Travelers 2003 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2003 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36

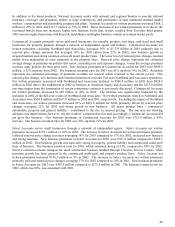

On August 1, 2002, Commercial Insurance Resources, Inc. (CIRI), a subsidiary of Travelers and the holding company for

the Gulf Insurance Group (Gulf), completed its previously announced transaction with a group of outside investors and

senior employees of Gulf. Capital investments made by the investors and employees included 9.7 million shares of

mandatorily convertible preferred stock for a purchase price of $8.83 per share, $49.7 million of convertible notes and .4

million common shares for a purchase price of $8.83 per share, representing a 24% ownership interest of CIRI, on a fully

diluted basis. The dividend rate on the preferred stock is 6.0%. The interest rate on the notes is 6.0% payable on an

interest-only basis. The notes mature on December 31, 2032. Trident II, L.P., Marsh & McLennan Capital Professionals

Fund, L.P., Marsh & McLennan Employees’ Securities Company, L.P. and Trident Gulf Holding, LLC (collectively

Trident) invested $125.0 million, and a group of approximately 75 senior employees of Gulf invested $14.2 million. Fifty

percent of the Gulf senior employees’ investment was financed by CIRI. This financing is collateralized by the CIRI

securities purchased and is forgivable if Trident achieves certain investment returns. The applicable agreements provide

for registration rights and transfer rights and restrictions and other matters customarily addressed in agreements with

minority investors. Gulf’s results, net of minority interest, are included in the Commercial Lines segment.

On October 1, 2001, Travelers paid $329.5 million to Citigroup for The Northland Company and its subsidiaries

(Northland) and Associates Lloyds Insurance Company. In addition, on October 3, 2001, the capital stock of Associates

Insurance Company (Associates), with a net book value of $356.5 million, was contributed to Travelers by Citigroup.

These companies are principally engaged in Commercial Lines specialty and transportation businesses and Personal Lines

nonstandard automobile business.

CONSOLIDATED OVERVIEW

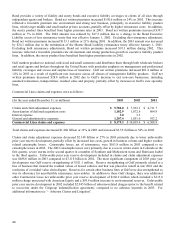

Travelers provides a wide range of commercial and personal property and casualty insurance products and services to

businesses, government units, associations and individuals, primarily in the United States.

Consolidated Results of Operations

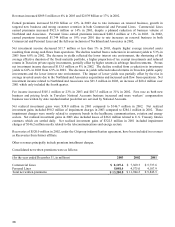

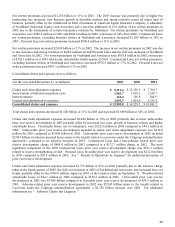

(for the year ended December 31, in millions, except per share data) 2003 2002 2001

Income before minorit

y

interest and cumulative effect of chan

g

es in

in accountin

g

p

rinci

p

les $ 1,696.0 $ 215.6

$

$ 1,062.2

Cumulative effect of chan

g

es in accountin

g

p

rinci

p

les, net of tax -

(

242.6

)

3.2

Net income

(

loss

)

$1

,

696.0 $

(

27.0

)

$

$1

,

065.4

Basic earnings per share:

Income before minority interest and cumulative effect of changes

in accounting principles

$ 1.69

$ 0.23

$ 1.38

Cumulative effect of changes in accounting principles, net of tax - (0.26) 0.01

Net income (loss) $ 1.69 $ (0.03) $ 1.39

Diluted earnings per share:

Income before minority interest and cumulative effect of changes

in accounting principles

$ 1.68

$ 0.23

$ 1.38

Cumulative effect of changes in accounting principles, net of tax - (0.26) 0.01

Net income (loss) $ 1.68 $ (0.03) $ 1.39

Weighted average number of common shares outstanding (basic) 1,002.0 949.5 769.0

Weighted average number of common shares outstanding

and common stock equivalents (diluted)

1,007.3

951.2

769.0