Travelers 2003 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2003 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

136

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

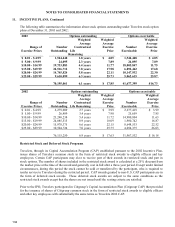

11. INCENTIVE PLANS, Continued

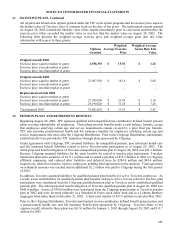

The significant assumptions used in estimating the fair value on the date of the grant for original options and

reload options granted in 2003 and 2002 and for replacement awards issued August 20, 2002 to Travelers

employees who held Citigroup stock option awards on that date were as follows:

2003 2002

Ex

p

ected life of stock o

p

tions 3

y

ears 4

y

ears

Expected volatility of TPC stock (1) 29.4% 36.8%

Risk-free interest rate 2.04% 3.17%

Expected annual dividend per TPC share $ 0.26 $ 0.20

Expected annual forfeiture rate 5% 5%

(1) The expected volatility is based on the average volatility of an industry peer group of entities because

Travelers only became publicly traded in March 2002.

In accordance with FAS 123, the exchange of options in conjunction with a spinoff is considered a modification

and therefore the modification guidance was applied to the replacement awards issued on August 20, 2002. For

vested replacement options, any excess of the fair value of the modified options issued over the fair value of the

original options at the date of exchange was recognized as additional compensation cost. For nonvested

replacement options, any excess of the fair value of the modified options issued over the fair value of the original

options at the date of exchange is added to the remaining unrecognized compensation cost of the original option

and recognized over the remaining vesting period.

Under FAS 123, reload options are treated as separate grants from the original grants and as a result are

separately valued when granted. Reload options are exercisable for the remaining term of the related original

option and therefore would generally have a shorter estimated life. Shares received through option exercises

under the reload program are subject to restriction on sale. Discounts (as measured by the estimated cost of

protection) have been applied to the fair value of reload options granted to reflect these sales restrictions.

Awards issued prior to 2002 were granted in Citigroup stock options. The estimated fair value effect of stock

options for 2001 were derived by applying the following significant assumptions underlying the Citigroup stock

option plan.

2001

Ex

p

ected life of stock o

p

tions 3

y

ears

Expected volatility of Citigroup stock 38.6%

Risk-free interest rate 4.52%

Expected annual dividend per Citigroup share $ 0.92

Expected annual forfeiture rate 5%