Travelers 2003 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2003 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.123

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

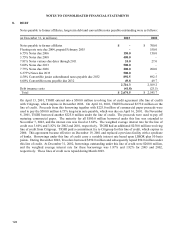

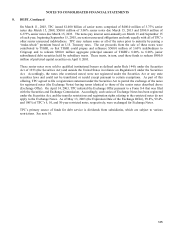

8. DEBT, Continued

Effective April 17, 2003, TPC entered into the following line of credit agreements with Citibank, a subsidiary of

Citigroup, TPC’s former parent: (i) a $250.0 million 45-month revolving line of credit (the 45-Month Line of

Credit), and (ii) a $250.0 million 364-day revolving line of credit (the 364-Day Line of Credit and, together with

the 45-Month Line of Credit, the Lines of Credit). TPC may, with Citibank’s consent, extend the commitment of

the 364-Day Line of Credit for additional 364-day periods under the same terms and conditions. TPC has the

option, provided there is no default or event of default, to convert outstanding advances under the 364-Day Line

of Credit at the commitment termination date to a term loan maturing no later than one year from the

commitment termination date. Borrowings under the Lines of Credit may be made, at TPC’s option, at a variable

interest rate equal to either the lender’s base rate plus an applicable margin or at LIBOR plus an applicable

margin. Each Line of Credit includes a commitment fee and, for any date on which advances exceed 50% of the

total commitment, a utilization fee. The applicable margin and the rates on which the commitment fee and the

utilization fee are based vary based upon TPC’s long-term senior unsecured non-credit-enhanced debt ratings.

Each Line of Credit requires TPC to comply with various covenants, including the maintenance of specified

minimum statutory capital and surplus of $5.5 billion and compliance with a ratio of total consolidated debt to

total capital of 45%. At December 31, 2003, Travelers was in compliance with these financial covenants. In

addition, an event of default will occur if there is a change in control (as defined in the Lines of Credit

agreements) of TPC. The proposed merger with SPC would constitute such a change in control of TPC;

however Travelers has obtained a waiver from Citibank of the event of default that otherwise would have

occurred in connection with the proposed merger with SPC. There were no amounts outstanding under the Lines

of Credit at December 31, 2003.

At December 31, 2001, TPC had a note payable to Citigroup in the amount of $1.198 billion, in conjunction with

the purchase of TIGHI’s outstanding shares in April 2000. On February 7, 2002, this note payable was replaced

by a new note agreement. Under the terms of the new note agreement, interest accrued on the aggregate

principal amount outstanding at the commercial paper rate (the then current short-term rate) plus 10 basis points

per annum. Interest was compounded monthly. This note was prepaid following the offerings.

In February 2002, TPC paid a dividend of $1.000 billion to Citigroup in the form of a non-interest bearing note

payable on December 31, 2002. This note would have begun to accrue interest from December 31, 2002 on any

outstanding balance at the floating base rate of Citibank, N.A., New York City plus 2.0%. On December 31,

2002, this note was repaid in its entirety.

In February 2002, TPC also paid a dividend of $3.700 billion to Citigroup in the form of a note payable in two

installments. This note was substantially prepaid following the offerings. The balance of $150.0 million was

due on May 9, 2004. This note would have begun to bear interest from May 9, 2002 at a rate of 7.25% per

annum. This note was prepaid on May 8, 2002.

In March 2002, TPC paid a dividend of $395.0 million to Citigroup in the form of a note payable, which would

have begun to bear interest after May 9, 2002 at a rate of 6.0% per annum. This note was prepaid following the

offerings.

In March 2002, TPC issued $892.5 million aggregate principal amount of 4.5% convertible junior subordinated

notes, which will mature on April 15, 2032, unless earlier redeemed, repurchased or converted. Interest is

payable quarterly in arrears. TPC has the option to defer interest payments on the notes for a period not

exceeding 20 consecutive interest periods nor beyond the maturity of the notes. During a deferral period, the

amount of interest due to holders of the notes will continue to accumulate, and such deferred interest payments

will themselves accrue interest. Deferral of any interest can create certain restrictions for TPC.