Travelers 2003 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2003 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

128

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

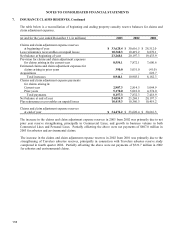

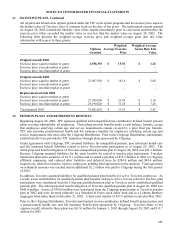

10. SHAREHOLDERS’ EQUITY AND DIVIDEND AVAILABILITY

Mandatorily Redeemable Securities of Subsidiary Trusts

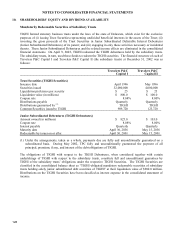

TIGHI formed statutory business trusts under the laws of the state of Delaware, which exist for the exclusive

purposes of (i) issuing Trust Securities representing undivided beneficial interests in the assets of the Trust; (ii)

investing the gross proceeds of the Trust Securities in Junior Subordinated Deferrable Interest Debentures

(Junior Subordinated Debentures) of its parent; and (iii) engaging in only those activities necessary or incidental

thereto. These Junior Subordinated Debentures and the related income effects are eliminated in the consolidated

financial statements. On April 9, 2003, TIGHI redeemed the TIGHI debentures held by the subsidiary trusts.

The subsidiary trusts, in turn, used these funds to redeem the TIGHI securities. The financial structure of each of

Travelers P&C Capital I and Travelers P&C Capital II (the subsidiary trusts) at December 31, 2002 was as

follows:

Travelers P&C Travelers P&C

Ca

p

ital I Ca

p

ital II

Trust Securities

(

TIGHI Securities

)

Issuance date A

p

ril 1996 Ma

y

1996

Securities issued 32,000,000 4,000,000

Li

q

uidation

p

reference

p

er securit

y

$ 25 $ 25

Li

q

uidation value

(

in millions

)

$ 800.0 $ 100.0

Cou

p

on rate 8.08% 8.00%

Distributions

p

a

y

able

Q

uarterl

y

Q

uarterl

y

Distributions

g

uaranteed b

y

(1) TIGHI TIGHI

Common Securities issued to TIGHI 989,720 123,720

Junior Subordinated Debentures

(

TIGHI Debentures

)

Amount owned

(

in millions

)

$ 825.0 $ 103.0

Cou

p

on rate 8.08% 8.00%

Interest

p

a

y

able

Q

uarterl

y

Q

uarterl

y

Maturit

y

date A

p

ril 30, 2036 Ma

y

15, 2036

Redeemable b

y

issuer on or afte

r

A

p

ril 30, 2001 Ma

y

15, 2001

(1) Under the arrangements, taken as a whole, payments due are fully and unconditionally guaranteed on a

subordinated basis. During May 2002, TPC fully and unconditionally guaranteed the payment of all

principal, premium, if any, and interest of the debt obligations of TIGHI.

The obligations of TIGHI with respect to the TIGHI Debentures, when considered together with certain

undertakings of TIGHI with respect to the subsidiary trusts, constitute full and unconditional guarantees by

TIGHI of the subsidiary trusts’ obligations under the respective TIGHI Securities. The TIGHI Securities are

classified in the consolidated balance sheet as “TIGHI-obligated mandatory redeemable securities of subsidiary

trusts holding solely junior subordinated debt securities of TIGHI” at their liquidation value of $900.0 million.

Distributions on the TIGHI Securities have been classified as interest expense in the consolidated statement of

income.