Travelers 2003 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2003 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.96

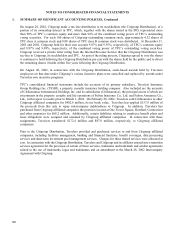

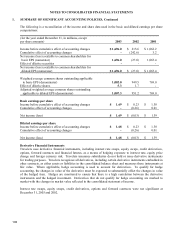

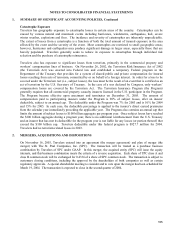

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES, Continued

Real estate held for sale is carried at the lower of cost or fair value less estimated costs to sell. Fair value is

established at the time of acquisition by internal analysis or external appraisers, using discounted cash flow

analyses and other acceptable techniques. Thereafter, an impairment is taken if the carrying value of the

property exceeds its current fair value less estimated costs to sell.

Accrual of income is suspended on fixed maturities or mortgage loans that are in default, or on which it is likely

that future payments will not be made as scheduled. Interest income on investments in default is recognized

only as payment is received. Investments included in the consolidated balance sheet that were not income-

producing for the preceding 12 months were not significant.

Trading securities and related liabilities are normally held for periods of less than six months. These investments

are marked to market with the change recognized in net investment income during the current period.

Short-term securities, consisting primarily of money market instruments and other debt issues purchased with a

maturity of less than one year, are carried at amortized cost, which approximates fair value.

Other invested assets include certain private equity securities along with partnership investments and real estate

joint ventures and are accounted for on the equity method of accounting. Undistributed income is reported in net

investment income.

Investment Gains and Losses

Net realized investment gains and losses are included as a component of pretax revenues based upon specific

identification of the investments sold on the trade date. A decline in the value of a security below its amortized

cost basis is assessed to determine if the decline is other-than-temporary. If so, the security is deemed to be

impaired, and a charge is recorded in net realized investment gains and losses.

Reinsurance Recoverables

Amounts recoverable from reinsurers are estimated in a manner consistent with the claim liability associated

with the reinsured business. Such recoverables are reported net of an allowance for estimated uncollectible

reinsurance recoverables and amounts due from known reinsurer insolvencies. Travelers evaluates and monitors

the financial condition of its reinsurers under voluntary reinsurance arrangement to minimize its exposure to

significant losses from reinsurer insolvencies.

Deferred Acquisition Costs

Amounts which vary with and are primarily related to the production of new insurance contracts, primarily

commissions and premium taxes, are deferred and amortized pro rata over the contract periods in which the

related premiums are earned. Deferred acquisition costs are reviewed to determine if they are recoverable from

future income, and if not, are charged to expense. Future investment income attributable to related premiums is

taken into account in measuring the recoverability of the carrying value of this asset. All other acquisition

expenses are charged to operations as incurred.

Contractholder Receivables and Payables

Under certain workers’ compensation insurance contracts with deductible features, Travelers is obligated to pay

the claimant for the full amount of the claim. Travelers is subsequently reimbursed by the policyholder for the

deductible amount. These amounts are included on a gross basis in the consolidated balance sheet in

contractholder payables and contractholder receivables, respectively.