Travelers 2003 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2003 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

39

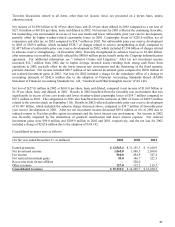

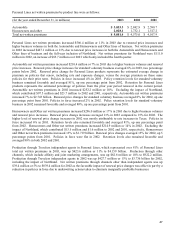

Net written premiums increased $1.256 billion or 11% in 2003. The 2003 increase was primarily due to higher but

moderating rate increases, new business growth in favorable markets and strong retention across all major lines of

business, partially offset by the withdrawal in 2002 of business at American Equity Insurance Company, a subsidiary

of Northland (American Equity) and Associates and a one-time additional $115.0 million of net written premiums in

2002 due to the termination of certain reinsurance contracts by Northland. Net written premiums for Northland and

Associates were $546.8 million in 2003 and $824.8 million in 2002, a decrease of 34% from 2002. Commercial Lines

net written premiums, excluding business written in Northland and Associates, increased $1.028 billion or 16% in

2003. Personal Lines net written premiums increased $506.4 million or 11% in 2003.

Net written premiums increased $2.099 billion or 21% in 2002. The increase in net written premiums in 2002 was due

to rate increases and strong retention in both Commercial and Personal Lines and the full year inclusion of Northland

and Associates in 2002. Net written premiums for Northland and Associates were $935.8 million in 2002, an increase

of $743.1 million over 2001 which only included the fourth quarter of 2001. Commercial Lines net written premiums,

excluding business written in Northland and Associates, increased $974.5 million or 17% in 2002. Personal Lines net

written premiums increased $467.1 million or 11% in 2002.

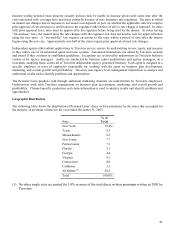

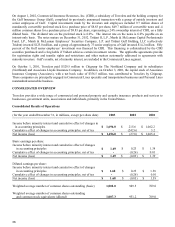

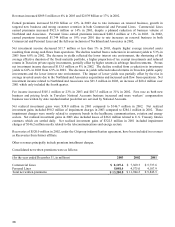

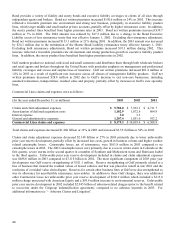

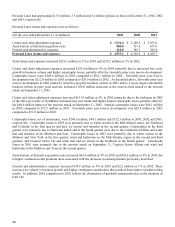

Consolidated claims and expenses were as follows:

(for the year ended December 31, in millions) 2003 2002 2001

Claims and claim ad

j

ustment ex

p

enses $ 9,118.4 $ 11,138.5 $ 7,764.7

Amortization of deferred ac

q

uisition costs 1,983.7 1,810.2 1,538.7

Interest ex

p

ense 166.4 156.8 204.9

General and administrative ex

p

enses 1,641.3 1,424.0 1,333.2

Consolidated claims and expenses $ 12,909.8 $ 14,529.5 $ 10,841.5

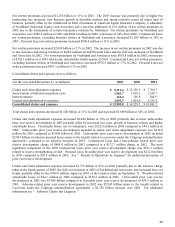

Total claims and expenses decreased $1.620 billion or 11% in 2003 and increased $3.688 billion or 34% in 2002.

Claims and claim adjustment expenses decreased $2.020 billion or 18% in 2003 primarily due to lower unfavorable

prior year reserve development in 2003 partially offset by increased loss costs, growth in business volume and higher

catastrophe losses. Catastrophe losses, net of reinsurance, were $352.4 million in 2003 compared to $84.1 million in

2002. Unfavorable prior year reserve development included in claims and claim adjustment expenses was $476.0

million for 2003 compared to $3.088 billion in 2002. Unfavorable prior year reserve development in 2002 included

$2.945 billion of asbestos incurred losses (prior to the benefit related to recoveries under the Citigroup indemnification

agreement), compared to no asbestos incurrals in 2003. Commercial Lines had a non-asbestos related prior year

reserve development charge of $688.0 million in 2003 compared to a $172.7 million charge in 2002. The most

significant component of the 2003 Commercial Lines prior year reserve development charge was $521.1 million

related to reserve strengthening at Gulf. Personal Lines favorable prior year reserve development was $212.0 million

in 2003 compared to $29.9 million in 2002. See “- Results of Operations by Segment” for additional discussion of

prior year reserve development.

Claims and claim adjustment expenses increased $3.374 billion or 43% in 2002 primarily due to the asbestos charge

taken in the fourth quarter of 2002, the full year inclusion in 2002 of Northland and Associates, and increased loss cost

trends, partially offset by the $704.0 million impact in 2001 of the terrorist attack on September 11. Weather-related

catastrophe losses of $84.1 million in 2002 compared to $103.3 million in 2001. Unfavorable prior year reserve

development in 2002 was $3.088 billion compared to favorable prior year reserve development of $59.5 million in

2001. Asbestos-related prior year reserve development in 2002 was $2.945 billion (prior to the benefit related to

recoveries under the Citigroup indemnification agreement), a $2.756 billion increase over 2001. For additional

information see “– Asbestos Claims and Litigation.”