Travelers 2003 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2003 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.32

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis of the financial condition and results of operations for Travelers Property

Casualty Corp. (“TPC”) and its subsidiaries (collectively, “Travelers”) should be read in conjunction with the

consolidated financial statements of Travelers and related notes included elsewhere in this Annual Report. These

financial statements retroactively reflect TPC’s 2002 corporate reorganization for all periods presented.

EXECUTIVE SUMMARY

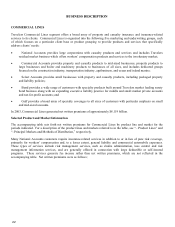

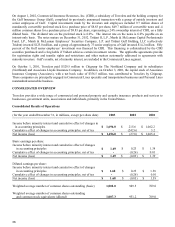

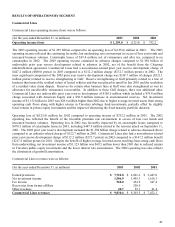

2003 Consolidated Results of Operations

• Net income of $1.696 billion or $1.69 per share basic and $1.68 per share diluted

• Continuing favorable, but moderating, rate environment in excess of loss trends

• Higher catastrophe losses; however, improvement in non-catastrophe-related claim frequency

• No asbestos charges in 2003 compared to 2002 charges of $1.394 billion, net of reinsurance, taxes and the benefit

from the Citigroup indemnification agreement

• Higher non-asbestos prior year reserve charges primarily related to business lines placed in runoff

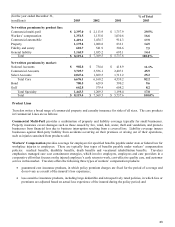

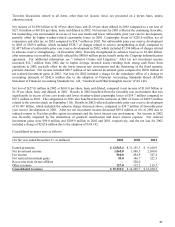

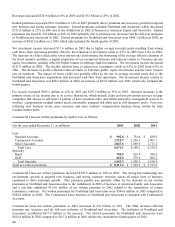

2003 Financial Condition

• Total assets of $64.9 billion, up $0.7 billion from the prior year

• Total investments of $38.7 billion; fixed maturities and short-term securities comprise 91% of total investments

which is consistent with the prior year

• Net unrealized gains on fixed maturities and equities securities of $1.6 billion, up $0.5 billion from the prior year

• Shareholders’ equity of $12.0 billion, up $1.8 billion from the prior year

• Total debt reduced to $2.7 billion from $3.4 billion (including mandatorily redeemable securities)

• Cash flow provided from operations of $3.8 billion, up from $2.9 billion in the prior year

Other 2003 Highlights

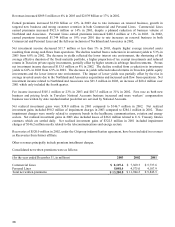

• Proposed Merger with SPC

o Travelers entered into an agreement and plan of merger with SPC. Each share of the TPC class A and

class B common stock will be exchanged for 0.4334 of a share (the exchange ratio) of SPC common

stock. The transaction is expected to close in the second quarter of 2004. A special meeting of Travelers

shareholders will be held on March 19, 2004 to consider and to vote upon this proposed transaction.

• Renewal Rights Transactions

o Royal & SunAlliance - purchased renewal rights to its commercial lines national accounts, middle market

and marine businesses, and standard and preferred personal lines businesses

o Atlantic Mutual – purchased renewal rights to the majority of commercial lines inland marine and ocean

cargo businesses written by its Marine Division

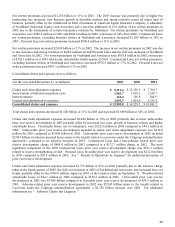

• Debt Refinancing

o Issued $1.4 billion of senior notes comprising $400.0 million of 3.75% senior notes, $500.0 million of

5.00% senior notes and $500.0 million of 6.375% senior notes

o The net proceeds from the sale of these notes were used to prepay and refinance $500.0 million of 3.60%

indebtedness to Citigroup and to redeem $900.0 million aggregate principal amount of 8.00% to 8.08%

junior subordinated debt securities held by subsidiary trusts. These trusts, in turn, used these funds to

redeem $900.0 million of preferred capital securities.