in the cost of medical treatments and underlying fee schedules (“inflation”)

Frequency of visits to health providers

Number of medical procedures given during visits to health providers

Types of health providers used

Type of medical treatments received

Use of preferred provider networks and other medical cost containment practices

Availability of new medical processes and equipment

Changes in the use of pharmaceutical drugs

Degree of patient responsiveness to treatment

Workers’ compensation book of business risk factors

Product mix

Injury type mix

Changes in underwriting standards

General workers’ compensation risk factors

Frequency of claim reopenings on claims previously closed

Mortality trends of injured workers with lifetime benefits and medical treatment

Degree of cost shifting between workers’ compensation and health insurance

Fidelity and Surety

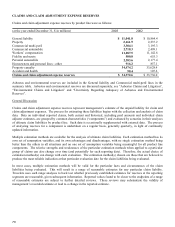

Fidelity is considered a short tail coverage. It takes a relatively short period of time to finalize and settle fidelity

claims. The volatility of fidelity reserves is generally related to the type of business of the insured, the size and

complexity of the insured’s business operations, amount of policy limit and attachment point of coverage. The

uncertainty surrounding reserves for small, commercial insureds is typically less than the uncertainty for large

commercial or financial institutions. The low severity, high frequency nature of small commercial fidelity losses

provides for stability in loss estimates whereas, the high severity, low frequency nature of losses for large insureds

results in a wider range of ultimate loss outcomes. Actuarial techniques that rely on a stable pattern of loss

development are generally not applicable to high severity, low frequency policies.

Surety is also considered a short tail coverage. The frequency of losses in surety correlates with economic cycles as

the primary cause of surety loss is the inability to perform financially. The volatility of surety reserves is generally

related to the type of business performed by the insured, the type of bonded obligation, the amount of limit exposed to

loss, and the amount of assets available to the insurer to mitigate losses, such as unbilled contract funds, collateral, first

and third party indemnity, and other security positions of an insured’s assets. Surety claims are generally high

severity, low frequency in nature. Other claim factors affecting reserve variability of surety includes litigation related

to amounts owed by and due the insured (e.g., salvage and subrogation efforts) and the results of financial restructuring

of an insured.

Examples of common risk factors that can change and, thus, affect the required fidelity and surety reserves (beyond

those included in the general discussion section) include:

Fidelity risk factors

Type of business of insured

Policy limit and attachment points

Third-party claims

Coverage litigation

Complexity of claims

Growth in insureds’ operations