Travelers 2003 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2003 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16

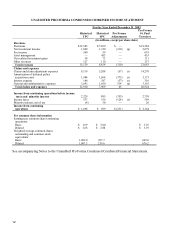

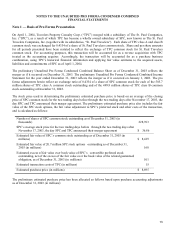

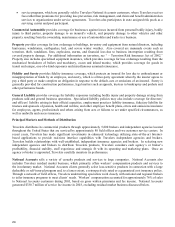

Note 2 — Pro Forma Adjustments

The pro forma adjustments related to the preliminary Unaudited Pro Forma Condensed Combined Balance Sheet as of

December 31, 2003 assume the merger occurred on December 31, 2003. The pro forma adjustments to the preliminary

Unaudited Pro Forma Condensed Combined Income Statement for the year ended December 31, 2003 assume the

merger occurred on January 1, 2003.

The following pro forma adjustments result from the allocation of the purchase price for the acquisition based on the

fair value of the assets, liabilities and commitments acquired from SPC and to conform SPC's accounting policies to

TPC. The amounts and descriptions related to the preliminary adjustments are as follows:

Increase (Decrease)

as of December 31,

2003

(in millions)

Unaudited Pro Forma Condensed Combined Balance Sheet

Assets

a) Adjustment of carrying amount of investment real estate to fair value $ 283

b) Reinsurance recoverables —

i. Adjustment to conform the accounting policy for discounting certain workers'

compensation claim reserves $ (15)

ii. Adjustment to record the reinsurance recoverables related to claims and

claim adjustment expense reserves at fair value — See Note 3 $ (402)

c) Adjustment to conform the accounting policy for the deferral of certain policy

acquisition costs $ (78)

d) Adjustment to record the deferred tax liability resulting from all pro forma

adjustments except goodwill at a statutory rate of 35% $ (296)

e) Net adjustment to eliminate SPC's historical goodwill and to record the goodwill

related to this merger $ 1,919

f) Net adjustment to eliminate SPC's historical intangible assets and to record the

identifiable intangible assets related to this merger — See Note 4 $ 1,061

g) Other assets —

i. Adjustment to record the fair value of SPC's pension plans, using the

December 31, 2003 plan assumptions $ (346)

ii. Adjustment to eliminate SPC's unamortized issue costs related to long-term

debt, equity unit related debt and mandatorily redeemable preferred securities $ (38)

Liabilities

h) Claims and claim adjustment expense reserves —

i. Adjustment to conform the accounting policy for discounting certain workers'

compensation claim reserves $ (125)

ii. Adjustment to conform the accounting policy for discounting involuntary

market workers’ compensation claims reserves $ 39

iii. Adjustment to record claims and claim adjustment expense reserves at fair

value — See Note 3 $ (675)

i) Adjustment to record long-term debt, equity unit related debt and mandatorily

redeemable preferred securities at fair value $ 293

j) Other liabilities —

i. Adjustment to record the fair value of SPC's post-retirement benefit plans,

using the December 31, 2003 plan assumptions $ 86

ii. Adjustment to record the liability for TPC estimated merger related

transaction costs $ 15