Travelers 2003 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2003 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56

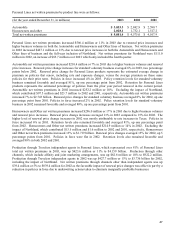

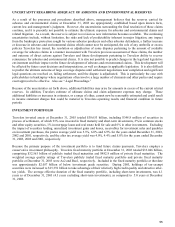

The following table sets forth Travelers combined fixed maturity investment portfolio classified by Moody’s Investor’s

Service Inc. ratings:

(at December 31, 2003, in millions)

Carrying

Value Percent of

Total Carrying

Q

ualit

y

Ratin

g

:

Aaa $ 19,586.0 59.3%

Aa 6,002.1 18.2

A 2,510.1 7.6

Baa 2,890.8 8.7

Total investment

g

rade 30

,

989.0 93.8

Non-investment

g

rade 2,056.5 6.2

Total fixed maturity investment $ 33,045.5 100.0%

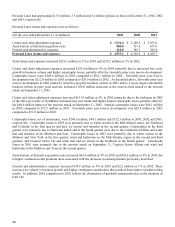

Travelers makes investments in collateralized mortgage obligations, or CMOs. CMOs typically have high credit

quality, offer good liquidity, and provide a significant advantage in yield and total return compared to U.S. Treasury

securities. Travelers investment strategy is to purchase CMO tranches which offer the most favorable return given the

risks involved. One significant risk evaluated is prepayment sensitivity. This drives the investment process to

generally favor prepayment protected CMO tranches including planned amortization classes and last cash flow

tranches. Travelers does not purchase residual interests in CMOs.

At December 31, 2003, Travelers held CMOs with a fair value of $3.932 billion. Approximately 46% of CMO

holdings were fully collateralized by GNMA, FNMA or FHLMC securities at that date, and the balance was fully

collateralized by portfolios of individual mortgage loans. In addition, Travelers held $3.802 billion of GNMA,

FNMA, FHLMC or FHA mortgage-backed pass-through securities at December 31, 2003. Virtually all of these

securities are rated Aaa.

Travelers equity investments are primarily through private equity, arbitrage and real estate partnerships, which are

subject to more volatility than Travelers fixed income investments, but historically have provided a higher return. At

December 31, 2003, the carrying value of Travelers investments in private equity, arbitrage and real estate partnerships

was $2.449 billion.

OUTLOOK

As previously discussed, Travelers announced the proposed merger with SPC. The following discussion does not

reflect the impact, if any, of the proposed merger including the integration of Travelers business with that of SPC.

The 2003 year continued to see a significant increase in the number of downgrades by rating agencies for property

casualty insurance companies. Many competitors are experiencing pressure on their capitalization levels due to

underperforming investment portfolios and the need to strengthen prior year reserves, especially for asbestos liabilities.

This pressure has caused many competitors to sell, discontinue or shrink certain books of business.

A variety of other factors continue to affect the property and casualty insurance market and Travelers core business

outlook, including continued price increases in the commercial lines marketplace, although at a moderating level, a

continuing highly competitive personal lines marketplace, inflationary pressures on loss cost trends, including medical

inflation and auto loss costs, asbestos-related developments and rising reinsurance and litigation costs.

Travelers strategic objective is to enhance its position as a consistently profitable market leader and a cost-effective

provider of property and casualty insurance in the United States.