Travelers 2003 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2003 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

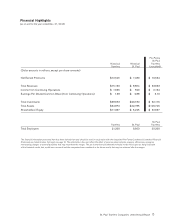

11

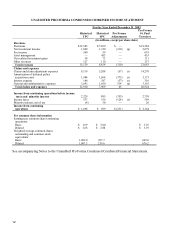

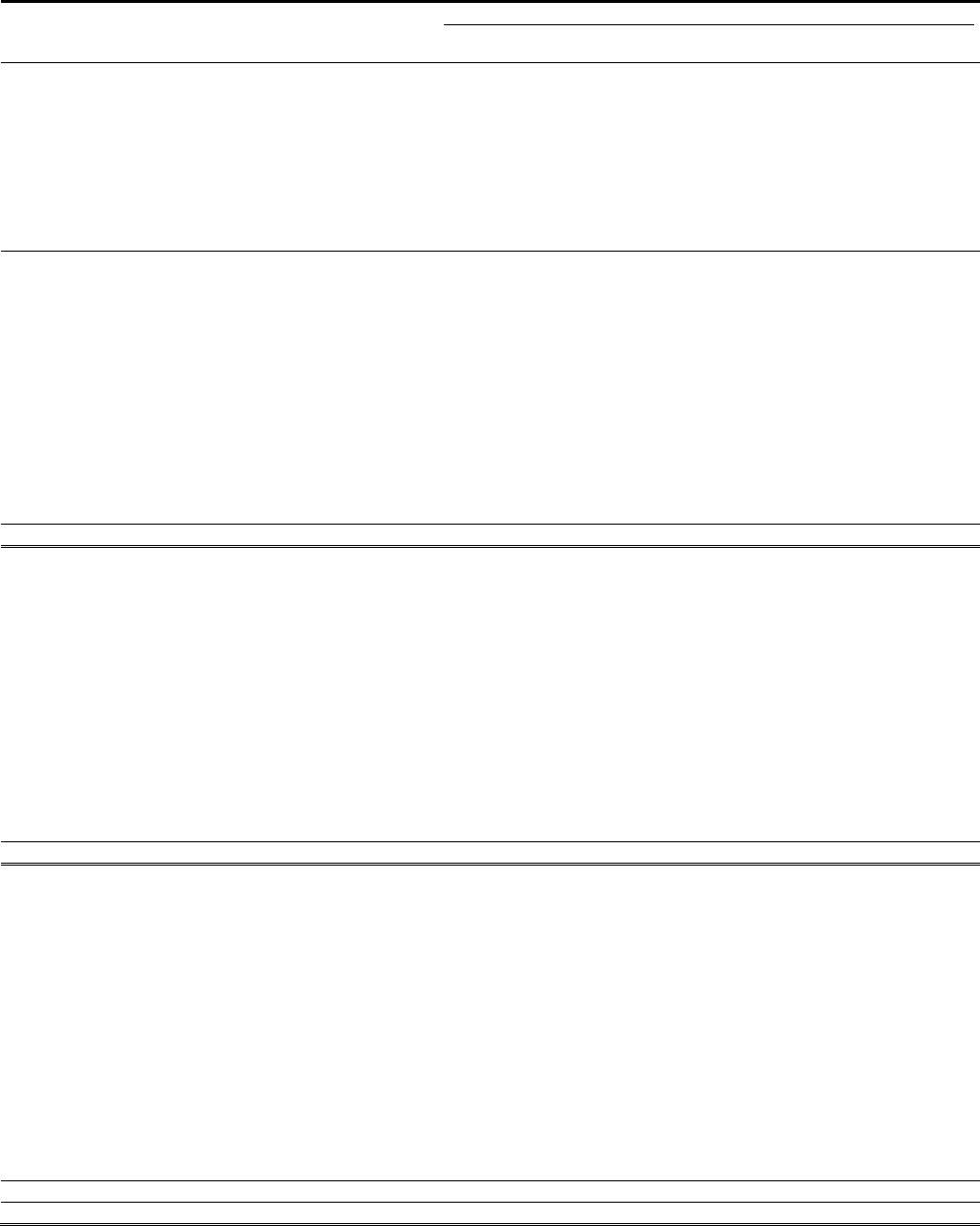

UNAUDITED PRO FORMA CONDENSED COMBINED BALANCE SHEET

At December 31, 2003

Historical

TPC

Historical

SPC

Pro Forma

Adjustments

Pro Forma

St. Paul Travelers

(in millions)

Assets

Fixed maturities, available for sale at fair value $ 33,045 $ 18,021 $ — $ 51,066

Equity securities, at fair value 733 190 — 923

Mortgage loans 211 63 — 274

Investment real estate — 775 283 (a) 1,058

Short-term securities 2,138 2,709 — 4,847

Trading securities, at fair value 57 — — 57

Other investments 2,469 1,422 — 3,891

Total investments 38,653 23,180 283 62,116

Cash 352 150 — 502

Investment income accrued 362 248 — 610

Premium balances receivable 4,089 2,486 — 6,575

Reinsurance recoverables 11,174 8,718 (417) (b) 19,475

Deferred policy acquisition costs 965 695 (78) (c) 1,582

Deferred federal income taxes 678 1,285 (296) (d) 1,667

Contractholder receivables 3,121 1,585 — 4,706

Goodwill 2,412 926 (926) (e) 5,257

2,845 (e)

Other intangibles 422 139 (139) (f) 1,622

1,200 (f)

Other assets 2,644 3,374 (384) (g) 5,634

Total assets $ 64,872 $ 42,786 $ 2,088 $109,746

Liabilities

Claims and claim adjustment expense reserves $ 34,573 $ 21,035 $ (761) (h) $ 54,847

Unearned premium reserves 7,111 4,248 — 11,359

Contractholder payables 3,121 1,585 — 4,706

Commercial paper — 322 — 322

Long-term debt 1,756 2,057 160 (i) 3,973

Convertible junior subordinated notes payable 869 — — 869

Convertible notes payable 49 — — 49

Equity unit related debt — 443 24 (i) 467

SPC-obligated mandatorily redeemable preferred

securities of trusts holding solely subordinated

debentures of SPC — 928 109 (i) 1,037

Other liabilities 5,406 5,943 101 (j) 11,450

Total liabilities 52,885 36,561 (367) 89,079

Shareholders' equity

Preferred stock:

Stock Ownership Plan - convertible preferred stock — 98 119 (k) 217

Guaranteed obligation - Stock Ownership Plan — (23) (2) (k) (25)

Common stock:

No par value — 2,655 14,474 (n,o,p) 17,129

Class A 5 — (5) (l) —

Class B 5 — (5) (l) —

Additional paid-in capital 8,705 — (8,705) (l) —

Retained earnings 2,290 2,874 (2,874) (m) 2,290

Accumulated other changes in equity from nonowner

sources 1,086 621 (621) (m) 1,086

Treasury stock, at cost (74) — 74 (l) —

Unearned compensation (30) — — (30)

Total shareholders' equity 11,987 6,225 2,455 20,667

Total liabilities and shareholders’ equity $ 64,872 $ 42,786 $ 2,088 $109,746

See accompanying Notes to the Unaudited Pro Forma Condensed Combined Financial Statements.