Travelers 2003 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2003 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.130

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

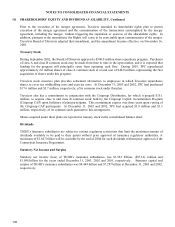

10. SHAREHOLDERS’ EQUITY AND DIVIDEND AVAILABILITY, Continued

Prior to the execution of the merger agreement, Travelers amended its shareholder rights plan to permit

execution of the merger agreement and the consummation of the transactions contemplated by the merger

agreement, including the merger, without triggering the separation or exercise of the shareholder rights. In

addition, pursuant to the amendment, the Rights will cease to be exercisable upon consummation of the merger.

Travelers Board of Directors adopted that amendment, and the amendment became effective, on November 16,

2003.

Treasury Stock

During September 2002, the Board of Directors approved a $500.0 million share repurchase program. Purchases

of class A and class B common stock may be made from time to time in the open market, and it is expected that

funding for the program will principally come from operating cash flow. During 2003, TPC repurchased

approximately 2.6 million shares of class A common stock at a total cost of $40.0 million, representing the first

acquisition of shares under this program.

Travelers stock incentive plan provides settlement alternatives to employees in which Travelers repurchases

shares to cover tax withholding costs and exercise costs. At December 31, 2003 and 2002, TPC had purchased

$17.6 million and $3.7 million, respectively, of its common stock under this plan.

Travelers also has a commitment in conjunction with the Citigroup Distribution, for which it prepaid $15.1

million, to acquire class A and class B common stock held by the Citigroup Capital Accumulation Program

(Citigroup CAP) upon forfeiture of plan participants. This commitment expires over three years upon vesting of

the Citigroup CAP participants. At December 31, 2003 and 2002, TPC had acquired $3.9 million and $1.3

million, respectively, of its common stock pursuant to this arrangement.

Shares acquired under these plans are reported as treasury stock in the consolidated balance sheet.

Dividends

TIGHI’s insurance subsidiaries are subject to various regulatory restrictions that limit the maximum amount of

dividends available to be paid to their parent without prior approval of insurance regulatory authorities. A

maximum of $1.647 billion will be available by the end of 2004 for such dividends without prior approval of the

Connecticut Insurance Department.

Statutory Net Income and Surplus

Statutory net income (loss) of TIGHI’s insurance subsidiaries was $1.952 billion, ($973.6) million and

$1.090 billion for the years ended December 31, 2003, 2002 and 2001, respectively. Statutory capital and

surplus of TIGHI’s insurance subsidiaries was $8.444 billion and $7.287 billion at December 31, 2003 and 2002,

respectively.