Travelers 2003 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2003 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.129

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

10. SHAREHOLDERS’ EQUITY AND DIVIDEND AVAILABILITY, Continued

Common Stock

TPC’s common stock consists of class A and class B common stock. On all matters submitted to vote of the

TPC shareholders, holders of class A and class B common stock are entitled to one and seven votes per share,

respectively.

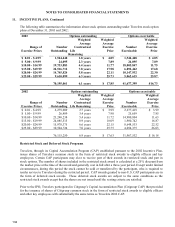

On January 22, 2004 and January 23, 2003, Travelers, through its Capital Accumulation Program (CAP), issued

1,955,682 and 1,943,627 shares, respectively, of class A common stock in the form of restricted stock to

participating officers and other key employees. The fair value per share of the class A common stock was

$17.92 and $16.18, respectively. The restricted stock generally vests after a three-year period.

On March 21, 2002, TPC sold approximately 231.0 million shares of its class A common stock in a public

offering for net proceeds of $4.090 billion.

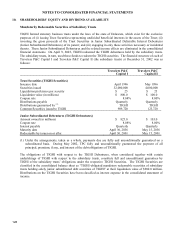

Rights Plan and Preferred Stock

In 2002, prior to Travelers IPO, Travelers Board of Directors adopted a shareholder rights plan as a result of

which each outstanding share of Travelers class A common stock and class B common stock carries with it the

right to acquire one-thousandth of a share in a new series of Travelers preferred stock designated as series A

junior participating preferred stock. On March 20, 2002, the Board of Directors designated three million of the

50 million shares of preferred stock authorized as Series A Junior Participating Preferred Stock (the Series A

Preferred Stock).

Under Travelers shareholder rights plan, each outstanding share of Travelers class A and class B common stock

carries with it the right to acquire one-thousandth of a share of the Series A Preferred Stock. These Rights trade

with Travelers common stock and will expire on March 20, 2012, unless the Rights are earlier redeemed. Such

Rights are not presently exercisable and have no voting rights. At December 31, 2003 and 2002, there were no

shares of preferred stock, including the Series A Preferred Stock, issued or outstanding.

Ten business days after the announcement that a person is making a tender or exchange offer for 15% or more of

Travelers general voting power or acquires 15% or more of Travelers general voting power (other than as a

result of repurchases of stock by Travelers or through inadvertence by certain shareholders that subsequently

divest all excess shares as set forth in the rights agreement), the Rights detach from the common stock and

become freely tradable and exercisable, entitling a holder to purchase one-thousandth of a share in Travelers

Series A Preferred Stock at $77.50, subject to adjustment.

If a person becomes the beneficial owner of 15% or more of Travelers general voting power, each Right will

entitle its holder to purchase $155 market value of Travelers common stock for $77.50. If Travelers

subsequently merges with another entity or transfers 50% or more of its assets, cash flow or earnings power to

another entity, each Right will entitle its holder to purchase $155 market value of such other entity’s common

stock for $77.50. Travelers may redeem the Rights, at its option, at $0.01 per Right, prior to any person

acquiring beneficial ownership of at least 15% of Travelers common stock. The shareholder rights plan is

designed primarily to encourage anyone seeking to acquire Travelers to negotiate with the Board of Directors.