Travelers 2003 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2003 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.60

TRANSACTIONS WITH FORMER AFFILIATES

Prior to the 2002 Citigroup Distribution, Travelers provided and purchased services to and from Citigroup affiliated

companies, including facilities management, banking and financial functions, benefit coverages, data processing services,

and short-term investment pool management services. Charges for these shared services were allocated at cost. In

connection with the Citigroup Distribution, Travelers and Citigroup and its affiliates entered into a transition services

agreement for the provision of certain of these services, tradename and trademark and similar agreements related to the use

of trademarks, logos and tradenames and an amendment to the March 26, 2002 Intercompany Agreement with Citigroup.

During the first quarter of 2002, Citigroup provided investment advisory services on an allocated cost basis, consistent with

prior years. On August 6, 2002, Travelers entered into an investment management agreement, which has been applied

retroactively to April 1, 2002, with an affiliate of Citigroup whereby the affiliate of Citigroup is providing investment

advisory and administrative services to Travelers with respect to its entire investment portfolio for a period of two years

and at fees mutually agreed upon, including a component based on performance. Charges incurred related to this

agreement were $59.7 million for 2003 and $47.2 million for the period from April 1, 2002 through December 31, 2002.

This agreement terminates on March 31, 2004. Travelers intends to arrange an orderly transition of the investment

management and the associated accounting and administrative services to St. Paul Travelers following the merger with

SPC. Travelers and Citigroup also agreed upon the allocation or transfer of certain other liabilities and assets, and rights

and obligations in furtherance of the separation of operations and ownership as a result of the Citigroup Distribution. The

net effect of these allocations and transfers, in the opinion of management, was not significant to Travelers results of

operations or financial condition.

See note 16 of notes to Travelers consolidated financial statements for a description of these and other intercompany

arrangements and transactions between Travelers and Citigroup.

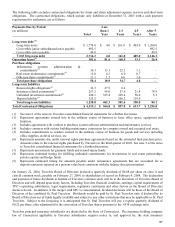

LIQUIDITY AND CAPITAL RESOURCES

Liquidity is a measure of a company’s ability to generate sufficient cash flows to meet the short- and long-term cash

requirements of its business operations. The liquidity requirements of Travelers business have been met primarily by

funds generated from operations, asset maturities and income received on investments. Cash provided from these

sources is used primarily for claims and claim adjustment expense payments and operating expenses. Catastrophe

claims, the timing and amount of which are inherently unpredictable, may create increased liquidity requirements. The

timing and amount of reinsurance recoveries may be affected by reinsurer solvency and increasingly by reinsurance

coverage disputes. Additionally, recent increases in asbestos-related claim payments, as well as potential judgments

and settlements arising out of litigation, may also result in increased liquidity requirements. In the opinion of

Travelers management, Travelers future liquidity needs will be met from all of the above sources.

Net cash flows provided by operating activities totaled $3.833 billion, $2.926 billion and $1.219 billion in 2003, 2002

and 2001, respectively. The 2003 net cash flows provided by operating activities benefited from premium rate

increases, the receipt of $360.7 million from Citigroup related to recoveries under the asbestos indemnification

agreement and $530.9 million of federal income taxes refunded from Travelers net operating loss carryback. The 2002

net cash flows provided by operating activities also benefited significantly from premium rate increases compared to

2001.