Travelers 2003 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2003 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

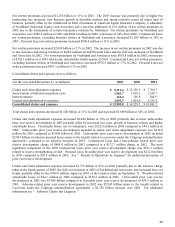

RESULTS OF OPERATIONS BY SEGMENT

Commercial Lines

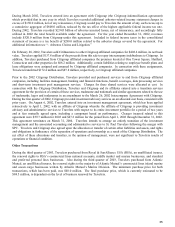

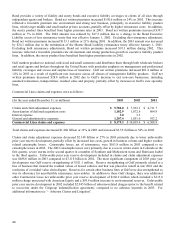

Commercial Lines operating income (loss) was as follows:

(for the year ended December 31, in millions) 2003 2002 2001

O

p

eratin

g

income (loss) $ 1,295.0 $

(

125.8

)

$ 752.2

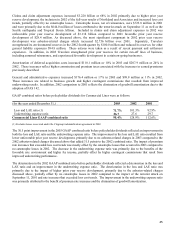

The 2003 operating income of $1.295 billion compared to an operating loss of $(125.8) million in 2002. The 2003

operating income reflected the continuing favorable, but moderating, rate environment in excess of loss cost trends and

increased business volumes. Catastrophe losses of $67.4 million, net of reinsurance and after tax, compared to no

catastrophes in 2002. The 2003 operating income contained no asbestos charges compared to $1.394 billion of

unfavorable prior year reserve development related to asbestos in 2002, net of the benefit from the Citigroup

indemnification agreement. Commercial Lines had a non-asbestos-related prior year reserve development charge of

$447.2 million ($688.0 pretax) in 2003 compared to a $112.2 million charge ($172.7 million pretax) in 2002. The

most significant component of the 2003 prior year reserve development charge was $338.7 million of charges ($521.1

million pretax) related to reserve strengthening at Gulf. Reserve strengthening at Gulf primarily related to a line of

business that insured the residual values of leased vehicles and that was placed in runoff in late 2001 and the resolution

of a residual value claim dispute. Reserves for certain other business lines at Gulf were also strengthened as was its

allowance for uncollectible reinsurance recoverables. In addition to these Gulf charges, there was additional other

Commercial Lines net unfavorable prior year reserve development of $108.5 million which included a $74.8 million

charge associated with American Equity and a $38.9 million increase in environmental reserves. Net investment

income of $1.152 billion in 2003 was $28.6 million higher than 2002 due to higher average invested assets from strong

operating cash flows along with higher returns in Travelers arbitrage fund investments, partially offset by slightly

lower returns in private equity investments and the impact of shortening the fixed maturity portfolio duration.

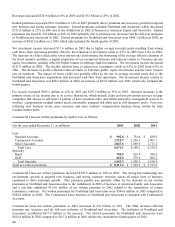

Operating loss of $(125.8) million for 2002 compared to operating income of $752.2 million in 2001. The 2002

operating loss reflected the benefit of the favorable premium rate environment in excess of loss cost trends and

increased business volumes. Operating loss in 2002 was favorably impacted by no catastrophe losses compared to

$470.5 million of catastrophe losses in 2001, including $447.9 million related to the terrorist attack on September 11,

2001. The 2002 prior year reserve development included the $1.394 billion charge related to asbestos discussed above

compared to an asbestos-related charge of $122.7 million in 2001. Commercial Lines also had a non-asbestos-related

prior year reserve development charge of $112.2 million ($172.7 pretax) in 2002 compared to a $141.2 million benefit

($217.2 million pretax) in 2001. Despite the benefit of higher average invested assets resulting from strong cash flows

from underwriting, net investment income of $1.123 billion was $69.5 million lower than 2001 due to reduced returns

in Travelers public equity investments and the lower interest rate environment. The 2002 operating loss also reflects

the elimination of goodwill amortization.

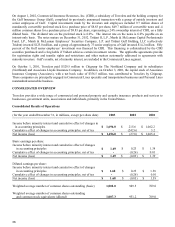

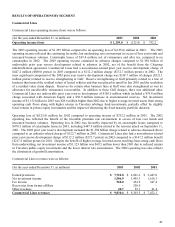

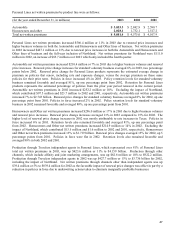

Commercial Lines revenues were as follows:

(for the year ended December 31, in millions) 2003 2002 2001

Earned

p

remiums $ 7,722.8 $ 6,801.2 $ 5,447.0

N

et investment income 1,506.9 1,495.3 1,616.3

Fee income 560.0 454.9 347.4

Recoveries from former affiliate - 520.0 -

Other revenues 40.7 32.1 41.4

Commercial Lines revenues $ 9,830.4 $ 9,303.5 $ 7,452.1