Travelers 2003 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2003 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

18

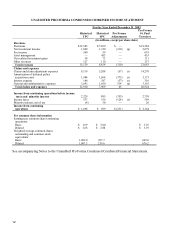

Increase (Decrease)

Year ended

December 31, 2003

(in millions)

Unaudited Pro Forma Condensed Combined Income Statement

Revenues

q) Adjustment to recognize the amortization of fair value adjustments allocated to

investments using the interest method over the estimated remaining life of the

investments — See Note 6 $ (310)

Claims and Expenses

r) Adjustment to claims and claim adjustment expenses to reflect the accretion of

fair value — See Note 3 $ (57)

s) Adjustment to the amortization of deferred policy acquisition costs due to

conforming the accounting policy described in "c" above $ (375)

t) Adjustment to interest expense for the amortization of fair value adjustments

allocated to long-term debt, equity unit related debt and mandatorily redeemable

preferred securities, using the interest method over the remaining term to maturity $ (37)

u) General and administrative expenses —

i. Adjustment to amortization expense for the estimated value of identifiable

intangible assets with finite lives — See Note 4 $ 130

ii. Adjustment to the amortization of deferred policy acquisition costs after

conforming the accounting policy described in "c" above $ 384

v) To adjust income taxes for all pro forma adjustments except goodwill at the

statutory rate of 35% $ (124)

The pro forma adjustments do not include an anticipated restructuring charge in conjunction with the merger. The

preliminary estimate related to restructuring is approximately $300 million to $400 million and is subject to final

decisions by management of the combined company. These costs may include severance payments, asset write-offs

and other costs associated with the process of combining the companies. No determination has been made as to the

allocation of the restructuring reserve between SPC- and TPC-related expenditures for purposes of the preliminary

unaudited pro forma condensed combined financial statements.

Certain other assets and liabilities of SPC will also be subject to adjustment to their respective fair values at the time of

the merger. Pending further analysis, no pro forma adjustments are included herein for these assets and liabilities.