Travelers 2003 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2003 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.43

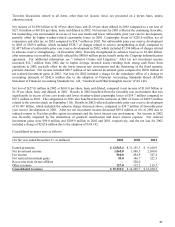

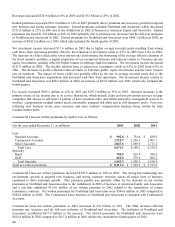

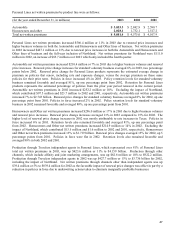

In addition to fee based products, National Accounts works with national and regional brokers to provide tailored

insurance coverages and programs, mainly to large corporations, and participates in state mandated residual market

workers’ compensation and automobile assigned risk plans. National Accounts net written premiums increased $168.2

million or 23% in 2003 and $315.7 million or 75% in 2002. These increases in net written premiums were due to the

continued benefit from rate increases, higher new business levels that, in part, resulted from Travelers third quarter

2003 renewal rights transaction with Royal & SunAlliance and higher business volume in residual market pools.

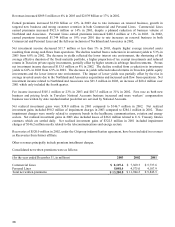

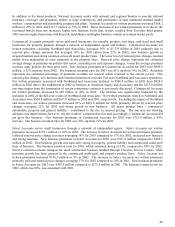

Commercial Accounts primarily serves mid-sized businesses for casualty products and large, mid-sized and small

businesses for property products through a network of independent agents and brokers. Commercial Accounts net

written premiums, excluding Northland and Associates, increased 16% to $3.179 billion in 2003 primarily due to

renewal price change increases that averaged 10% for 2003 (down from 22% in 2002), new business growth in

targeted markets and strong retention across all major product lines. The lower level of renewal price changes resulted

mostly from moderation in rates, primarily in the property lines. Renewal price change represents the estimated

average change in premium on policies that renew, including rate and exposure changes, versus the average premium

on those same policies for their prior term. New business premiums in Commercial Accounts for 2003 were $809.5

million, a 12% increase from 2002. The business retention ratio for 2003 was 81% up from 76% in 2002. Retention

represents the estimated percentage of premium available for renewal which renewed in the current period. This

renewal price change, new business and retention information excludes Travelers Northland and Associates operations.

Net written premiums associated with Northland and Associates declined to $546.8 million in 2003 from $824.8

million in 2002 due to the withdrawal in 2002 of business at American Equity and Associates and the $115.0 million

one-time impact from the termination of certain reinsurance contracts as previously discussed. Commercial Accounts

net written premiums increased $1.149 billion or 48% in 2002. The increase was significantly impacted by the

inclusion in 2002 of the full-year results of Northland and Associates. Net written premiums related to Northland and

Associates were $824.8 million and $167.4 million in 2002 and 2001, respectively. Excluding the impact of Northland

and Associates, net written premiums increased 22% or $491.6 million for 2002, primarily driven by renewal price

changes averaging 22% for 2002 and strong growth in new business. All major product lines – commercial

automobile, property and general liability – contributed to the rise in renewal pricing. The one area not showing

adequate rate improvement, however, was the workers’ compensation line and, accordingly, Commercial Accounts did

not grow this business. New business premiums in Commercial Accounts for 2002 were $725.4 million, a 43%

increase. The business retention ratio for 2002 was 76%, up from 71% for 2001.

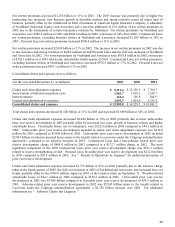

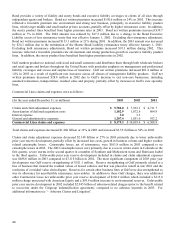

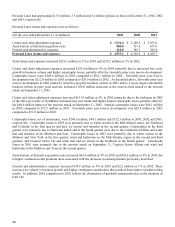

Select Accounts serves small businesses through a network of independent agents. Select Accounts net written

premiums increased $178.1 million or 10% in 2003. The increase in Select Accounts net written premiums primarily

reflected renewal price change increases averaging 14% for 2003 compared to 17% for 2002, increased new business

and strong retention. New business premiums in Select Accounts for 2003 were $367.8 million compared to $305.3

million in 2002. New business growth was especially strong in property, general liability and commercial multi-peril

lines of business. The business retention ratio for 2003, which remained strong at 83%, compared to 80% for 2002.

Select’s retention remains strongest for small commercial business handled through Travelers Service Centers, while

premium growth has been greatest in the commercial multi-peril and property product lines. Select Account net

written premiums increased $156.3 million or 9% in 2002. The increase in Select Accounts net written premiums

primarily reflected renewal price changes averaging 17% for 2002 compared to 14% in 2001. New business premiums

in Select Accounts for 2002 were $305.3 million compared to $275.8 million in 2001. The business retention ratio for

2002, which was 80%, was consistent with 2001.