Travelers 2003 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2003 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

139

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

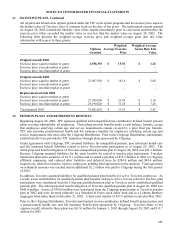

12. PENSION PLANS AND RETIREMENT BENEFITS, Continued

The accumulated benefit obligation for Travelers defined benefit pension plans was $573.7 and $476.0 million

at December 31, 2003 and 2002, respectively.

For pension plans with an accumulated benefit obligation in excess of plan assets, the aggregate projected

benefit obligation and the aggregate accumulated benefit obligation were each $27.6 million at December 31,

2003 and were $521.0 million and $476.0 million, respectively, at December 31, 2002.

The pretax minimum liability included in other comprehensive income decreased by $95.3 million from

December 31, 2002 to December 31, 2003.

Travelers does not have a best estimate of contributions expected to be paid to the qualified pension plan during

the next fiscal year at this time. However, the maximum tax deductible contribution to the qualified pension

plan for 2004 is currently estimated to be $40.0 million, which may be contributed on or before September 15,

2005.

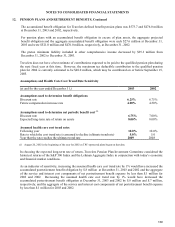

Assumptions and Health Care Cost Trend Rate Sensitivity

(

at and for the

y

ear ended December 31,

)

2003 2002

Assumptions used to determine benefit obligations

Discount rate 6.25% 6.75%

Future com

p

ensation increase rate 4.00% 4.50%

Assumptions used to determine net periodic benefit cost (1)

Discount rate 6.75% 7.00%

Ex

p

ected lon

g

-term rate of return on assets 8.00% 8.00%

Assumed health care cost trend rates

Followin

g

y

ea

r

10.0% 10.0%

Rate to which the cost trend rate is assumed to decline

(

ultimate trend rate

)

5.0% 5.0

Year that the rate reaches the ultimate trend rate 2009 2008

(1) August 20, 2002 is the beginning of the year for 2002 as TPC-sponsored plans began on that date.

In choosing the expected long-term rate of return, Travelers Pension Plan Investment Committee considered the

historical returns of the S&P 500 Index and the Lehman Aggregate Index in conjunction with today’s economic

and financial market conditions.

As an indicator of sensitivity, increasing the assumed health care cost trend rate by 1% would have increased the

accumulated postretirement benefit obligation by $.8 million at December 31, 2003 and 2002 and the aggregate

of the service and interest cost components of net postretirement benefit expense by less than $.1 million for

2003 and 2002. Decreasing the assumed health care cost trend rate by 1% would have decreased the

accumulated postretirement benefit obligation at December 31, 2003 and 2002 by $.8 million and $.7 million,

respectively, and the aggregate of the service and interest cost components of net postretirement benefit expense

by less than $.1 million for 2003 and 2002.